How Does Credit Score Impact Fix and Flip Loans?

Categories: Blog Posts

How can your credit score impact fix and flip loans in the real estate investing world?

Credit score impacts investors potentially more than anything else. Lenders will adjust the rates and terms of loans based purely on the three digits of credit score on a person’s financial records.

Leverage is the key to successful real estate investing, and understanding the impact of credit score is a critical facet of that leverage.

This article uses real-life examples to illustrate the difference a good credit score makes in the investment world.

How Does Credit Score Impact Fix and Flip Loans?

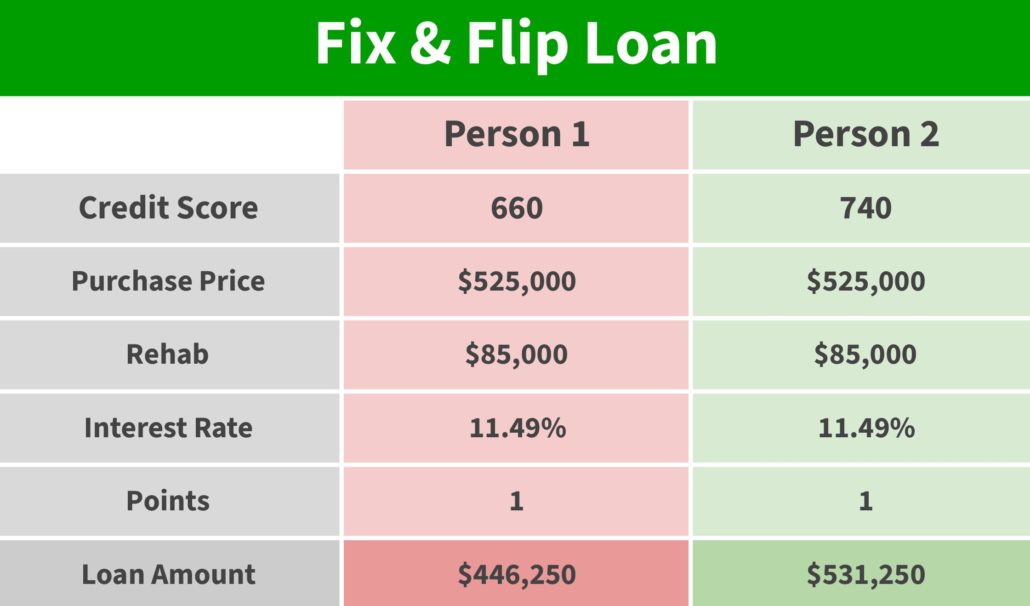

Let’s compare two clients:

- One (Person 1) has a low credit score of 660

- The other (Person 2) has a high score of 740

These numbers are based on real clients who have approached us for loans.

What Changes?

If you look at the way the numbers worked out in the chart above, you’ll notice that the actual interest rate is the same for both clients.

Obviously credit score can impact a rate, however it’s also common for the impact to be even simpler. In this situation, the lender simply gives less money to clients with lower scores.

In this scenario, the lender only offered 85% of the purchase price to the person with the lower credit score. The person with the higher score ended up having 85% of the purchase price covered as well as 100% of the rehab costs.

The Cost of a Low Score

If we estimate the closing costs for Person 1’s project at around $7,500 and combine that with the leftover 15% of the purchase price and 85K rehab, the cost of a low credit score starts to take shape. In our example, Person 1 will need to find over $171,000 of additional funding simply because they had a lower score.

Even when the rates aren’t affected, a low credit score is going to cost more in the long run. It’s hard to do multiple projects when you have to bring in that much money on your own.

Read the full article here.

Watch the full video here: