DSCR Calculator: How to Determine Your Rental Income

Categories: Blog Posts

What do you need to know in order to effectively use a DSCR calculator?

If you’re new to the DSCR game, you’ve likely heard people talking about the DSCR ratio and how that number helps you set rents. But how do you actually calculate all of that?

What is a DSCR Ratio?

A DSCR ratio is simply the break-even point.

Essentially, you start by adding up all of your monthly expenses (mortgage payments, taxes, insurance, HOA fees, etc.). If you compare that number to the amount you’re charging for rents and those numbers are the same (you’re putting out and bringing in the same $$ amount), then you have a DSCR ratio of 1.

You never want a DSCR below 1 (spending more than you’re bringing in). However, a ratio of 1 simply means that you’re breaking even. In other words, you’re not actually making money unless you can raise the ratio (and raise rents) in order to bring in more money than you’re spending.

Lenders like to see positive cash flow, so it’s typically good to aim for a DSCR ratio of 1.25. That means you’ll make 25% more than you’re spending.

How to Calculate Your Fixed Costs

The first step of figuring out the ratio is to get a really clear picture of your expenses. Expenses come in two parts: fixed costs and monthly payments for loans.

Let’s look at fixed costs first.

These fixed monthly expenses consist of things like HOA fees, insurance, taxes, and other exciting things.

For Example…

Let’s take a peek at some numbers based on a property we reviewed recently:

- Taxes. This property had $1,200/year in taxes. Divide that by 12 and you have $100/month.

- Property Insurance. We’re going to look at $1,800/year or $150/month.

- Flood Insurance. This property didn’t have any HOA fees, but it did need flood insurance. That comes to $2,4000/year or $200/month.

In total, you have $450/month in expenses for this property before factoring in your mortgage payment.

How To Calculate Monthly Loan Payments

Once you know your fixed costs, there are a few other numbers to take into consideration before setting your rents. Once we know how much money is going out every month, we can figure out how much we need coming in.

The property in our example cost $250K and the investor paid a 20% down payment.

- Purchase Price = $250,000

- Down Payment = 20%

- 30-Year Fixed-Rate (8.5%) DSCR Loan = $200,000

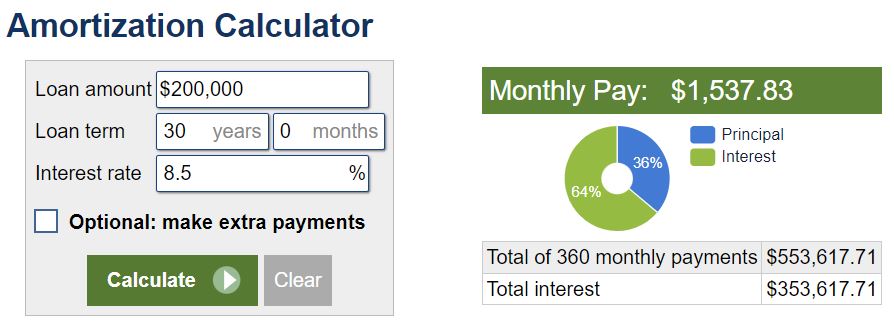

The easiest way to calculate your monthly payments is to use a calculator designed for these numbers. We recommend using a site like calculator.net and selecting their amortization calculator.

You can plug in the numbers, and it will do the work for you.

Once you plug in the numbers and hit calculate, you’ll see that your monthly loan payments are just under $1,538.

Updated Monthly Costs:

- Fixed Costs = $450

- Approximate Loan Payments = $1,538

- Total = $1,988

Now that you know all of the money you’re paying each month, you know that to hit a DSCR ratio of 1, you’ll need to have rents of at least $1,988 in order to break even.

Using the DSCR Ratio to Set Rents

As we mentioned before, a DSCR ratio of 1 is fine – you won’t be losing money. But it’s not an optimal investment strategy.

Lenders like to see you turning a profit, and you should too!

Returning to our above example, let’s say your outgoing expenses are $1,988. If you raise your rents by 25% (raising that DSCR ratio to 1.25 instead of 1), you’ll suddenly be making a 25% profit.

Here’s how you get those numbers:

Breaking even on your real estate investing projects is great, but making money is the goal. Understanding how to calculate these numbers is a critical step towards successful investing

Check Out Our DSCR Calculator

To help you get an even clearer understanding of DSCRs, check out our DSCR calculator. It’s free to download and easy to use.

You’re also welcome to email us at Info@TheCashFlowCompany.com. We’re more than happy to answer questions and help you find the right deal.

We’re always looking for ways to help you succeed in your investment journey by giving you the knowledge and tools to win.