5 Simple Steps to Starting a Successful Business

Many real estate investors and contractors wonder how they can get everything done that they need to. From setting up the EIN to naming the business, it can all be daunting. Today we are going to discuss the 5 steps to starting a successful business in order to get you on the right path quickly and easily.

What are the 5 simple steps to starting a successful business?

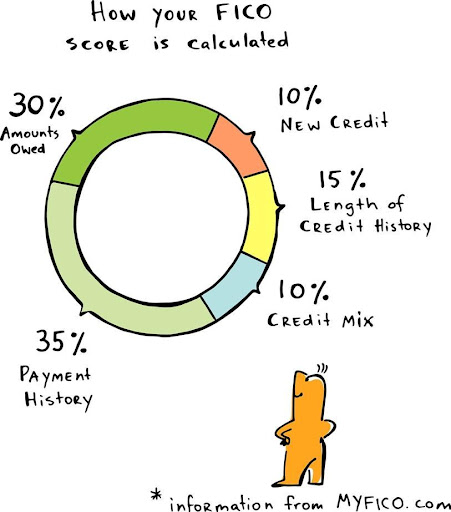

#1: Make sure that your personal credit is set up for success. This will look differently for each person, so be sure to focus on the areas that need improvement.

#2: Define your business by deciding what the business is and how many businesses you want.

#3: Decide the name for your business. It does help to have a parent company with no specified direction. Not only will it simplify things for you, but more importantly it will smooth things out for the banks for future financing needs.

#4: Create an EIN by registering the company with the secretary of state.Setting this up correctly will ensure that you are seen as a business not only to lenders, but to clients as well.

#5: Define your goals. Be very clear with your goals! Where do you want to go with your business, how many properties do you need, do you need to buy machinery? All of these goals need to be established first and foremost when starting your business.

You are not alone!

There are a lot of companies out there who can help you through the process of setting things up correctly. They can help you find the right bank for your needs, register for an EIN, and even complete a DBA to change the name that you are working under. Contact us today to find out what you need to do to get started and ways you can set yourself up for success.

Establishing your goals are the key to success!

Even though we have goals as #5 on our list, it really should be first and foremost in all of your business decisions. Those who don’t have their goals established will only focus on completing a checklist, which will result in more work. Maybe your goal is to buy five more properties this year. Another person’s goal might be to scale their business so that they can bring on two more employees. No matter what the goal is, make sure that you achieve it using your company name. In doing so, you will be able to work backwards and determine the steps you need to take in order to complete your goal.

Fitting into the lending box.

Those who establish their goals in the beginning are able to create a roadmap to success. As a result they can then begin looking for banks, as well as vendors, who have the products they need to succeed. Just to clarify, vendors can include home depot, lowes, and the gas company. These are just a few of the companies that can help you build business credit if you do it correctly. It is important that you get into the charge accounts as well. This will help you to not only grow your business, but build your business credit score as well.

Build the migration from personal credit to business credit.

Finding the right vendors can help you begin the transition from personal credit to business credit. By having business credit you will be able to open more doors that will allow you to reach your business goals. Do you need a business credit card? Contact us today to find out more!

Play the game to win it.

Real estate investing is all about leverage. In order to be successful in this community, you need other people’s money, loans, and debt. This will allow you to buy properties, as well as fix up properties. Investors and contractors who take the time to work on their credit will be able to open more doors than they would have otherwise. It is important to remember that times have changed and will continue to do so. Those who can set things up correctly, take the steps to get there, and focus on the quickest steps will have a greater chance of winning the real estate game!

Watch our most recent video to find out more about the 5 Simple Steps to Starting a Successful Business.

Are you starting a business and not sure where to begin? Contact us today to get on the right path!