The Mortgage Market is Showing Signs of Being on the Mend.

What We Know:

The mortgage market is finally showing signs that it is starting to recover and heal. As states begin to lift travel and business closure restrictions and reopen for commerce, lenders appear to be relaxing some of their restrictions in-kind. Last week, we welcomed back a few lenders offering loans outside the standard conventional box.

This week, we see even more positive progress, such as lenders expanding the LTVs up to 70% on their investor cash flow loans (based on credit score and lease.)

We are noticing the lending requirements are a little more restrictive than before Covid-19, but at least additional options are making a comeback. Hopefully, this upward trend will continue over the following weeks.

What You Can Expect:

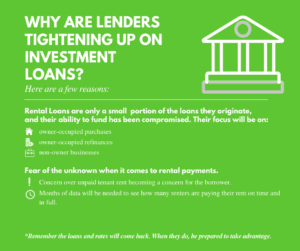

A return to business-as-usual won’t happen overnight, of course. The lower credit scores and higher LTVs will more than likely take some additional time to return to their pre-COVID closure state. Lenders will want more data on the unemployment and rental payment front before expanding.

Rates in the standard-conforming market are coming down. For investors, 30-year rates are in the mid 3’s for purchases and no cash-out refinances. Cash-out refinances are still a big challenge for investors, and will more than likely continue to be so for the next few months.

Expect to find the expanded requirements (up to 6 months reserves for each property) to be in place with underwriters through the end of the year.

*All non-commercial and construction loans offered by TNS Loans NMLS #1719349