If you’re stuck with a bad credit score, a 911 loan could be the perfect way to pay down debt.

One of the most common issues of investors we talk to is low credit score.

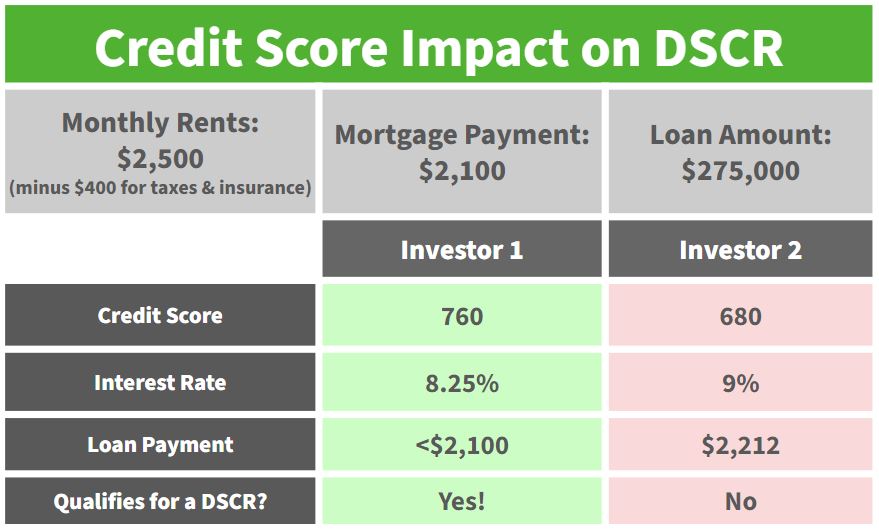

In the real estate world, when the Fed tightens everything up (as they have done recently), credit scores become more and more important. This means that the threshold of what qualifies as a “good” credit score goes up, and it’s almost impossible to get a loan if you don’t meet that threshold.

How can you fix that quickly so it doesn’t tank your investments?

The Changing Economic Landscape

Everyone used to have options. If your credit score was a little low, it was alright; you could still find someone willing to lend to you without too much penalty.

In recent years, things have shifted.

As the Fed tightens up, there’s less money going around, meaning banks don’t have as much money to lend as they used to.

How do they solve this problem?

They raise the requirements for getting a loan.

Now, instead of being minorly penalized for a low credit score, some people are finding it difficult to find loans at all. And some of the loans they do find are smaller and have significantly higher rates.

Some banks may not even look at your loan application if you don’t meet their credit score requirement.

Understanding Your Credit Score

The 2 largest factors that make up your credit score are payments and usage.

- Payments look at whether or not you’re paying on time.

- Usage looks at how much of your total possible balance you’re using each month.

For example, if your usage limit is $10,000, and you’re frequently using $7,000 of that, you have 70% usage.

Ideally, FICO wants to see you using about 20%-30% of your available credit. Any higher than that, and you become riskier for the banks.

Especially when you’re beginning as a real estate investor, it can be so easy to rack up the usage: getting supplies at Home Depot, paying contractors, etc.

It’s all-too-common to see people have $50,000 or $100,000 on maxed out credit cards.

This is where a credit 911 loan comes into play to pay down debt.

What is a Credit Score 911 Usage Loan?

A Credit Score 911 Usage Loan is essentially a non-reporting loan that pays off all credit cards, allowing your credit score to shoot upwards.

These loans act as a fast-acting antidote to your credit score usage problems. The next time your credit report is generated, you should see significant improvement.

Essentially, it’s a quick fix for people who pay their bills on time.

Who Should Use a 911 Loan?

If your credit score is weighed down by a long history of late payments, this loan is not going to help you very effectively.

These loans are perfect for people whose credit has been plagued by high usage, who need to fix their credit score FAST.

In short, here’s what you should know about a 911 Usage Loan:

- It’s used to pay down debt that’s accumulated through usage issues, not late payments.

- We’re an asset-based lender, so make sure you have some real estate to secure your loan.

- You need an exit strategy. We want to make sure you have a way of paying that loan back.

Real estate investing is a fast-moving business, and it’s important to have a quick solution for an issue that could otherwise cost you thousands of dollars in higher payments or declined deals.

How Long Before it Pays Down my Debt?

We call this a “Credit Score 911” because we understand that a low credit score can be an emergency need.

It can take as little as 2 weeks (or up to 30 days) to get this loan and see results in your credit score. The timing depends simply on when your credit cards report and when your statements come out.

You still owe the money, but now you owe it to a non-reporting entity.

Although it can be daunting to take out an unexpected usage loan, a delay of a month is far better than a long term delay where you can’t refinance or buy.

How Can I Set Myself Up to Avoid Needing a 911 Loan?

The root of this problem is almost always using personal credit cards for business-level needs.

Getting the right business credit card in the name of your investing company has a number of benefits:

- It won’t report to your personal credit if you pay on time.

- They don’t penalize high usage.

- Some business cards even reward running up a larger balance.

- Even if your business is brand new, if you apply for a business credit card with a high personal credit score, you’ll likely be approved.

We’ve partnered with Nav to help you find a business credit card that works well with real estate investing.

As with a personal card, you can find cards that offer perks and rewards that appeal to you. Just make sure you look for ones that 1) don’t report to your personal credit and 2) like high usage.

Our goal is to help you fix your credit score and get your business in order so that you never need a 911 loan again!

Next Steps

If you’re wondering if a Credit Score 911 loan is right for you, what steps should you take?

- Look at sites like Credit Karma or TransUnion. See where your score is at, and run simulators to see what would happen if you paid off certain credit cards.

- Consider the qualifications for a 911 loan. Are you paying on time? Do you need to fix the problem quickly?

- Draft a plan to pay off a credit score loan. Especially if timing is important, having your exit strategy ready helps us get that money to you more quickly.

Remember, you still need to pay everything on time. We’re just here to help people who have fallen into the trap of using personal credit cards for business purposes in this competitive environment.

If you’re ready to take the next steps or have questions, reach out to us at Info@TheCashFlowCompany.com.

We’re always happy to talk you through a 911 loan, how it can pay down debt, and how you can set up your business to avoid this problem in the future.