How can your credit score impact DSCR loans in the real estate investing world?

Credit score impacts investors potentially more than anything else. Lenders will adjust the rates and terms of loans based purely on the three digits of credit score on a person’s financial records.

Leverage is the key to successful real estate investing, and understanding the impact of credit score is a critical facet of that leverage.

This article uses real-life examples to illustrate the difference a good credit score makes in the investment world.

How Can Credit Score Impact DSCR Loans?

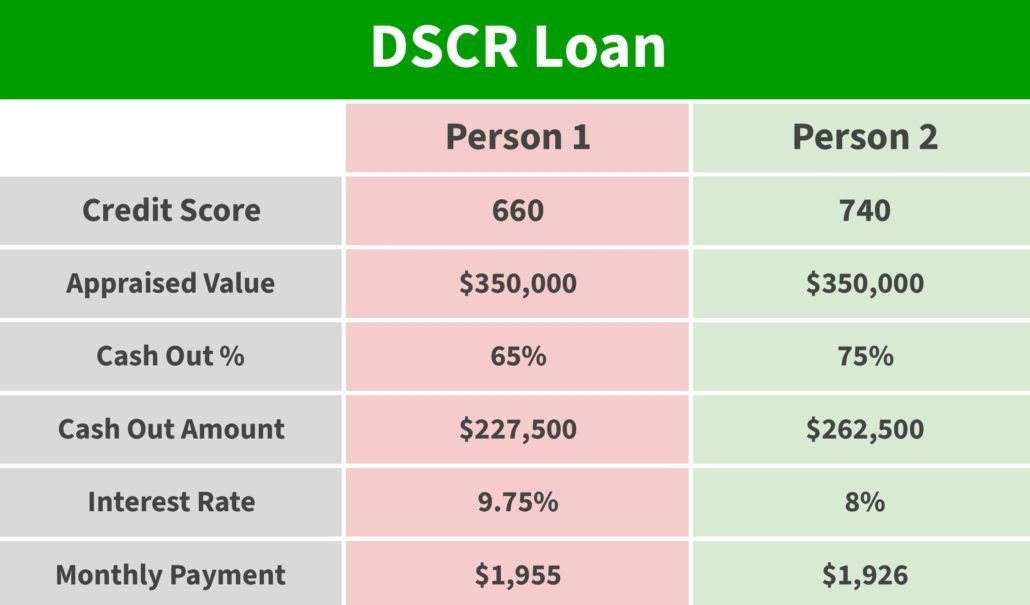

Let’s look at how DSCR loans can be impacted by a low credit score using two example clients:

- One (Person 1) has a low credit score of 660

- The other (Person 2) has a high score of 740

We see a lot of clients looking at cash out refinancing, so we’ll look at that type of project.

What’s the Difference?

If Person 1 has a 660 credit score, not only will they likely struggle to find lenders, but 65% is about the best they could look for. This directly translates into less money out of that property.

In contrast, Person 2 with a 740 score should be able to fairly easily get 75%. The more money out, the better your leverage.

As you can see in the chart above, not only does the person with a lower credit score get less cash out, but their rate is also higher which raises their monthly payments.

Credit Score Matters

Although at first glance, it’s tempting to just look at the monthly payments and think, “It’s not that big of a difference,” don’t fall into that trap!

The person with the higher score not only has a lower monthly payment, but because they also got a higher Cash Out % which gave them an additional $35,000 out.

Having that good credit score makes it possible to keep cash flowing. If you’re serious about investing, your credit score matters.

Read the full article here.

Watch the full video here: