You Are Doing BRRRR Wrong

Categories: Blog Posts

Most people do BRRRR wrong. Here’s the step they usually miss.

Buying properties at undermarket prices. Fixing them up. Keeping them as rentals. Refinancing.

We’ve helped clients with this process for over 20 years. What’s the biggest error we see people make?

They don’t start with the end in mind.

Many beginning investors take the order of the BRRRR acronym literally. They buy, rehab, rent, THEN try to figure out what the refinance will look like. That’s actually doing BRRRR wrong.

Going into the refinance blindly is how to do BRRRR wrong. At best, you won’t know how the property cash flows. At worst, you can’t get a refinance loan at all.

Let’s look at what you need to do instead.

How to Keep From Doing BRRRR Wrong

The refinance is where you make your money in a BRRRR. Refinancing determines the cash flow, your money out-of-pocket, and the financial success of the project.

If everything hinges on the refinance, why would you wait until the fourth step of the process to start figuring it out?

You need to mentally move the third R, “Refinance,” up to the beginning of the process, before you even buy.

Refinance Questions to Answer

There are certain questions you should know the answers to before you put money down on an undermarket property.

You can get the cheapest house out there, with the highest ARV… But if you aren’t able to get a decent refinance for it, you’ll still lose money.

Here are some questions you should be able to answer at the beginning to ensure you don’t do BRRRR wrong:

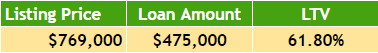

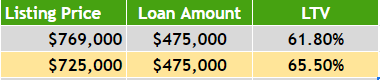

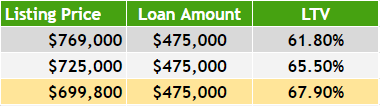

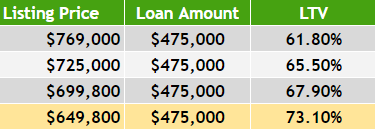

- What loan-to-value (LTV) does the bank require?

- When you go to refinance, will you have to bring in money? How much?

- Will it cost more money than you have? Or more than you want to spend on this project?

- Will you do a rate-and-term or cash-out refinance?

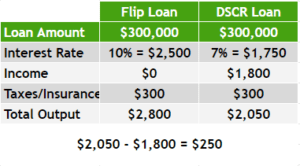

- What will be your cash flow on the property?

- What’s the minimum cash flow you need? What about the minimum the bank needs?

- Does the bank require investment experience to lend you a refinance loan?

- Does the bank have reserves requirements? (This is usually around six months’ worth of payments the bank requires you to have in savings or a mutual fund).

If you don’t know the answer to these questions up front, you end up like a lot of buyers who get BRRRR wrong and lose money.

You get to the refinance part of the process and learn you don’t have enough money to bring in. Or you find the cash flow is bad.

Prepping for a BRRRR Buy

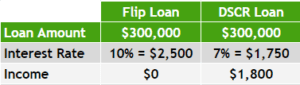

Does it make sense to buy a property (with a higher interest loan), put all the money into repairs, rent it, and THEN figure out whether it’s a good or bad investment?

It takes just a little time and effort up-front to figure out if a property is worth pursuing.

We like to call this time up-front “building your BRRRR buyer’s box.” It’s a process that helps you prepare for the refinance ahead of time so you don’t do BRRRR wrong.

Going into a property, you should know:

- Your max LTV

- Your cash flow minimum

- How much cash you’ll need to bring in

- What rehab budget you can afford.

Do BRRRR Right

Download our free BRRRR Checklist to understand the numbers of your refinance. Make your rental property a success.

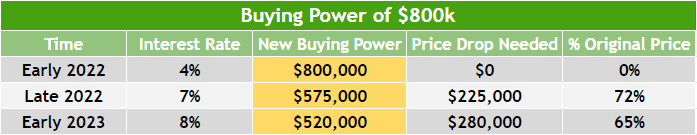

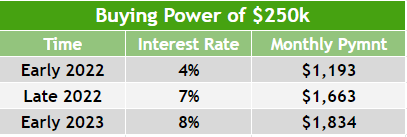

Leverage determines whether you’ve done BRRRR wrong or right. All real estate investing hinges on leverage, and our goal is to help you create the best leverage possible.

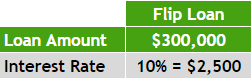

Using the right debt will accelerate your business, while the wrong stuff will slow your investing career to a halt.

If you have questions about a BRRRR product, email us at Info@TheCashFlowCompany.com.