Investing in Rental Properties: DSCR Loans

Categories: Blog Posts

If you’re new to investing in rental properties, understanding how DSCR loans work is essential.

In the investment world, rental properties are a great source of wealth. The financial potential in fixing up places to then rent out is a very lucrative model, especially in the current housing economy.

What is a DSCR Loan?

DSCR loans are specifically designed for real estate investors who hold rental properties.

The acronym literally stands for Debt-Service Coverage Ratio which is a fancy way of saying that the loan cares about the cash flow of a property.

The great news, especially for new investors, is that accessing these loans is less dependent on personal or business income. Even if you’ve just begun a new business, qualification for DSCR depends almost entirely on the potential value and expenses of the rental property itself.

What is a DSCR Ratio?

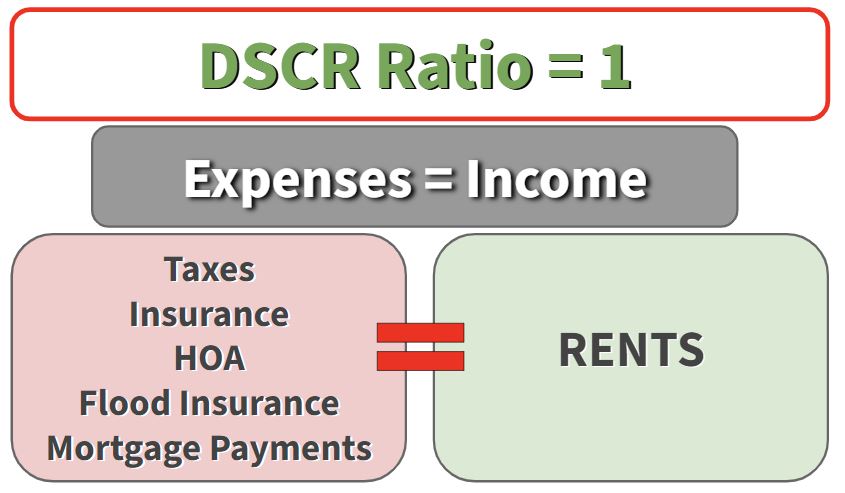

The DSCR ratio is a simple calculation that compares income to expenses—the cash flowing in vs. the cash flowing out—on a single property.

Essentially, a DSCR ratio of 1 simply means that the income and expenses equal each other.

The DSCR ratio measures the break-even point of your investment. So long as you bring in the same amount of money as you invest, you won’t lose anything.

However, a DSCR ratio of higher-than-1 is even better. A higher ratio means that you’re bringing in more money than you’re spending—generating cash flow and building wealth.

Use Our DSCR Loan Calculator

To help you find your projected rents, expenses, and ratio, you can use our DSCR loan calculator. It’s a free, user-friendly download that will help you estimate your DSCR ratio to see if your investment property is going to break even.

Once you have an estimate for your ratio, it’s time to start looking for loans.

Finding a DSCR Loan

Banks typically like to see ratios of 1 or higher.

However, if you’re investing in rental properties that might not break even, you can often still find a loan, but you might be stuck with higher rates.

You can also check out our website and inquire about the DSCR options we offer.

Read the full article here.

Watch the full video here: