What is BRRRR? Here’s an intro to the most basic concepts.

BRRRR is one of the most powerful forms of real estate investing.

It’s not uncommon for people to retire, 10x their net worth, or become full-time investors with BRRRR.

Done wrong, though, BRRRR is a giant waste of time and money.

We want to help you have a positive experience with BRRRR. Getting BRRRR right is a matter of basic education. So let’s go over the 3 key fundamentals that explain: What is BRRRR?

What Is BRRRR?

“BRRRR” stands for “buy, rehab, rent, refinance, repeat.” It’s a process for capturing equity and creating cash flow on rental properties.

What Is BRRRR Step 1: Buy

BRRRR is not a retail-buy strategy. The properties you get for a BRRRR need to be off-market and under-market.

There are several considerations that go into a “good” BRRRR property:

- The rent you can charge has to create cash flow.

- The appraisal during the refinance will need to create a profit.

- The property needs to be desirable enough to attract great tenants.

BRRRRs are bought with “sweat equity.” This doesn’t just refer to the physical work you put into a home once you have it… It also applies to the work you have to put in before purchasing the property to ensure it’ll make you money.

What Is BRRRR Step 2: Rehab

For the rehab of a BRRRR, there’s a balancing act to make the project “rental grade.” On the one hand, you have to stay within budget. Rental properties take some wear and tear, so your updates should account for that.

On the other hand, you still want quality. Why? Firstly, because better properties attract better tenants. And secondly, because your refinance depends on the appraisal. To get a good appraisal value, the property must show quality work.

What Is BRRRR Step 3: Rent

A BRRRR property’s cash flow is largely dependent on the amount of rent you can charge. Be aware of the rent range you can realistically charge in your property’s location.

Knowing the rent will help tell you what updates you should make to the property. For example, if adding an extra bedroom would get you an extra $500 per month, it may be worth the construction costs.

You can estimate an area’s rents by going to Zillow, Rentals.com, or talking to local property managers.

What Is BRRRR Step 4: Refinance

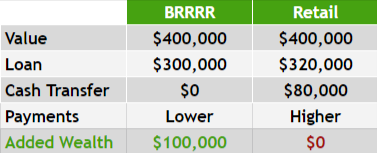

Part of the BRRRR strategy is to use two loans. You buy with a short-term hard money loan, then refinance into a long-term loan after all the rehab.

To make the most money, you’ll want to set yourself up for a rate and term refinance rather than cash out.

What Is BRRRR Step 5: Repeat

The true secret to how BRRRR can create so much wealth is the repeat-ability of the process.

We recommend people getting into real estate investing to buy 10 BRRRR properties in 3 years, or 5 in 2 years.

How can you possibly afford to buy so much real estate in such a short amount of time? The right BRRRR properties require zero money down. If you were pulling from your savings for every down payment, you wouldn’t be able to get as far.

So, what is BRRRR? It’s a method for building an investment rental property portfolio that requires no money out of your pocket.

3 Factors that Ensure a BRRRR Success

After helping investors through the BRRRR process for over 15 years, we’ve seen 3 key factors that make these transactions successful.

1. Building a Team

The really good under-market BRRRR properties won’t just jump into your lap. These properties require a little digging, and – more importantly – a team to help you.

You’ll need to know wholesalers, real estate agents, other investors, and anyone else who can help you locate good undermarket properties.

(It’s also an advantage to keep lenders on your team so you can close fast on these great properties once you find them.)

2. The Money Side

“It takes money to make money.”

If you can learn the basics about the costs of your BRRRR projects, you can squeeze more money out of each project.

We always say that there’s money in the money. Do the research to learn about real estate before your first investment, and you’ll be miles ahead of other investors.

3. Using the Right Leverage

Yes, it takes money to make money, but it doesn’t have to be your money.

Plan for and understand the entire BRRRR process, and leverage can work to 10x your net worth.

Where To Go From Here

This only brushes the surface of BRRRR. Over the coming weeks, we’ll visit each of these topics in much more detail. Why do you use two loans? How can you do this with zero money down? How do you go about a refinance?

If you have a deal now you’d like us to look at for you, send us an email at Info@TheCashFlowCompany.com.