What do you need to know about your credit score and money bucket so your investing is easy, lucrative, fun, and fast?

We want to give you the tools you need to win in the real estate game.

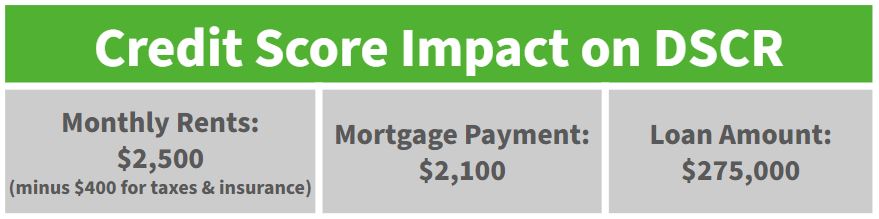

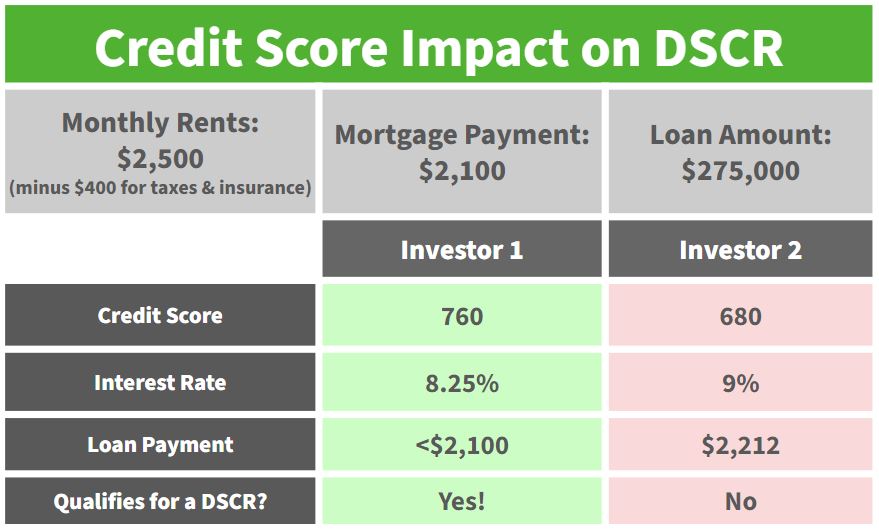

In a recent article, we learned how lenders look at your credit score to determine the maximum loan they’ll offer. Today, we want to apply the same principles specifically to DSCR loans.

Some investors focus on fixing and flipping properties, while others create wealth through rentals. DSCR loans are one of the most useful tools for investors that are specifically designed for rental properties.

Understanding Leverage

Leverage is what we call using other people’s money. This typically comes in the form of bank loans, but it’s not limited to that.

Things like financial gifts, small loans from friends and family, your credit score, and loans from companies like Hard Money Mike can all give you leverage.

This leverage creates an equal playing field in the investing world. You don’t need to be wealthy to use leverage well.

Credit Score as Leverage

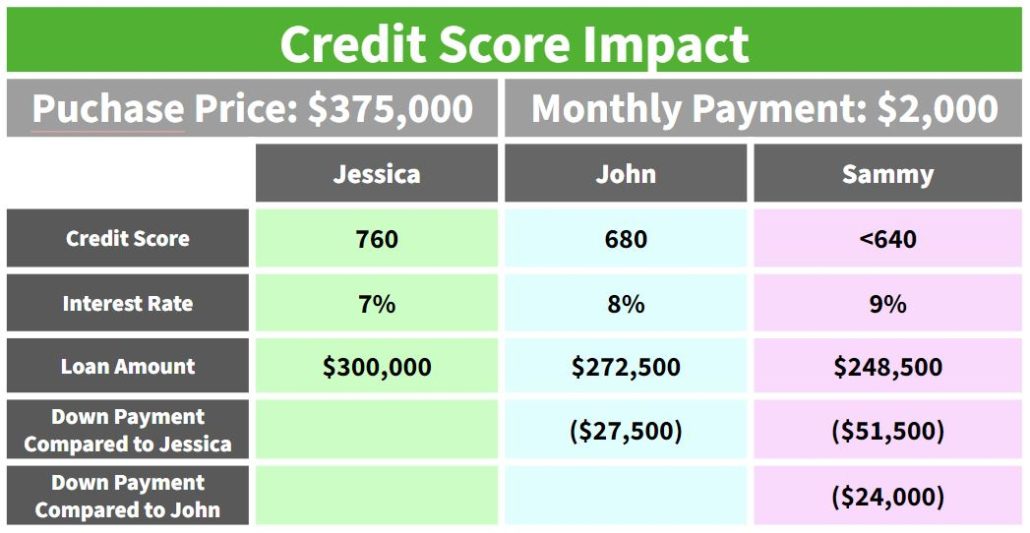

In this day and age, credit scores matter a lot. A good credit score is a powerful tool that you can use to increase your leverage.

We also sometimes talk about money buckets. Your ‘money bucket’ is the money you bring to the table. Obviously, if you’re a newer investor, your money bucket might not have as much personal money to fill it, in which case credit score matters even more.

However, strategically using your credit score, credit cards, business cards, HELOCs, etc. to fill your money bucket now is a great way to make sure you’re ready for future investing.

How to Fix a Bad Credit Score

If you have a low score, it’s typically because of 1) late payments, or 2) usage. Unfortunately, there are no quick fixes for late payments. However, if you struggle with usage issue, there are a few things you can do.

First of all, a usage issue typically happens when you’re using too high of a percentage of your monthly allowance. This means that, even though they paid off their balance on time every month, excessive use of a personal credit card can driving down your score.

Here’s the deal: personal credit cards are not built to handle consistent real estate investing expenses. If you’re doing consistent real estate investing, we recommend looking into business credit cards.

Business cards often have higher usage limits which are ideal for the constant wear and tear of this industry.

You can also look into secured usage loans as a way to quickly boost your credit score.

Main Money Bucket Takeaways

Leverage is king, and credit scores are an important piece of your leverage.

A good credit score makes it easier for you to qualify for and refinance your DSCRs. They can also help you put less money down on a property and increase your cash flow.

Take care of your money buckets and credit score on the front end so you can succeed when deals come your way.

To help you get prepared, you can explore our website where we have free tools you can download to help you get organized, including a DSCR calculator and a business credit card marketplace.

If you’re interested in learning more about how you can E.L.F.F. your investing, feel free to reach out to us at Info@TheCashFlowCompany.com or fill out a contact card.

Read the full article here.

Watch the full video here: