How to Price a Flip in 2022’s Real Estate Market

Categories: Blog Posts

With rising interest rates, homes aren’t valued like they used to be. Here’s how to price a flip in the current market.

As a real estate investor with a fix-and-flip, it’s tempting to fixate on purchase price. Why aren’t buyers throwing themselves at your door with your listing price?

You have to remember one simple reality: People buy based on payment.

When interest rates change, the monthly payment people can afford doesn’t. This results in buyers’ available price points dipping lower and lower.

People might be willing to pay a little more per month for a higher purchase price in this market. But that doesn’t matter if they can still only qualify for a loan with the original lower payment.

Let’s look at a real example from one of our recent clients about how they need to price their current flip.

Interest Rates Impact How to Price a Flip

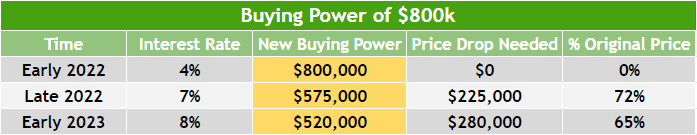

Back in January, our client’s property would have sold for $800,000. That number was still on their mind as they brought the house to market a couple months ago.

However, back then, the interest rate would have been around 4%. This would have made the property’s monthly payment around $3,800.

Fast forward to now. If people are buying properties based on payment… Could this client still sell for $800,000?

The problem is: interest rates are now closer to 7%.

Let’s look at how this impacts payment. If someone could qualify for the $3,800 payment back in January… then they qualified for that payment, not necessarily that purchase price.

If the target buyer can only budget/qualify for $3,800, then in order to keep that monthly payment with a 7% rate, the new price will need to be $575,000.

Why Is It Important to Know How to Price a Flip?

This client’s main motivation is that they want to clear off properties like this because they know better deals are coming. They need to be free to buy soon without past flips hanging over them.

Another motivation is: they don’t want to keep making payments on a property that will sell for even less in a year.

Next year, experts anticipate interest rates will be up to 8%. Affordability for this property would go down to $520,000. This client certainly doesn’t want to be caught with this property for sale in that market.

How a Buydown Impacts Your Listing Price

You end up with two main strategies regarding how to price a flip in this market:

- You can lower your price to make the monthly payment the same for the buyer, based on interest rates.

- You can buy down the rate for your buyer.

A buydown is a strategy where the seller pays in advance to bring down the interest rate for the buyer.

In our previous example of the $800,000 property, our target payment would be $3,800/month. What would the purchase price be if we took the 7% interest rate down by a percentage point? Could that get us closer to $3,800 without sacrificing as much purchase price?

Let’s say it would cost 2 points to bring the interest rate down to 6%. That interest rate would allow you to sell at $640,000, while still keeping the buyers’ monthly payment at $3,800/month.

Buying down the interest at a cost of 2 points would only cost you $12,800. Yet even with that buydown cost, you’d still make an additional $52,200 selling at $640,000 (compared to the $575,000 pre-buydown).

It becomes a win-win: the buyer can qualify for the $3,800/month payment, and the seller can ask for a higher price.

How to Price a Flip at a Lower Price Point

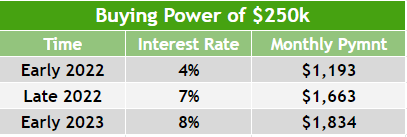

This example covered a higher-end, $800,000 house. Does all this math work the same at a lower price point?

Let’s look at a $250,000 instead.

At the beginning of 2022, a $250,000 house would have cost a homeowner $1,193/month. Now, that same house would cost the same person $1,663. That’s $470 more per month, or a 39% increase. From early 2022 to early 2023, the monthly payments will have gone up by 54%, to $1,834/month.

These numbers are still probably cheaper than rent for a comparable property. However, that doesn’t necessarily mean buyers will be able to qualify with lenders.

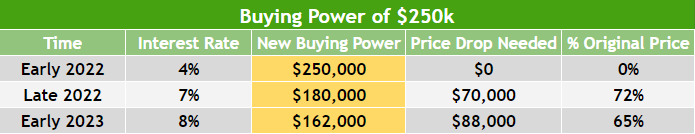

If someone could buy a $250,000 house at the beginning of 2022, now the same exact person could only afford $180,000. By next year, they can only afford $162,000.

This is why properties are sitting on the market. When prospective homeowners buy by payment, they can only afford 30-40% less in purchase price.

Buydown at $250,000

What if you try the buydown technique here?

If you paid 2 points, you could bring the interest rate down to 6%. This would cost you $4,000, but allow you to sell for $200,000. You’d net $16,000 more than if you were to sell at $180,000.

Sometimes, it’s not about price for the buyer. Many homebuyers are payment-motivated shoppers. Instead of lowering the price, try getting your buyer’s payment in line.

If Selling a Flip Isn’t Right for You Right Now…

Once you learn how to price a flip, you can try lowering price to accommodate buyer payments, or you can try a buydown strategy.

Or, if you have a property sitting with a hard money loan, maybe it’s time to refinance into a rental. Maybe it’s time to take the property off the market, instead of continuing to drop the price. Every time you drop the price, it hurts your appraised value.

We can help you with a DSCR loan or a traditional loan.

Reach out if you’d like us to price out a property and see if we could provide you a loan.

Send us an email at Info@TheCashFlowCompany.com.