Stop Dropping Listing Price NOW

Categories: Blog Posts

If you want to refinance your flip – stop dropping the listing price!

Will you keep your flip property as a rental? If the answer is “yes” or “maybe,” then STOP dropping the listing price today.

Lowering the listing price kills your deal. It becomes impossible to get the best loan to keep the property as a rental.

Why? Let’s go over the ways a lower list price affects your ability to refinance – plus a real life example from one of our clients.

How an Appraisal Impacts Real Estate Loans

If you plan on keeping the property, stop dropping the listing price NOW. Otherwise, it will impact the value of your home (and your LTV when you go to refinance).

The appraiser has certain guidelines they have to follow while determining the value of your home.

First of all, they have to go by whatever the current market conditions are. What are like-properties selling for in your market?

It doesn’t matter what properties sold for 3-6 months ago in the same place – they look at current conditions.

Your Price Changes the Appraisal

From the appraiser’s perspective, your price keeps dropping because the house won’t sell there. If the house won’t sell at a price, then it’s not worth that value.

If you dropped the price by $30,000, then $40,000, then $50,000, and it still hasn’t sold… the appraiser can’t give you the original value. In fact, they can’t even use your last list price. It’s clear the house didn’t sell for that much, so it must not be worth that much right now. Typically, your appraisal will come in between 1-10% lower than your last listing price.

Everything in a refinance hinges on the appraisal. If the appraisal is too low, you’ll get a low LTV. With a low LTV, your rates will be high. If your rates are too high, you’ll have negative cash flow. Your loan options can get totally squashed – all because of a lower list price.

Stop dropping the price if you may want to refinance before selling.

How Dropping Listing Price Hurt a Refinance

We had a recent client come across this exact issue. Here are his real numbers and what happened to him.

The First Listing

This client listed his property in late July, early August of this year. Everything had been going well for his investments in the last 7 or 8 years, so he took his time on a couple recent flips. But it took him a little too long on this one, and the timing is now killing him.

Let’s look at his numbers.

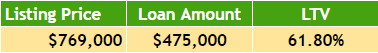

This client owes $425,000 on the loan. His initial listing price for this property was $769,000.

So far, so good. These numbers are great. He has a low loan-to-value. Sixty-five percent is a major threshold for LTVs. Being under 65%, this would be a great position for a refinance.

He would have had a lot of options available to him at this point, even if his income didn’t suffice for a conventional loan.

The Second Price

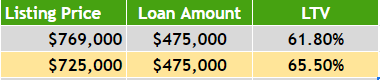

A couple weeks later, like most people would do when their property hasn’t sold, he decided to lower the price.

The new price was $725,000. His LTV crossed the threshold to above 65%.

Although not as great as before, he still would have plenty of loan options. Everything still looking good.

Third and Fourth Price Drops

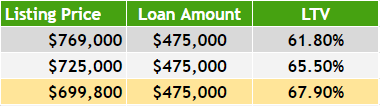

One week later, he decided to drop price again. His realtor talked him into dropping below $700,000.

Now at $699,800, he’s lowered the price three times. When the appraiser looks at this, they’re going to see the continual drops, making it clear that the property is not selling at these prices.

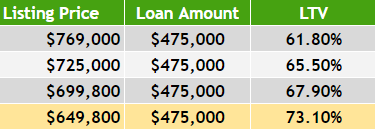

Eight weeks in, this client started getting desperate. Remember, he’s making monthly payments on this property. The house has a high negative cash flow. So he drops the price to $649,000 in hopes of selling.

He’s crossed another major LTV threshold into 70-75%. He’s created a big hurdle for refinancing by dropping the property 4 times over the last 8 weeks.

Dropping Listing Price Hurts Refinance

The appraiser will see the property isn’t selling at $649,000. So based on the current market rates, they’ll appraise it 1-10% less than that number. With this low appraisal, our client could get trapped above a 75% LTV. Getting a decent refinance loan just became way harder, with a nearly guaranteed negative cash flow.

The LTV has gone up, so now his refinance rates will go up. Additionally, he’s backed into a corner where he’ll need a higher credit score to get the loan. At a 65% LTV, there are options for almost any credit score. At 75%, you need a much higher score to get anything.

Every time you drop the price, you’re putting yourself at a higher risk of a worse rental refinance loan. Dropping price gets you lower LTVs, worse cash flow, and potentially takes away the option to refinance altogether.

Other Tips to Help You Stop Dropping Listing Price

If you made the decision to rent the property and you’ll keep it on the market, that’s fine up to a certain point. We recommend a few extra tricks to get the property sold without lowering price:

- “Accepting all offers.” Putting this in your listing tells buyers you’ll take less. But it doesn’t affect the actual listing price (so it won’t knock down your property’s value in an appraisal).

- Offer an incentive. You can give an incentive to the buying broker to put your property up front.

- Buy down. Buying 2 points on a $500,000 loan costs you $10,000. This buys down the rate up to 1 point, which could help a buyer qualify with a new debt ratio.

Help to Stop Dropping Listing Price

We hate to see clients end up with pains from dropping their listing price. Let’s make sure you don’t land in the same spot.

If you have a loan you want us to look at, price out, and calculate cash flow on, send it our way! Email us at Info@TheCashFlowCompany.com.