Quick to Buy, Quick to Refi, a new 2-step loan strategy, helps you maximize your loan amounts while limiting the amount of cash you put into a project. It also helps you rapidly finish your projects and buy again, and again, and again.

What does that all mean? It means you no longer need to worry about missing out on great deals and getting stuck in expensive hard money loans.

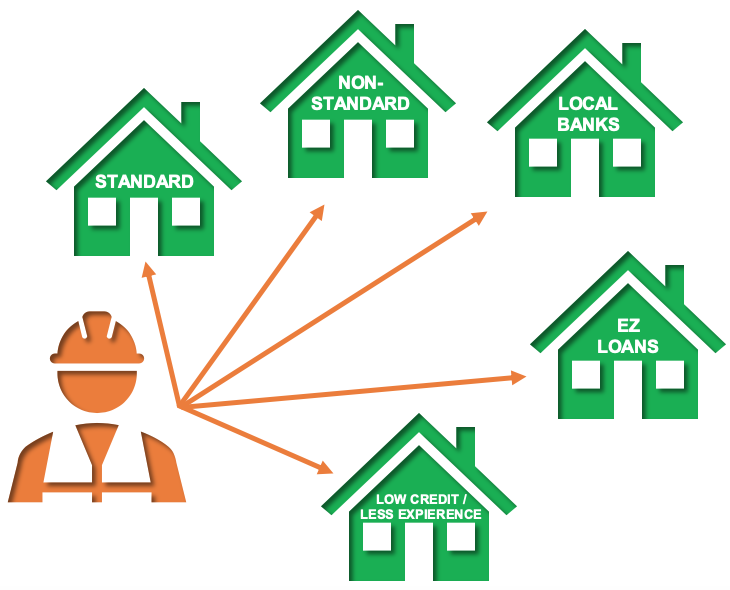

The Quick to Buy, Quick to Refi strategy all starts with properly setting up your short AND long-term loans.

Now, even though your short-term loan will come first (to quickly buy an under market property from a wholesaler), a key step is to FIRST get pre-qualified for the long-term loan. Why? To ensure you’re able to maximize both loan amounts. If you can qualify for a larger loan upfront, then it’s likely your short-term lender will match that amount.

It also means you’re already going through the process for securing a long-term loan as you begin renovating a property with a short-term loan. Think, “Two birds, one stone.” By the time you finish renovations, you’re ready to refinance into a long-term loan.

But, hold on. You also need to know about the types of refinances. There are two you need to know about: “rate and term” and “cash out”. And yes, it matters you know the differences.

Ready to find out what about those differences? Then check out the whole video here and start capturing free equity, boosting your cash flow, and investing in more properties.

Want more videos with more tips to maximize your cash flow? Then check out our new video page, or subscribe to our new YouTube channel! Be sure to also check out all of our invest tools.