Are the high interest rates worth paying right now?

There are a number of questions that investors are faced with going into 2024. The main concern is whether or not it is worth paying the higher interest rates right now, and if it will pay off in the end. To help answer these questions, let’s take a closer look at how the market has changed, what you should avoid, and how you can succeed in the New Year.

How has the market changed?

It is the perfect time to jump in if you can buy something low. As long as you do it correctly, you should invest now while everyone is running away! Then when rates go back down, you will be able to create wealth for future investments. A few years ago many people were buying properties for $100K over asking price. In today’s market they would be able to sell it for maybe $250K. Since they overpaid on the property a few years ago, they are now upside down on their investment. Don’t let this happen to you! As a new buyer, make sure you are purchasing it at a good number while the market is down. Over time you are going to win the game by buying at the right time.

What should you Avoid?

Getting into real estate investing now will get you on the fast track to success. If you are able to buy good properties in good markets, then you will be successful. It is important to avoid properties that are on corners or busy streets. In these times, the best properties are on a culdesac or near local parks. Real estate investors need to research current market trends before jumping in. There are some markets where cities are doing better than suburbs, while others are growing at a faster rate. Another thing to be aware of as a real estate investor is all of the negativity out there, which is driving people out of the market. Instead of following the herd, turn this negativity around so it can benefit you.

Number of Real Estate Investors is Shrinking

There has been a whole generation of real estate investors who have gone through good times with money, banks, and lenders in the past. This was when everyone was trying to give you more money for your investments. However, the Fed is now trying to slow that down. The huge pool has gotten a little bit smaller for those who are trying to qualify for loans. This lending squeeze has resulted in many real estate investors getting out because they don’t have the credit score or income to succeed in this market. In 2024 there will be less real estate investors, less money available for funding projects, but more deals available for the driven investor.

In Conclusion

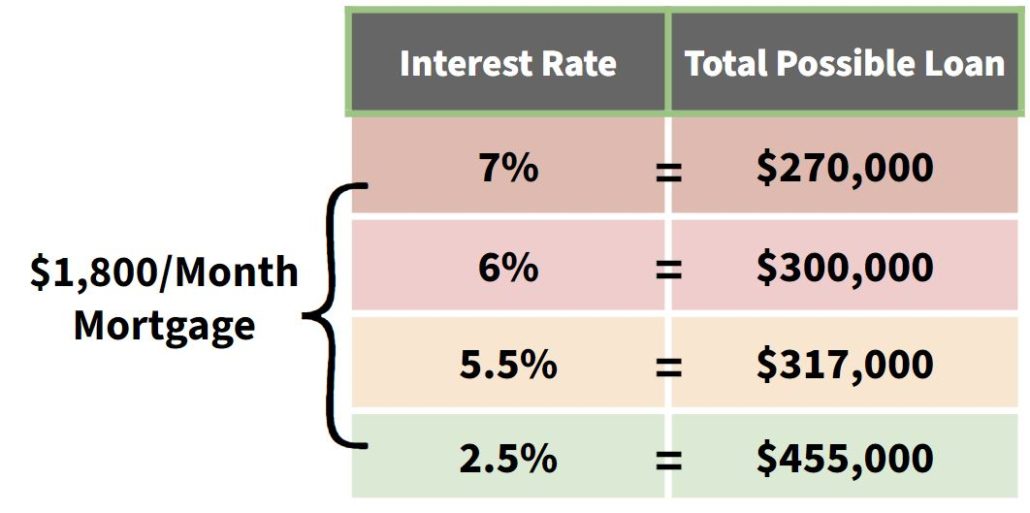

Now is the time you should invest in real estate properties! By strategically selecting properties, investors have the opportunity to grow their wealth when rates drop. Don’t let the high interest rates prevent you from investing now. Those who take the plunge will not only take advantage of lower rates later by refinancing, but they will also be ahead of other investors who are just coming into the game. There is a lot of money to be made in real estate. Invest today to succeed in the New Year!

Watch our most recent video to find out more about investing in today’s market.

We can help you get set up to win in 2024! Contact us today!