DSCR Loan Calculator: How to Find Your Ratio

Categories: Blog Posts

A DSCR loan calculator is an invaluable tool for real estate investors.

In the investment world, rental properties are a great source of wealth. The financial potential in fixing up places to then rent out is a very lucrative model, especially in the current housing economy.

What is a DSCR Loan?

DSCR loans are specifically designed for real estate investors who hold rental properties.

The acronym literally stands for Debt-Service Coverage Ratio which is a fancy way of saying that the loan cares about the cash flow of a property.

The great news, especially for new investors, is that accessing these loans is less dependent on personal or business income. Even if you’ve just begun a new business, qualification for DSCR depends almost entirely on the potential value and expenses of the rental property itself.

What is a DSCR Ratio?

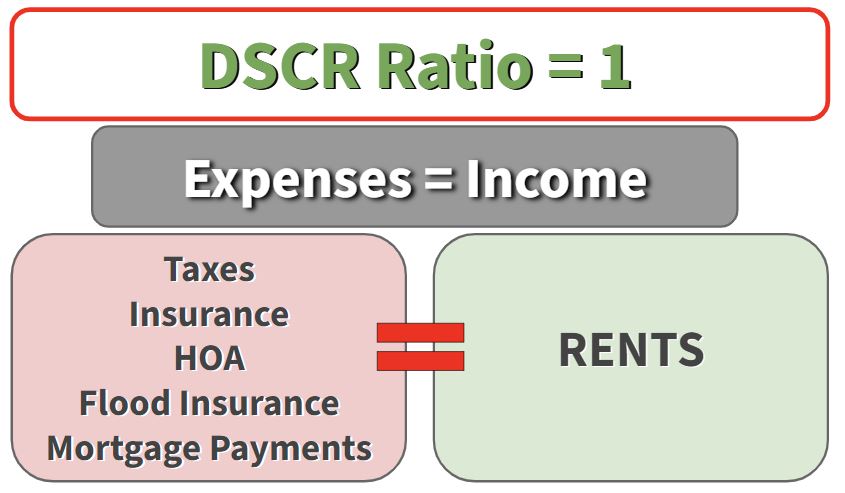

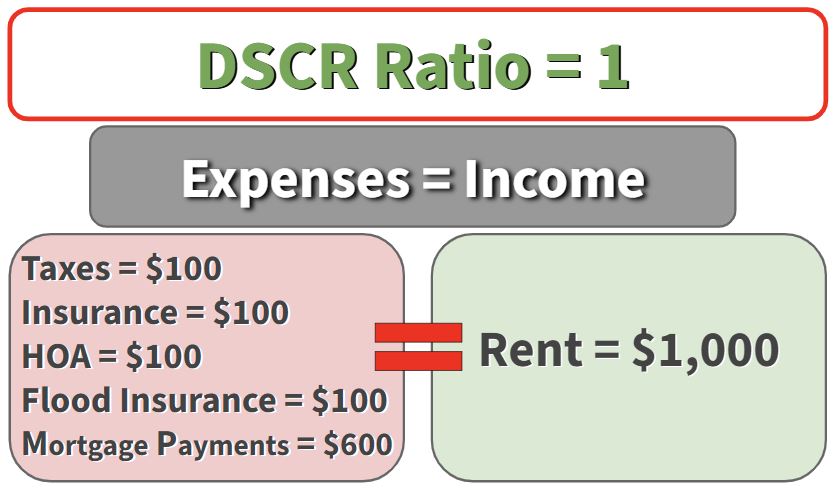

The DSCR ratio is a simple calculation that compares income to expenses—the cash flowing in vs. the cash flowing out—on a single property.

Essentially, a DSCR ratio of 1 simply means that the income and expenses equal each other.

The DSCR ratio measures the break-even point of your investment. So long as you bring in the same amount of money as you invest, you won’t lose anything.

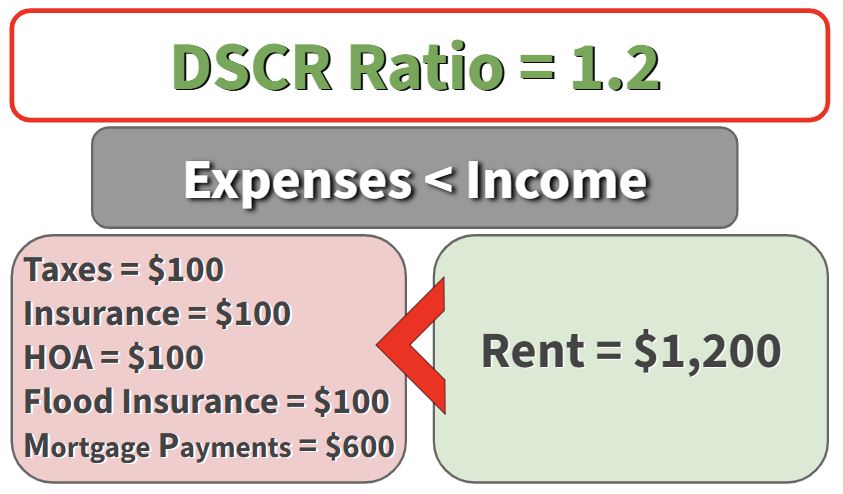

However, a DSCR ratio of higher-than-1 is even better. A higher ratio means that you’re bringing in more money than you’re spending—generating cash flow and building wealth.

Raising the Ratio

You can get a higher DSCR ratio in a few ways.

1. Be mindful of your expenses.

Especially if you’re a new investor, make sure you’re shopping around for the best deals.

Before you buy a property, research the typical costs for the area. Is there an HOA? Will you need any specialized insurance? Typical taxes?

Knowing these things beforehand can help you make more informed decisions and keep your costs lower.

2. Set rents intentionally.

Look at the average rents in your area. Remember, the higher your income (rents), the higher your DSCR ratio.

Let’s look at an example:

When rents equal our cash out, lenders may see your loan as “safe,” but it’s not making you any money.

Instead, raising rents can help you end up with a higher DSCR ratio (and more money in your pocket).

When you raise rents, simply divide your expenses by your income (rents) to find your new ratio.

By raising rents by $200, we end up with a much better ratio (1.2) that actually creates wealth instead of simply covering expenses.

Use Our DSCR Loan Calculator

To help you find your projected rents, expenses, and ratio, you can use our DSCR loan calculator. It’s a free, user-friendly download that will help you estimate your DSCR ratio to see if your investment property is going to break even.

Once you have an estimate for your ratio, it’s time to start looking for loans.

Finding a DSCR Loan

Banks typically like to see ratios of 1 or higher.

However, if you’re working with a property that might not break even, you can often still find a loan, but you might be stuck with higher rates.

You can also check out our website and inquire about the DSCR options we offer.

Here at The Cash Flow Company, we scour the market to make sure we offer competitive rates and connect good people with good loans.

If you have questions or want to talk about a loan, reach out to us at Mike@TheCashFlowCompany.com.