Traditional vs. DSCR Loan Comparison

Categories: Blog Posts

This loan comparison can help you figure out what loan is right for YOU.

Whenever we’re talking about rentals, we’re always going to come back to cash flow, and it’s important to find the best cash-flowing loan.

We want to look at the pros and cons of each type of rental loan to help you understand which might be the best option to help your cash flow for a specific deal.

Traditional Rental Loans

Pros of Traditional Loans

1. It’s a 30 Year Mortgage. This standardized timeline is reliable and consistent across most traditional loans.

2. No Prepay Penalty. Without a prepayment penalty, you can get out of the loan whenever you want. This is great if you anticipate a changing market and might want to sell early.

3. Lower Interest Rates. Between DSCR and traditional rental loans, you’re often looking at at least a whole point difference in the interest rates. While a single percentage might seem small, when you’re dealing with hundreds of thousands of dollars, the interest adds up very quickly, and you should consider it during loan comparison.

Interest rates affect everything from your cash flow to your credit score to your debt ratio. Depending on where you’re at financially, lower interest rates can be a huge point in favor of these traditional loans.

4. Home Hacking. With traditional rental loans, you’re actually able to do an owner-occupied loan. This allows you to live in one of the units you’re working on. Especially if you’re working on multiple units, you can move from one to another as needed.

Sometimes these owner-occupied loans have lower down payments and better rates, so they’re often worth looking into.

5. Same Rules Nationwide. Traditional loans are consistent across the country. No matter where you go, the guidelines are the same. This makes them predictable although they often have stricter guidelines than other loan types.

Cons of Traditional Loans

1. Property Limits. With traditional loans, you’re limited to 10 properties or 10 units. So while they do often have the best rates, you’re limited in how many properties they cover.

2. Need Income Proof and Good Credit. Not all loans need proof of income, but traditional loans certainly do. Your rates will also be limited by your credit score.

3. Cannot Close in an LLC. Unlike other loan options, traditional loans require you to close in your personal name because you cannot own the property when you’re going through a purchase or refinance in an LLC.

An LLC typically works to protect individuals from the financial effects of a business. However, because of the limits of traditional loans, you can’t use that protection in this scenario.

4. One Year Seasoning. You’re not allowed to refinance until after a full year has passed. This is especially important to consider if you’re doing a BRRRR and want to tap into some equity with a full refinance or purchase.

DSCR Rental Loans

DSCR stands for debt-service coverage ratio. You’ll often see these loans come up for anything from a single family home to a larger multi-unit property.

Pros of DSCR

1. Flexibility. While traditional loans find strength in their consistency, investors sometimes find themselves needed a lot more flexibility. That’s where DSCRs come in.

DSCRs are significantly more flexible because lenders and investors can negotiate unique terms that fit a project’s specific needs. When doing your loan comparison, consider how much flexibility you’ll need.

2. Ease! The biggest benefit of DSCR is ease. It doesn’t matter if you’re employed, what your tax return says, or how much income you have flowing. DSCR lenders only care about the rental property and whether it has the potential to produce cash flow.

3. Close in an LLC. Another big thing in the real estate investor world is closing in an LLC. Unlike traditional bank loans, you can both buy and refinance in an LLC, so you’re protected all the way through.

4. Available in all 50 States. No matter where you are, you will be able to find available DSCR rental loans. However, the details might vary.

Each lender offering DSCRs have their own terms, guidelines, etc. This makes it incredibly important to shop around to make sure you find the right fit.

5. Unlimited Number of Properties. You will find so many options in the DSCR world. You can find loans for specific properties or do a blanket loan for $50 million that could cover as many units as you wanted.

Always make sure that the lender and loan are the right fit for you, and remember that there are a ton of options available!

Cons of DSCR

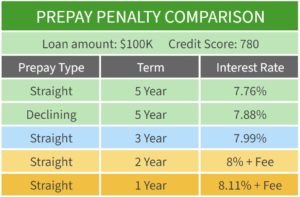

1. Prepayment Penalties. The number one downside of DSCR loans are the prepayment penalties. If you’re looking to get in and out of a property within the first three to five years, there’s a prepayment penalty unless you buy it out.

2. Higher Rates. Rates for DSCRs typically run anywhere from 1%-3% higher than traditional bank loans, depending on credit score, size of loan, etc.

3. Might Disappear or Change Quickly. DSCR loans are prone to change quickly. When shifts happen in the real estate market, they might even disappear for a brief time before showing up again.

While traditional bank loans are more slow-moving, DSCR moves quickly, and sometimes that can become an issue to real estate investors.

4. Can’t Home Hack. DSCR also does not allow you to live in any of the units you’re working on as you could with an owner-occupied traditional loan.

Read the full article here to learn more about loan comparison.

Watch the YouTube video: