The Lender Pie: 3 Key Loan Qualifications in Real Estate

The biggest hurdle that many investors face is learning the lending side of real estate. Today we are going to go over the lender pie and how it affects you as an investor. For over 23 years I have been working with investors. Many of them are just starting out and learning how to build both income and wealth. Wealth in real estate investing is achieved by using other people’s money for leverage. It is important that you understand the leverage side, what it looks like, and how you can make it work for you. This will in turn allow you to better understand how to play the game and win in real estate. Let’s take a look at the three things that lenders are looking for when making their decision for approval.

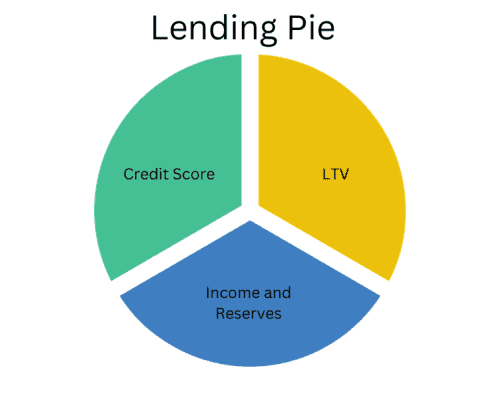

All lenders are looking for three things that make up their decision if they are going to lend to you. This includes your credit score, LTV, and your income.

1. LTV

LTV stands for the loan to value. It is determined by evaluating how much money you have in a property, how much equity you have, and what is your piece of this property. LTV is one of the biggest factors that lenders look at when determining if they are going to lend to you, how much they will lend, and what it is going to cost.

2. Income and Reserves

Income and reserves can either come from you or from the property. If you’re looking at a DSCR or fix and flip, and you are going to sell it, then it is the income that the lenders will evaluate. Reserves include the amount of money you have put away in case something comes up. In regards to rental properties, it is how many months of reserves you have in case the property goes unrented for 3 to 6 months. If you’re a flipper, the reserves can help you make payments over the next 6 to 9 months until your property is sold.

3. Credit score

Lenders will evaluate your credit score and how you have paid people in the past before considering loan approval. Lending is primarily based on algorithms, and your credit score is a big determining factor.

Which factor is the most important to lenders?

The answer is that It’s always a mix between the credit score, LTV, and income. This is because everyone’s pie is just a little bit different when lenders are looking. Let’s take a look at a few examples and how one piece of the pie can impact the other two.

Example 1: LTV

First let’s start by looking at LTV. The more money you have into the property the lower the LTV. This lower LTV allows the lender to be more flexible when it comes to your income requirements, or even your credit score. An example of this would be an individual who has owned a rental for a long time and is refinancing it with a 60% LTV. When your LTV is lower, they can overlook and maybe stretch the DTI or even lower the credit score requirements. On the other hand, if you have a property and you are into it for 90%, the lender will then be very diligent in making sure that you hit both the income and credit requirements. Remember if your LTV or credit score is not the perfect piece of the pie, then you may have to compensate for that with a higher rate. We want to make sure that you understand this so that you pay the least amount when you’re investing. Investing is all about creating more wealth and income by paying less on the money that you are borrowing.

Example 2: Income

The question is, does your personal income make the payments, or can it make the payments on this new debt? The more income you have to cover the expenses, the more lenders can look at a higher LTV or they could even lower credit limitations. On the other side of it, if you have more reserves, the lenders can look at giving you a higher LTV. Just to clarify, reserves include 401K, IRA, stocks, bonds, and savings. Reserves are anything that is liquid. Let’s say your expenses are $1000 a month. This includes your mortgage, HOA, flood insurance, taxes, and insurance payment. If this property is bringing in $300K, the lenders will be a little more flexible on your credit and LTV because they know that this property is able to sustain. However, if the expenses are $1000 and you’re only bringing in $1100, then there is less of a cushion. The lender will see the income as being less sufficient to take any hits or damage if the property goes vacant for a month or the market shifts. They may want a lower LTV or require a higher credit score to help balance things out.

Example 3: Credit score

Your credit score is the most important factor in being approved or denied for a loan. If you have a good property, but a bad credit score in the 500’s, it won’t matter for most lenders. To clarify, a good property could be one that is 50% or 60% LTV. However, most lenders won’t even look at you. This is due to the fact that all lenders have guidelines and have to take into consideration certain things. If you have a 600 or even 620 credit score, then you are going to be limited. Your credit score is vital to your success. The higher credit score will get you more money, a higher LTV, and it will provide more flexibility on income requirements. It is imperative for new investors to get their credit score as high as possible because it will lower the interest rates, the lower the mortgage payment, and decrease the amount of income you will need.

In conclusion

These examples create a great picture of what real estate investors need to understand about leverage. Again, leverage is how you create wealth and income. Remember that it is not just one piece of the pie that is taken into consideration in the lending process. Instead, a lender is going to look at every piece and make sure that your pie is where it needs to be for approval. While LTV and income are more difficult to change, your credit score is a place where you can make the biggest impact. Be on the lookout for future videos that focus on credit and easy ways to raise your scores.

Our goal is to make sure that you are as successful as possible. Contact us to find out more about the lending pie and how you can raise your credit scores.

Watch our most recent video about The Lender Pie: 3 Key Loan Qualifications in Real Estate to find out more.