Buying on-market properties is a money-suck for real estate investors. Here’s why to use the BRRRR strategy instead.

There are a lot of ways to mess up the BRRRR method.

But when you understand it right, this real estate strategy creates cash flow and net worth almost out of thin air.

We want to put the power of BRRRR in your hands. This is the start of a series walking through the BRRRR process step-by-step.

Let’s begin with the fundamental idea behind BRRRR – the thing that gives this method its money-making magic. How does the BRRRR strategy create cash flow out of seemingly nothing?

BRRRR Property vs Buying Retail

This is the basic concept behind real estate investing. There are two types of real estate properties:

- Retail – When we think of a house as “on the market,” it’s a retail property. These houses are sold at market price, a cost determined by current market conditions. In real estate, this includes supply, demand, location, interest rates, and a number of other factors.

- Undermarket – Properties that might be considered “off-market” are sold at an under-market price. There’s something preventing the house from being sold at market value as-is. The home could be outdated, damaged, foreclosed, or suffering from some other condition.

To break down exactly why and how BRRRR works, we need to look at the difference between buying retail and buying under-market as an investor.

Buying Retail with the BRRRR Strategy Doesn’t Work

The problem with buying retail as an investor is the house comes with no equity.

Let’s say you buy a property worth $400,000 (listed for that amount). With a conventional loan, the lender will cover up to 80% of the cost of the house. So you’ll need to put down 20%.

When you purchase the house and make the down payment, you’re transferring wealth, not creating it. You’re taking the money from your financial account and transferring it to the physical property.

So, you’ve moved $80,000 into the house, got a loan for $320,000, and created no additional wealth from the transaction.

There are three main disadvantages to retail properties:

- The property may create cash flow or wealth in the future as a rental property, but there is no wealth created from the purchase.

- You’ll require money up-front (in this case, $80,000 plus closing costs).

- You can only repeat BRRRR retail properties as long as you have the money to fund them.

Buying Under-Market for BRRRR

True BRRRR properties, however, solve all three of those problems retail properties have. A BRRRR property:

- Creates equity & cash flow immediately (and over time).

- Can be done with zero money down.

- Is a repeatable process.

BRRRR is all about buying under-market properties – the houses that are unwanted and unloved. In this market going into 2023, a lot of these types of homes will pop up, resulting in some great deals.

BRRRR Purchase

There are certainly some nuances to BRRRR, but let’s look at the bare basics. Let’s take the same example used for the retail property.

You, again, buy a property with a value of $400,000. However, since it’s valued under-market, you can purchase it for only $250,000.

The catch is that the house isn’t necessarily worth the $400k as-is. The potential is there, but you’ll have to update and rehab it. Between those fix-up costs and the closing costs, you’ll have to put $50,000 more into the property.

So the total cost of the property ends up being $300,000, or just 75% of the value of the home.

Cost of the BRRRR Strategy

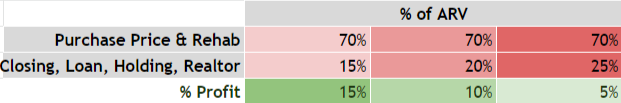

That 75% number is not only realistic but recommended for BRRRR properties. In down markets, it’s not entirely uncommon to see houses at 65% or below.

In this example, our all-in price (purchase + closing + rehab) is $300k, and the property is worth $400k.

Right away, we’ve created $100,000 in net worth.

Retail vs BRRRR: The Numbers

Now that we’ve explained the initial numbers, let’s do a side-by-side comparison to see why BRRRR is powerful enough to create generational wealth.

- Value: We’re comparing two homes with the same value – same neighborhood, same block, same size. Let’s say the value is $400k.

- Loan: For the BRRRR, our total costs would add up to $300k. Our leverage 100% covers this amount. For the retail home, we could get an 80% LTV, so our remaining loan is $320k. On retail, we have less cash flow because we owe more money.

- Cash Transfer: With BRRRR, you’re moving $0 of your own money. This is why properties with the BRRRR strategy are so popular for investors. With the retail property in our example, you need to transfer $80k of your money as a down payment.

There are two problems with the cash transfer requirement in retail properties. 1) You need the cash to get into it. And, 2) The last “R” in BRRRR is repeat, so you’d have to have $80k again for your next property and your next. On under-market BRRRR properties, the zero out-of-pocket costs free you up to repeat the process over and over.

- Payments: BRRRR payments will be lower than retail payments by about $25-$50/month, simply because the loan amount is lower.

- WEALTH: The BRRRR strategy property immediately creates $100k. The retail property adds $0. It only has the loan + the $80k that was yours to begin with.

How BRRRR Creates Wealth

The wealth in BRRRR comes from the difference between the value of the property and what you owe on it. This usually ends up being 25% of the value of the home.

If you multiply this process by 5-10 properties? You’ve suddenly got half a million to a million dollars in net worth.

Using the BRRRR strategy like this isn’t just wishful thinking. In 2010, we helped multiple families buy 10 properties in one year using this method. Many of their properties tripled and quadrupled in value over the last 10+ years.

The 2023 market is shaping up to look a lot like 2010. The time to buy is coming soon.

Using the BRRRR Strategy

Thinking about testing the BRRRR strategy for yourself?

We’ll be walking through the entire BRRRR process over the next few weeks. BRRRR is a simple way to generate wealth – but only if you really understand how the process works!

Send us an email at Info@TheCashFlowCompany.com if you have any questions. Check out our YouTube channel for more free information on BRRRR and other real estate investing strategies.