How to Turn a Flip Into a Rental

Categories: Blog Posts

Stuck on the market? You might need to turn a flip into a rental… Here’s how!

What do we do with these flips that aren’t selling?

First, you have a big decision to make quickly – will you turn the flip into a rental?

You get the freedom of a little cash flowing in while you wait out the bad market. Depending on how long you’re willing to wait, you have a couple options to get into a temporary rental.

Here’s what you need to know about turning a flip into a rental with DSCR or bridge loans.

Using a DSCR Loan to Turn a Flip Into a Rental

A DSCR loan is the perfect longer-term option if you need to switch your fix-and-flip property to a rental. First of all, a DSCR loan is based only on:

- Your credit score (640-680 minimum).

- The LTV (maximum of 80%).

- Whether the property’s rent covers monthly expenses (including mortgage, insurance, taxes, and HOA fees).

There’s a variety of DSCR loans available – interest-only, 40-year amortization, regular 30-year, etc. Whatever loan you get, there’s an important detail to consider for all DSCR loans…

The DSCR Prepayment Penalty

The downside of a DSCR loan is the prepayment penalty.

Each loan has a term set for this penalty. If you pay off the loan before that term ends, you’re charged an exit fee. However, the fee amount does decrease each year.

As an example, one common structure for DSCR loans is a 5-year prepay penalty with a 5% fee. If you pay 4 years early, the fee goes down to 4%, 3 years, 3%, etc.

Additionally, there’s always a point where a DSCR loan, despite the prepay fee, becomes cheaper than a bridge loan.

DSCR vs Bridge Loan – Which Is Better for Turning a Flip Into a Rental?

The two main options when you need to turn a flip into a rental are a DSCR loan or a bridge loan. But how do you know which to pick?

We’ve covered that the DSCR loan comes with the prepayment fee. But the bridge loan will have a much higher interest rate.

Difference in Cost

If you intend to keep a property for more than 2 years, then a DSCR loan will always end up costing less, despite the fee.

But if you only want the property for 1 year or less, then the bridge loan will always be cheaper.

The gray area is the 1-2 year range. It varies with each loan, but there’s a tipping point somewhere in that timeframe where the bridge loan (with interest) becomes more expensive than a DSCR loan (with prepay fee).

Difference in Time

An underrated aspect of a DSCR loan is its built-in peace of mind. We have our educated guesses about how the market will go, but at the end of the day – things don’t always go as planned.

With a DSCR loan, if you end up needing to keep the property for 3, or even 30 years, you already have a product in place.

After one year with a bridge loan, you commit to either getting rid of the property or putting another loan (like a DSCR) in place.

A Close Look at the Numbers

To help us understand when a DSCR loan becomes the cheaper option, let’s look at an example. Then we can see exactly when the scale tips in the DSCR’s favor.

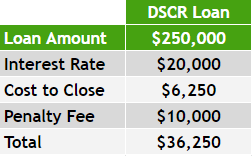

Let’s say we get a DSCR product with the following numbers:

- A higher interest rate at 8%

- All fees and loan costs at 2.5%

- We’re a year or two into the loan and the prepay penalty is down to 4%

Let’s look at the number comparison for a $250,000 loan.

The DSCR loan’s 8% rate adds up to $20,000/year. The fees at 2.5 points is $6,250. Lastly, that 4% penalty will cost us $10,000.

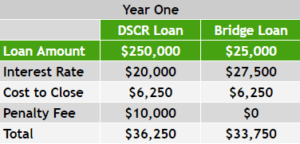

Now let’s factor in our bridge loan numbers. The average bridge loan for a $250,000 loan would look like an 11% rate costing $27,500 per year. This is $7,500 more yearly than the DSCR loan, or $625 more per month. The closing costs would be the same for the bridge loan, and then, of course, no prepay fee.

You can see the bridge loan is still almost $3,000 cheaper than the DSCR loan.

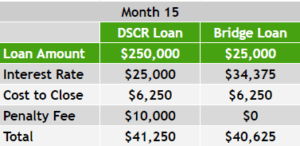

These calculations only represent year one of the loan, however. Within that first year, a bridge loan will definitely be cheaper. But let’s look at how things change at month 15:

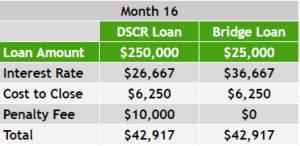

The bridge loan’s interest starts adding up, and suddenly the DSCR doesn’t seem so expensive. And at month 16, the loans are the same price:

After 16 months, the DSCR loan in this scenario would always be the cheaper option. And every year, the DSCR’s prepay fee drops lower; meanwhile, the bridge loan keeps accruing high interest at the same rate.

Is 16 Months a Realistic Timeline for the Market Right Now?

We expect that the market won’t pick back up for another 14-16 months anyway. If your flip is stuck on the market now, you could:

- Get a DSCR loan for the property.

- Take a 12-month tenant.

- Leave 4 months to spare for getting the house ready, on the market, and closed.

This puts you right at the 16 month minimum to make the DSCR loan worthwhile.

I Want to Turn My Flip Into a Rental

If you have a flip on the market now, converting it to a rental could be right for you. Do you know your tipping point? Should you get a DSCR or bridge loan? Bring your property to us, and we can give you an exact idea of the numbers.

Send us an email at Info@TheCashFlowCompany.com. Let’s get you connected to the right lender.