BRRRR Made Simple

Categories: Resources

Although it’s not a new strategy, we agree that Bigger Pockets’ BRRRR method for real estate investment is a great one. But, how does it actually work? Well, check out this podcast/video from Bigger Pockets:

Categories: Resources

Although it’s not a new strategy, we agree that Bigger Pockets’ BRRRR method for real estate investment is a great one. But, how does it actually work? Well, check out this podcast/video from Bigger Pockets:

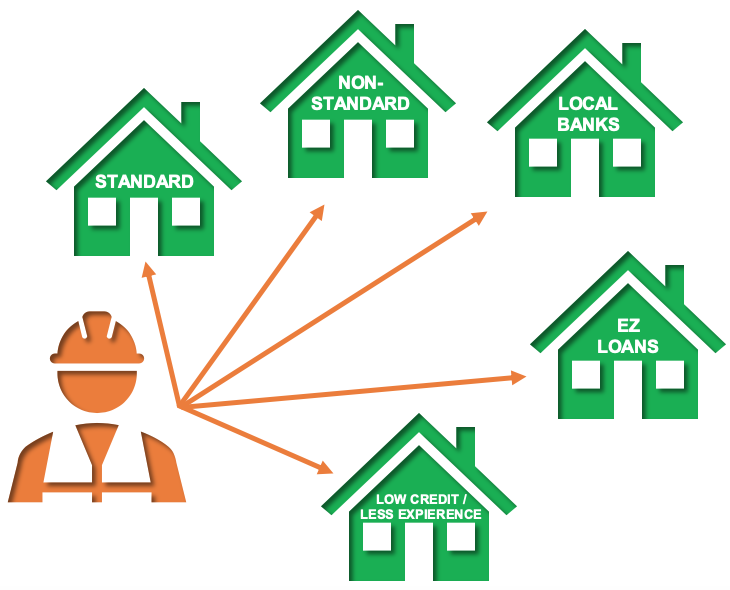

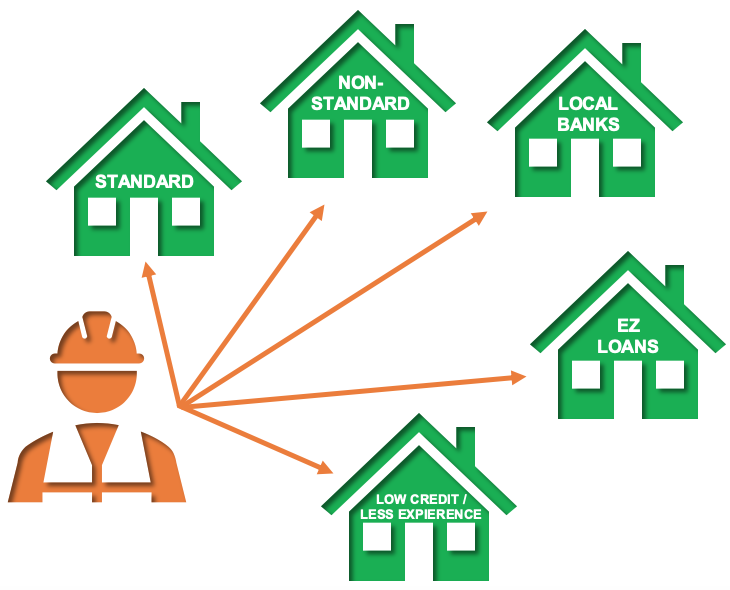

As introduced earlier, there are 5 paths to take with financing your rental property:

So, what’s the best path for you? It’ll depend on the following 4 key factors:

Based on your answers, what is the best loan for you now? How about in two years?

Need to know more about each loan type before you can answer these questions? Check out our Loan Cheat Sheet here!

Categories: Resources

Are you looking for a simple, easy-to-use strategy to use on your rental investments? Then we recommend Bigger Pockets’ BRRRR strategy (also known as BARRRR).

BRRRR/BARRRR stands for:

Buy

Advertise

Rehab

Rent

Refinance

Repeat

For a full introduction to this real estate investment method, check out this video from Bigger Pockets.

Did you know you have more than one option when it comes to financing your rental property investments?

As you can see, there are 5 paths to take with financing your rental property:

So, which loan type is best for your project so you can boost your cash flow and reach your goals faster? Find out here!