How can you choose the right DSCR prepay option for your project?

It’s important to look at the prepay penalties of your loan so that you can figure out what fits your particular investment. You should also take time to research the following to make sure you’re getting the best deal possible:

Think about your timeline.

Are you keeping the property long term? Do you think the market’s going to go down? All those things come into play when you’re determining what prepay is best for you.

A good lender will walk you through the numbers and your options, but the more information you have about your timeline, the better they’ll be able to help you.

Work with a knowledgeable lender.

Make sure you pick a lender who has options. DSCR companies often specialize in loans for a specific group, so it’s possible they won’t have the perfect loan for you.

A good lender should have at least five to ten different DSCR funders that they could match with your loan. They should be able to help you find a loan that fits your timeline, cash flow, and specific project needs.

Consider your exit strategy.

Prepay penalties come into play when you exit your loan.

If you know on the front end of your project that you want a DSCR loan but might not need five years to complete it, then that should be a huge consideration when configuring your DSCR.

Prepay Cost Examples

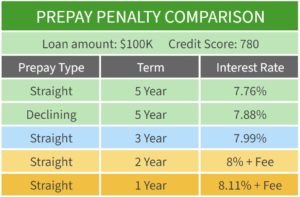

This chart can help you understand how DSCR prepay penalties can affect the cost of your project.

In this example, we’re considering a loan of $100K from a person with a 780 credit score.

When comparing straight vs. declining prepay options, it’s always worth considering the timeline of your project as well as whether or not interest rates are projected to drop.

Also, always check what added fees your lender might have connected with their prepay option as these can vary significantly.

Read the full article here.

Watch the full video here: