Investor Mortgage Report – Week of January 22 2024

Categories: Uncategorized

Private loans/HML have seen a small easing in pricing over the past week to 10 days.

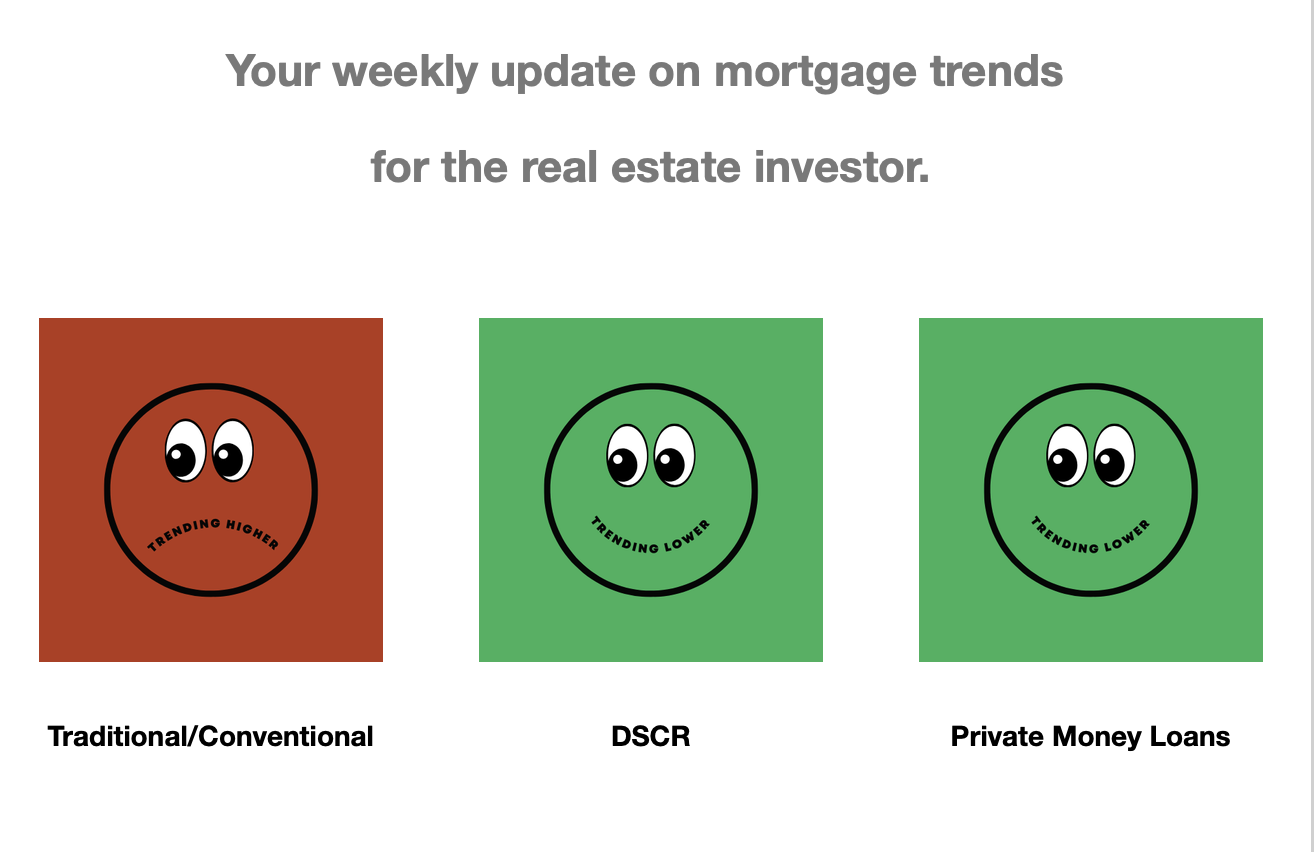

DSCR Loans

Best Rate at 60% LTV: 6.75% to 7.00%

Best Rate at 70% LTV: 6.875% to 7.25%

Best Rate at 80% LTV: 7% to 7.375%

Highest LTV: 85% (purchase + rate and term)

Lowest FICO score: 620

Smallest Loan: $75,000

Largest Loan: $20mm (large portfolios)

Vacant Properties: 75%

Short-Term Rentals: 80% (purchase + rate and term)

Best rates are based on 780+ credit score, DSCR above 1.15, loans over $300k and in major cities. We have 20+ of the best DSCR loan buyers at our fingertips and can help with most clients’ needs.

No Ratio Loans

Highest LTV: 75% (Purchase + rate and term)

No ratio loans are loans that do not require a rental agreement or have negative cash flow.

Conventional Loans

Owner Occupied: Low to mid 6%

Non-Owner Occupied: High 6% to low 7%

Conventional loan rates powered by TNS Loans NMLS #1719349 on properties in Colorado. If you want specific rates, reach out to TNS Loans via email at MB@TNSLoans.com.

Private Loans

Small Loans and Lenders (.5 – 3 Points): 9.75% – 12%

Large Lenders (15% down + 1 point + closing costs): 9.50 – 13%

What’s moving the conventional rates?

Although starting the week off a little bit better than Friday, mortgage rates could move higher this week if we continue to see markets give up on a March Fed rate cut. The likely best case scenario is that rates hold steady, because it is unlikely they will improve much from here this week.

What’s affecting rates this week:

- Economic data: · Thursday brings the preliminary 4th qtr GDP, along with unemployment claims. Friday we get the PCE inflation data, the Fed’s favored inflation gauge, which could influence rates to end the week.

- The Fed: Markets have been pricing in a Fed rate cut in March the last few weeks, which helped mortgage rates fall from October highs. However, markets are finally listening to Fed members who say a March cut is unlikely, causing rates to creep up, but there is room for rates to move higher yet.

Coming Soon…

Bank Loans

Construction Loans

HELOCS

Business Credit Cards

Please note all loans except Conventional Loans are Non-Trid loans (business purposes only) and require properties to be closed in a business entity like an LLC.

Don’t forget to grab a copy of your personal Investor Mortgage Report here!

What are the best loan products for where you are at now and where you are going.

Keep up as rates get better and requirements become easier.

Investor Mortgage Report – Week of January 22 2024