HELOC Vs Cash Out Refi: Which One is Better in 2024?

Are you thinking about tapping into your home equity to put more money into your life? If so, you might be wondering whether or not a Home Equity Line of Credit (HELOC) or a Cash-Out Refinance is the best choice for you. Both options have their perks, however one may suit your needs better than the other in 2024. Today we will discuss HELOC Vs Cash Out Refi. Let’s get started by breaking down the differences and comparing them in order to see which option will put more money into your pocket.

What is a HELOC?

First and foremost, what is a HELOC? A HELOC is a Home Equity Line of Credit, or an equity line on your property. Therefore, it operates like a credit card and you can draw from it as needed by using your home as collateral. To clarify, you only pay interest on the amount you borrow, not on the entire line of credit. Here are some key points about HELOCs:

- First, Low to no upfront costs: Many HELOCs have little to no initial fees if it is kept for a few years. Even if they do charge, it is normally only in the $400-$500 range.

- Next, Flexible borrowing: You can borrow as much or as little as you need, as long as you stay within your credit limit.

- Finally, Variable or fixed rates: Choose a rate that fits your financial plan. There are a variety of options available that can fit your needs.

What is a Cash-Out Refinance?

A Cash-Out Refinance on the other hand replaces your existing mortgage with a new, larger one. Therefore, you receive the difference in cash. This option can be helpful if you need a large sum of money and would prefer a single monthly payment. Here are some key points about a cash-Out Refinances:

- First, Higher upfront costs: Expect to pay between $3,000 and $8,000 in closing costs.

- Next, Fixed interest rate: Your new mortgage has a fixed rate, giving you predictable payments.

- Finally, Longer loan term: You start a new mortgage term, which can be up to 30 years.

5 Benefits of HELOCs

Here are five reasons why a HELOC might be a better choice than a Cash-Out Refinance in 2024:

- Lower Costs: It often costs little to nothing to refinance into a HELOC.

- More Funds Available: HELOCs usually allow you to borrow a higher percentage of your home’s value compared to Cash-Out Refinances.

- Keep Your Low Mortgage Rate: You don’t have to refinance your existing low-rate mortgage into a higher-rate loan.

- Fast and Simple: HELOCs are fast and simple to set up, often with less paperwork.

- No Regrets: With a HELOC, you’re not committing to a new long-term, higher-rate mortgage, potentially saving you money in the long run.

Which One is Better for You?

When choosing between a HELOC and a Cash-Out Refinance it depends on your financial goals, as well as the current market conditions. Here are some scenarios to help you decide:

Choose a HELOC if:

- Low upfront costs.

- Flexibility in borrowing.

- You plan to pay off the borrowed amount quickly.

- Receive 80% to 85% LTV.

- Interest on mortgage is 3% to 4% and will not be affected by HELOC.

- Less paperwork and closing in 1 to 3 weeks.

Choose a Cash-Out Refinance if:

- You need a large sum of money all at once.

- Fixed monthly payments.

- Payments are included within the life of the mortgage.

- Receive up to 75% LTV.

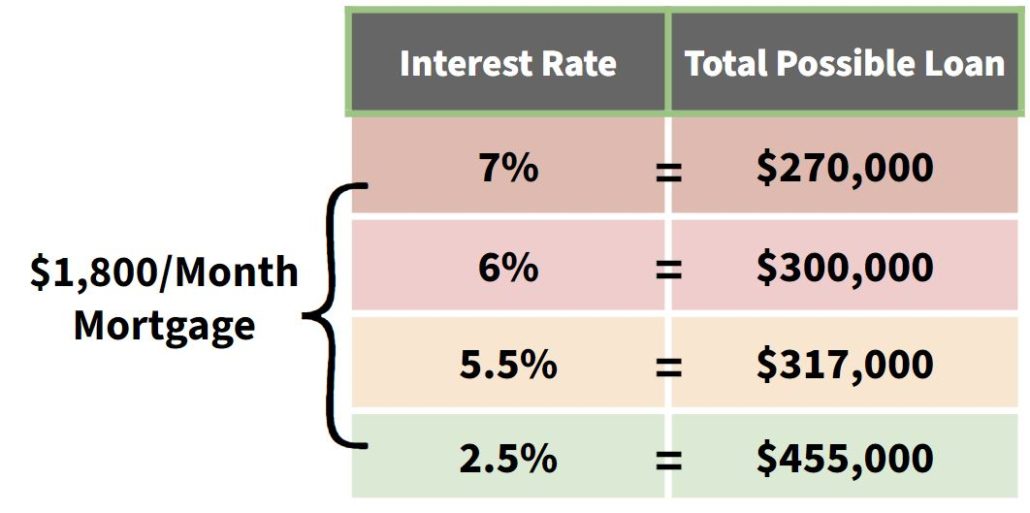

- Interest on mortgage will increase to 7%.

- More paperwork and closing in 3-4 weeks.

Real-Life Example

Today we are going to use the numbers right from David Ramsey’s website. On his website he states that the average debt in America for real estate, car, and credit card totals $290,000. It is important however to understand that these amounts can be even higher for some people. Therefore these numbers can multiply to an even higher number of savings for you depending on your situation.

| Total Debt | $290K |

| Current Mortgage | 4% |

| Total Debt Payments Per Month | $2,700 |

| Savings Goal Per Month | $700 |

| Refinance: Mortgage, Car, Credit Card Into One Payment | |

| Interest Rate | 7% |

| Mortgage After Refinance | $295K |

| Savings Goal Per Month | $700 |

| Cost Over the Life of the Loan | $250K |

| Cost After Just One Year | $113,000 |

| HELOC: Take Your Debt and Move it into a Home Equity Line of Credit | |

| Fixed Interest Rate | 9% |

| Consolidate the Car and Credit Cards | $57,000 |

| Savings Goal Per Month | $700 |

| Cost Over the Life of the Loan | $6,000 to $7,000 |

In sum, a HELOC is usually better for those who want low initial costs and flexible borrowing options. On the other hand, a Cash-Out Refinance might suit you if you need a large sum of money at once and prefer the stability of fixed payments.

Conclusion

In conclusion, a HELOC often provides more flexibility, as well as lower upfront costs than a Cash-Out Refinance will. However, your choice depends on your specific needs and financial situation. Therefore, think about your goals, how much money you need, and how quickly you plan to repay the loan. Most importantly, remember that interest rates and market conditions can change. What works best now might not be the best choice in the future. Always keep an eye on the market and consult with a financial advisor to make an informed decision.By making the right choice, you can save money, reduce stress, and improve your overall financial well-being.

Need More Information?

If you have questions or want more personalized advice, check out our website or give us a call. We’re here to help you make the best financial decision for your future.

Watch our most recent video to find out more about: HELOC Vs Cash Out Refi: Which One is Better in 2024?