What is a DSCR Ratio?

Categories: Blog Posts

The DSCR ratio is the foundation of successful DSCR investing. But what is it and how can you use it to build income?

When getting into the DSCR game, it’s important to run some numbers on the front end to evaluate potential deals.

How do you know if your property is going to meet DSCR requirements? What’s the minimum loan you’ll need, and what’s the maximum you can shop for the purchase price?

Today we’re going to look at these calculations, walking through how you can get pretty good estimates for these numbers using the DSCR ratio and the average rent rate in your local area.

It All Starts With The Ratio

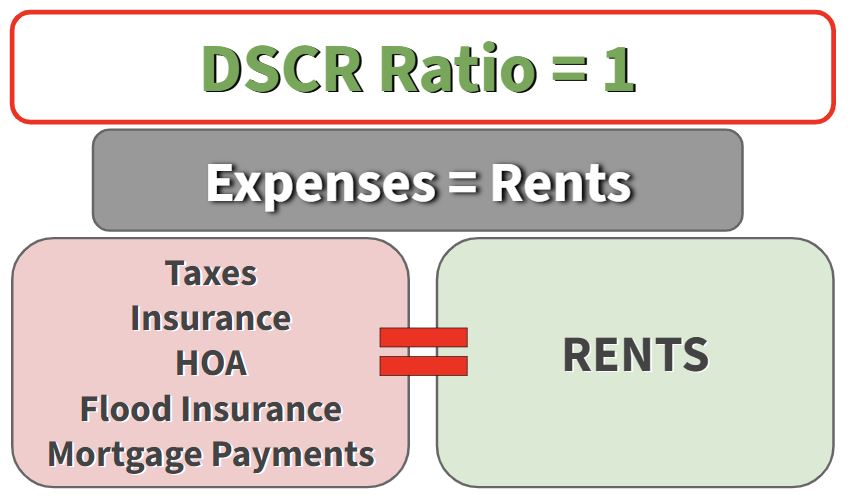

The DSCR ratio is simply the break-even point for that property. Essentially, if the ratio equals 1, then the total cost of the project is canceled out by the incoming rent.

These costs are decently easy to estimate by talking to other investors in your area. You can often find HOA or tax information online which will help you figure these numbers.

Understanding the DSCR ratio is the foundation for successful investing.

By building your investment strategy off of this ratio, you know that, at the very least, you’ll break even by sticking to a DSCR ratio = 1.

Once you’re sure you can break even, you can even set your rents slightly higher (or try to keep costs lower) to have a higher ratio of 1.25 (where you’ll have 25% higher income than outgoing cash). This typically comes in a later step which you can read about in a previous article.

Read the full article here.

Watch the full video here: