DSCR Loan – Is It Right For Your Real Estate Investment?

What is a DSCR Loan?

A DSCR loan stands for Debt Service Coverage Ratio loan and is an excellent loan for real estate investment. It’s designed specifically for real estate investors. This type of loan helps you buy rental properties, whether they are long-term or short-term rentals. It’s not for flips or homes you plan to live in.

Why Choose a DSCR Loan?

Choosing a DSCR loan can be a smart move for several reasons:

- Easy Qualification: You don’t need to worry about how long you’ve been in business or your personal income. Even if you started your business yesterday, you could qualify.

- Focus on Property Income: The loan qualification is based on the income generated by the property, not your personal income.

- 30-Year Loan Options: You get a good 30-year loan product, which can provide stability and predictability.

How Does a DSCR Loan Work?

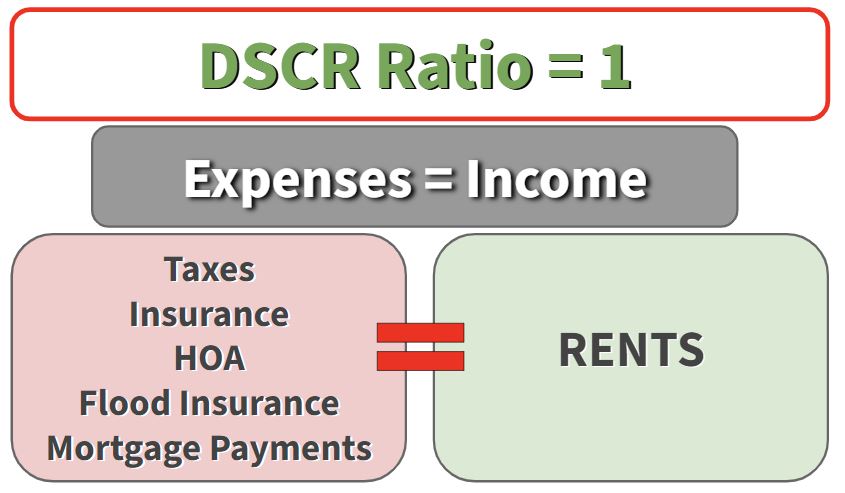

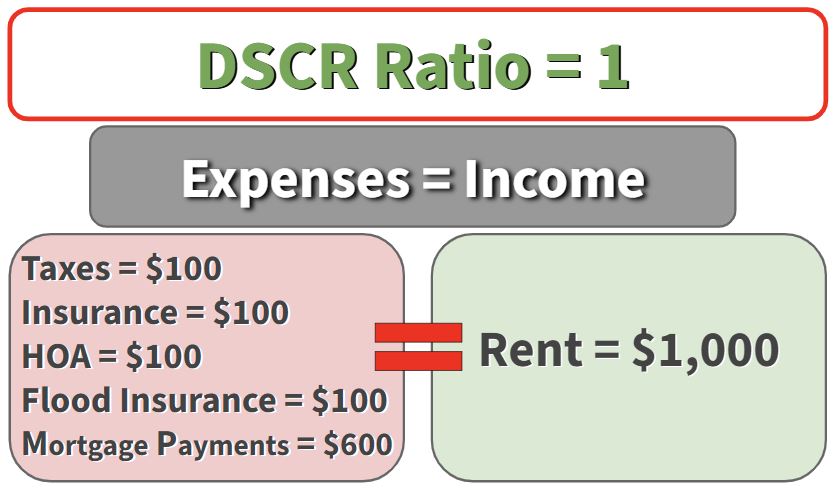

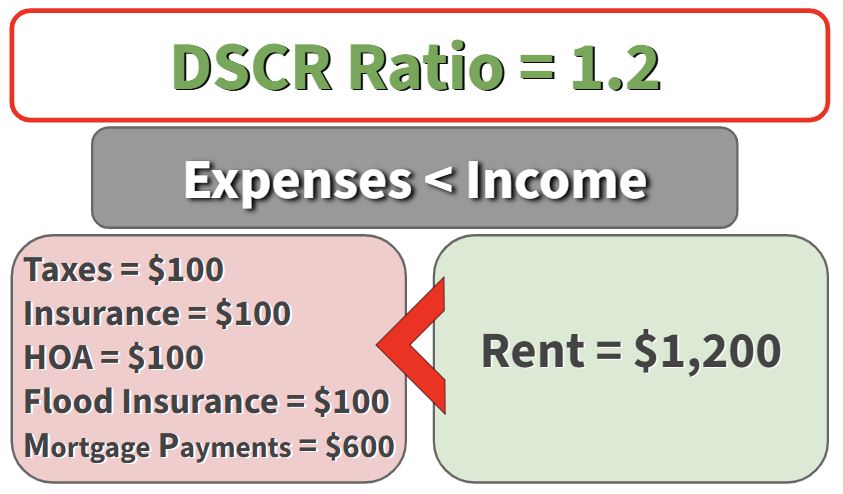

The key to a DSCR loan is that it focuses on the property’s ability to generate enough income to cover its expenses. Here’s how it works:

- Property Income: The income from the rental property should at least cover the mortgage, property taxes, insurance, and any HOA or flood insurance fees.

- Credit Score: Your personal credit score is important. The higher your score, the better the terms and rates.

- Loan-to-Value Ratio (LTV): This is the amount of the loan compared to the property’s value. Lower LTV means less risk for lenders and better terms for you.

Who Can Benefit from a DSCR Loan?

DSCR loans are perfect for:

- New Investors: If you’ve just started your real estate investment journey, you can qualify even without a long business history.

- Tax Savvy Investors: If you write off a lot of expenses on your taxes, which can reduce your reported income, this loan can still work for you.

- Expanding Portfolios: Investors looking to add more rental properties can benefit from the flexible qualification criteria.

Example

Imagine you are an investor who just started a year ago. You found a great rental property, but traditional lenders won’t approve your loan because you don’t have two years of business income. A DSCR loan can help. As long as the rental income covers the mortgage and other expenses, you can get the loan and grow your investment portfolio.

Important Considerations

Before jumping into a DSCR loan, consider these factors:

- Prepayment Penalties: These loans often come with penalties if you pay them off early. Make sure to understand these terms before committing.

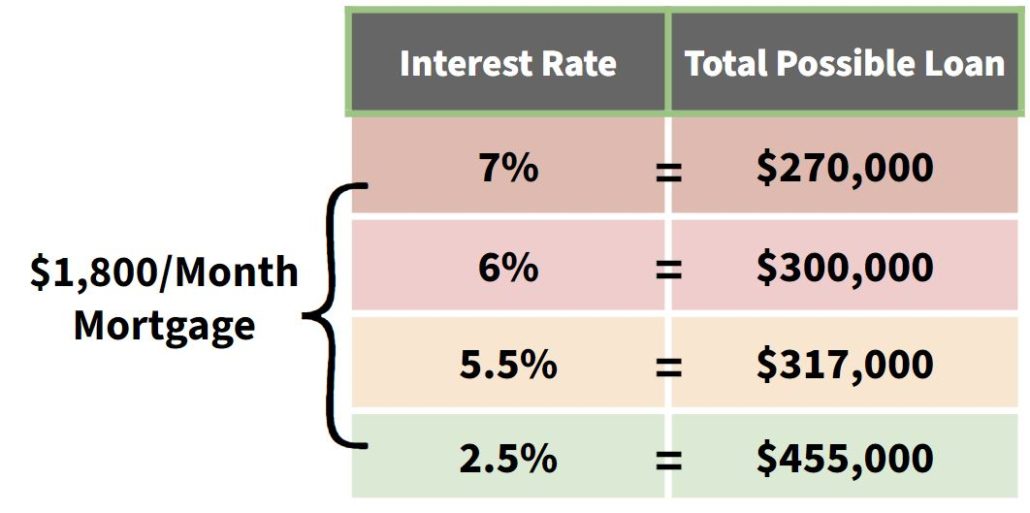

- Higher Interest Rates: DSCR loans can have slightly higher interest rates compared to traditional loans. This is because they are easier to qualify for.

- Not for Flips or Personal Use: These loans are strictly for rental properties, not for homes you plan to flip or live in.

Is a DSCR Loan Right for You?

If you’re a real estate investor looking for a flexible loan option that doesn’t rely heavily on your personal income, a DSCR loan could be the perfect fit. It’s especially useful if you’re new to the business or if you maximize your tax deductions. Always run the numbers and shop around for the best terms.

Get Started with a DSCR Loan Today

A DSCR loan is an excellent loan for real estate investors. Is it right for your investment needs? Contact us at The Cash Flow Company. We have the tools and expertise to help you understand your options and find the best loan for your needs.

Watch our most recent video to find out more about: DSCR Loan – Is It Right For Your Real Estate Investment?