The Key to ‘ELFF’ing the Real Estate Game

Categories: Blog Posts

Making the real estate game Easy, Lucrative, Fun, and FAST is a critical component to your success as an investor!

A while ago, Joe Polish from I Love Marketing began using the acronym “E.L.F.” to describe an easy, lucrative, and fun business.

However, in the real estate world, time is everything. While we totally support easy, lucrative, and fun real estate investing, we also recognize that we need to move FAST.

Leverage (using other people’s money in the form of loans and gifts) is what makes real estate investing lucrative and accessible. Having the right leverage when you need it can really make or break your business.

And the truth is this:

Leverage is significantly affected by your credit score.

How Does Credit Score Affect Leverage?

Having a high credit score often comes with many perks. You might get offered better rates or terms, asked fewer questions, and experience faster approvals with less paperwork.

Unfortunately, while your credit score might make the loan process easier, a bad credit score can make your life a lot more difficult.

Let’s Check Out a Scenario…

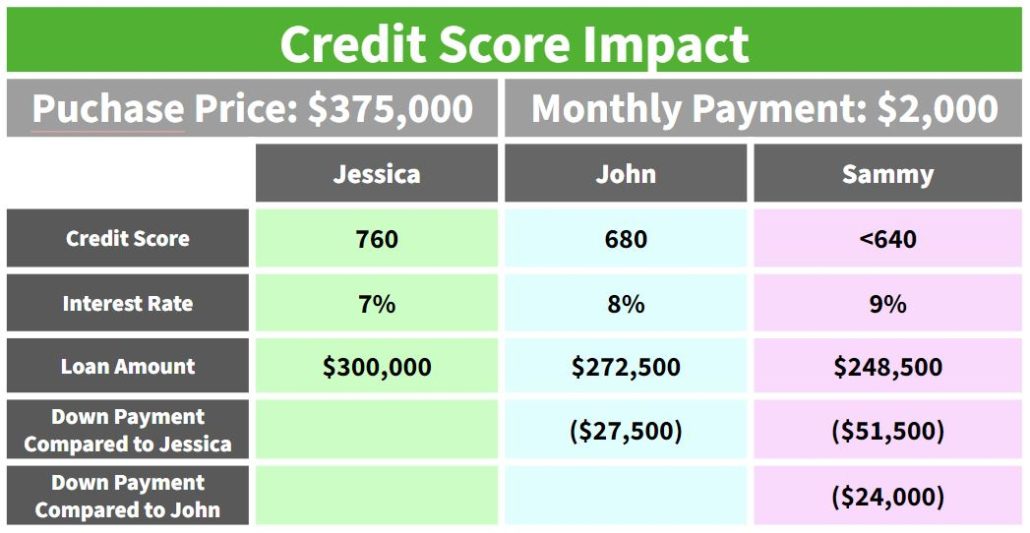

If we look at a hypothetical purchase price of $375,000. In order to make the property cashflow, all our hypothetical investors must maintain a monthly mortgage payment of $2,000.

Even though each investor is looking at the same property and mortgage payment, their credit score affects their other payments.

Our Investors:

- Jessica: She’s a dedicated investor who takes care of her credit, monitoring her score and keeping investment payments on business cards.

- John: He uses personal credit cards for all his investments which has resulted in a score just above the minimum eligibility requirement for most traditional loans.

- Sammy: He doesn’t monitor his credit and is convinced the banks just hate him. He never bothers to check his credit score.

The Numbers:

Each of our imaginary investors end up in a different financial situation purely based on their credit score.

Even though their monthly payments are the same, Jessica ends up getting much more money at a lower rate. Meanwhile John and Sammy are stuck with smaller loans, less leverage, and a slow-moving process.

The Need for Speed

In our example above, Jessica has the advantage over these two investors because she can move through projects faster. She isn’t stuck waiting for approvals or trying to come up with so much additional money outside of her primary loan.

Leverage makes real estate investing an even playing field for everyone out there, but credit scores can limit your leverage if you’re not careful.

A good credit score opens doors and makes everything cheaper, easier, faster.

To E.L.F.F. the real estate business, you need to set yourself up to win.

Read the full article here.

Watch the full video here: