How can your credit score impact different types of loans in the real estate investing world?

Credit score impacts investors potentially more than anything else. Lenders will adjust the rates and terms of loans based purely on the three digits of credit score on a person’s financial records.

Leverage is the key to successful real estate investing, and understanding the impact of credit score is a critical facet of that leverage.

This article uses real-life examples to illustrate the difference a good credit score makes in the investment world.

How Does Credit Score Impact Fix and Flip Loans?

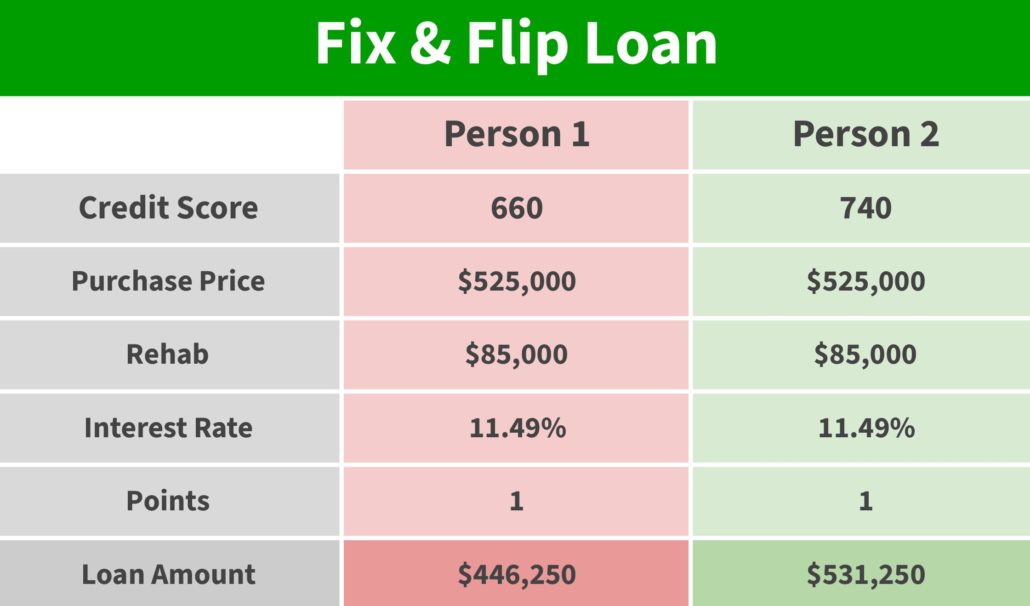

Let’s compare two clients:

- One (Person 1) has a low credit score of 660

- The other (Person 2) has a high score of 740

These numbers are based on real clients who have approached us for loans.

What Changes?

If you look at the way the numbers worked out in the chart above, you’ll notice that the actual interest rate is the same for both clients.

Obviously credit score can impact a rate, however it’s also common for the impact to be even simpler. In this situation, the lender simply gives less money to clients with lower scores.

In this scenario, the lender only offered 85% of the purchase price to the person with the lower credit score. The person with the higher score ended up having 85% of the purchase price covered as well as 100% of the rehab costs.

The Cost of a Low Score

If we estimate the closing costs for Person 1’s project at around $7,500 and combine that with the leftover 15% of the purchase price and 85K rehab, the cost of a low credit score starts to take shape. In our example, Person 1 will need to find over $171,000 of additional funding simply because they had a lower score.

Even when the rates aren’t affected, a low credit score is going to cost more in the long run. It’s hard to do multiple projects when you have to bring in that much money on your own.

How Can Credit Score Impact DSCR Loans?

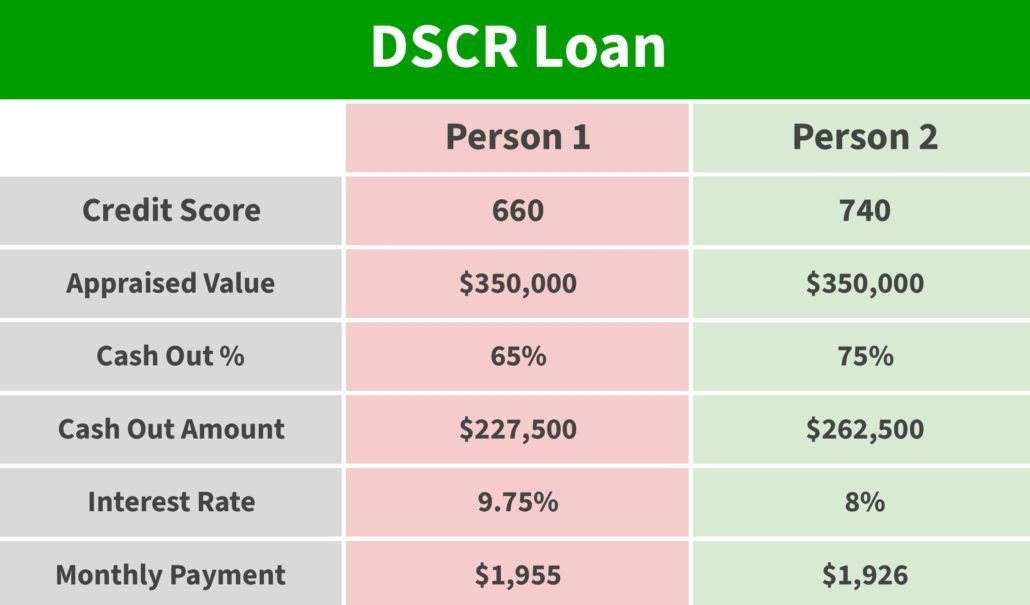

Using a similar example, let’s look at how DSCR loans can be impacted by a low credit score. We’ll use the same clients:

- One (Person 1) has a low credit score of 660

- The other (Person 2) has a high score of 740

We see a lot of clients looking at cash out refinancing, so we’ll look at that type of project.

What’s the Difference?

If Person 1 has a 660 credit score, not only will they likely struggle to find lenders, but 65% is about the best they could look for. This directly translates into less money out of that property.

In contrast, Person 2 with a 740 score should be able to fairly easily get 75%. The more money out, the better your leverage.

As you can see in the chart above, not only does the person with a lower credit score get less cash out, but their rate is also higher which raises their monthly payments.

Credit Score Matters

Although at first glance, it’s tempting to just look at the monthly payments and think, “It’s not that big of a difference,” don’t fall into that trap!

The person with the higher score not only has a lower monthly payment, but because they also got a higher Cash Out % which gave them an additional $35,000 out.

Having that good credit score makes it possible to keep cash flowing. If you’re serious about investing, your credit score matters.

How to Raise Your Credit Score

If you’re serious about real estate investing, you need to keep your credit score up. A low score is really going to cost you over time by strangling your cash flow.

But how can you fix a bad credit score?

There are a lot of options that can help you raise your credit, including usage loans, credit card strategies, or various tips.

If you’re interested in learning more about how credit scores affect investment opportunities or need help raising your score, reach out to us at Info@TheCashFlowCompany.com.