The Money Bucket: Lenders vs. You

Categories: Blog Posts

For any project you do, you need money. We refer to this collection of money as your money bucket.

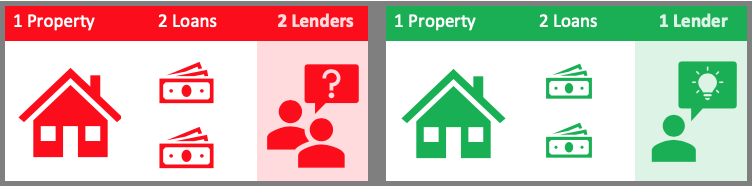

The money in your bucket comes from two sources: 1) a lender and 2) you.

Both of these areas of funding are going to come together and fill the bucket to finance your project.

Lenders

This is the part most people think about the most when it comes to real estate investing.

As an investor, it’s important that you’re attractive to lenders. Lenders, as a rule, want to lend you money, but it’s important to understand what they’re really looking for as well as how you can diversify your money bucket to maximize your success.

Sometimes you need hard money, sometimes you need a bank, sometimes you need conventional loans. Sometimes you just need gap funding.

Lenders offer a variety of options, and you should shop around to make sure you’re finding the right option that fits your project.

You

When it comes to the part of the money bucket you’re responsible for, there are two important areas for you to consider:

Credit Score

The better your credit, the more options you’ll have.

Impact of Credit: Banks love clients with high credit scores. The higher the score, the more options they’re likely to offer.

As with finding a loan, the more options banks offer, the more likely you are to find a great deal.

Personal vs. Business cards: Using personal credit for investing can quickly turn into a problem.

Using personal credit cards or lines of credit for business projects can drive people’s scores down.

We strongly recommend using business credit cards for your real estate investing. You still should make sure you’re paying everything on time, but that business credit card in your name isn’t going to be reported on your personal credit report.

This keeps your credit score higher as you’re looking for loans.

Lines of Credit: Having a variety of credit lines, and opening those strategically, will help you fill your money bucket. Lines of credit in business credit cards, HELOCs, etc. can get you more prepared for down payments, earnest money, repairs, and more.

It’s helpful to have backup lines of credit that are ready for when you need money for time-sensitive deals.

Fill your bucket and your options.

Other People’s Money

When trying to fill your money bucket, you shouldn’t overlook your friends and family.

Look out for real people in your life who are willing to invest in your project. Even if they only want to invest $10K, that can still help you cover your earnest money or smaller payments.

A lot of people are looking for private investments that offer better returns than traditional banks. Working with the real people in your life can make a huge difference in your ability to fund your project.

If you need help with navigating those personal investments, we’re happy to help. We have a lot of experience working with diverse money buckets and know how to keep notes for your financial records so those private loans are correctly accounted for.

Read the full article here.

Watch the video here: