DSCR and BRRRR: The importance of refinancing

Today we are going to talk about the importance of refinancing when using a DSCR loan and BRRRR strategy. Here at The Cash Flow Company we are averaging 10 to 15 calls a day regarding the fundamentals. This includes knowing where to start, what you need to do, and how to be successful. In order to be successful, it is imperative that you go over the numbers first to make sure that you are getting into a good property. In doing so, investors can then determine if the property is a profitable investment.

What is the BRRRR strategy?

What exactly is BRRRR? BRRRR stands for buy, repair, rent, refinance, and repeat. The main purpose of BRRRR is to get into properties using little to no money out of your pocket. Those who use this strategy correctly will be able to accumulate “value at” properties quickly and create a portfolio. Just to clarify, “value at” properties are those that are under market value and need work done. These are often hoarder houses, in need of yard cleanup, and ones that need maintenance or repairs. Whether the current owners were unable or unwilling to fix up the property, it creates the perfect opportunity for investors. By taking the time to fix up the properties, you will in turn create net worth for the property.

Two loans, one goal!

With BRRRR you need one loan for the purchase and repair, plus a long term loan for the refinance. The short term loans are often a hard money loan or a private loan ranging from 10% to 12% interest rates. It is important to keep in mind that these loans are only temporary, lasting 6 to 12 months. After that time, the loan balloons. That is why it is so important to have a long term loan option available when using the BRRRR strategy. Many investors use a DSCR loan for their long term loan because it is based solely on the property and their credit score. One thing to keep in mind is that the LTV is different for each person and for each property. In the end you need to determine if your expenses equal your income prior to purchasing the property. Unfortunately, many people do not do the research up front or run through the numbers before making the purchase. Don’t wait until the refinance! Take a look ahead to make sure that the property you want to buy will be able to cash flow later on.

Look ahead to ensure success.

One of the most important pieces of the BRRRR strategy is refinance. A refinance is needed so that you can carry the loan long term. While buying the right property is important, it is crucial that you look ahead and understand the importance of refinancing. Oftentimes investors get to the refinance and either can’t get a loan or they can’t get enough money to cover their costs. In either case, it would defeat the purpose of using the BRRRR strategy. By doing the research up front and making sure that the whole thing works, you will actually make money. A lot of people don’t take the time to work through the numbers. Instead they discover during the refinance closing that they are going to lose money.

What is a DSCR loan and how can it work with BRRRR?

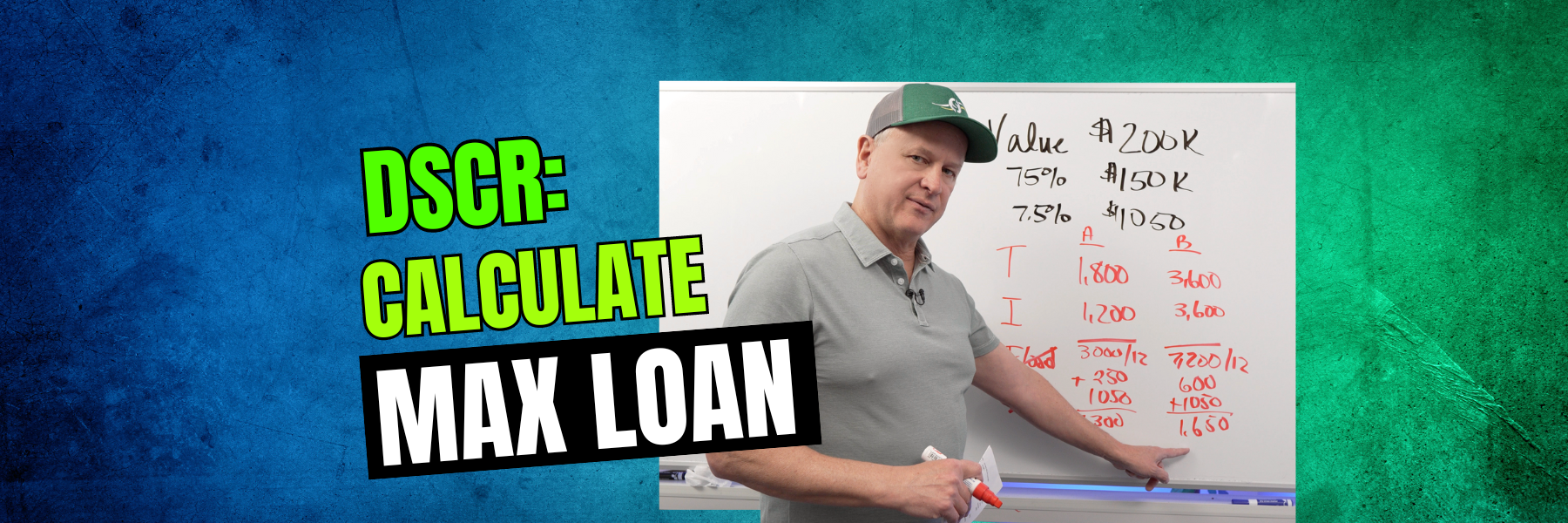

A DSCR loan is based solely on the property and your credit score. If the property’s income or rents are not very high, then you’re not going to get that big of a loan. The lenders will decrease the LTV until the break even point or sometimes higher. In the end, the lenders need the income and the expenses to be the same. This is referred to as the DSCR ratio. Just to clarify, expenses include the monthly payments, taxes, insurance, HOA, and flood insurance. One thing to keep in mind is that the LTV is different for each person and for each property. In the end you need to determine if your expenses equal your income prior to purchasing the property.

For example:

An investor is using a DSCR and buys something where the purchase, rehab, and everything puts them at 80%. However, the property itself only qualifies for 70% because of its break even point. While many think that they are good because they bought it and are into it for 75% to 80%, this is not always true. When it comes to refinancing the property, lenders can only do 70% to 75%. It is confusing and often daunting because there are so many moving parts. However, by laying it out and making sure that the property cash flows, you will be successful.

We are here to help!

Here at The Cash Flow Company, we are happy to run through the numbers with you to make sure that you are setting yourself up for success. That would include checking your rents, taxes, insurance, and LTV to make sure that you would qualify for a long term loan when you go to refinance. Don’t chance being surprised at the refinance closing! Take the time now to run through the numbers and ensure your success for the future!

Contact us today to see if a DSCR loan and the BRRRR strategy are right for you!

Watch our most recent video to learn more about DSCR and BRRRR: The importance of refinancing.