How Your Revolving Debt Utilization Rate Affects Your Credit Score

Categories: Blog Posts

When you apply for a loan, the lender will look at your credit report to assess your creditworthiness. One key metric lenders use is your revolving debt utilization rate, or the percentage of your available credit you’re using. A high revolving utilization ratio can make it harder to get approved for loans. Knowing how your revolving utilization rate impacts your credit score and taking preventative steps to keep it low can help you improve your chances of getting the loan approval you want.

What is a revolving debt utilization rate?

A revolving debt utilization rate is the amount of debt you currently owe on revolving credit accounts (such as credit cards) divided by your total credit limit on those accounts. It’s calculated by adding up the outstanding balances of your revolving credit, like credit cards and home equity lines of credit, and then subtracting the respective credit limits from those totals to find the debt-to-credit ratio. You can calculate this ratio by tallying up the outstanding balances on all your revolving credit and then dividing the result by the respective credit limit to find your utilization percentage.

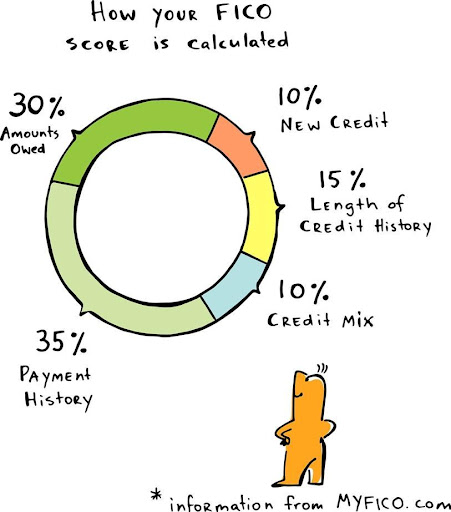

Your credit utilization rate is used to predict your credit risk and has a significant impact on your FICO credit scores, making it the second-most important factor behind only your payment history in the scoring model. The higher your revolving utilization, the more likely you are to have difficulty repaying what you borrow. For example, if you have a credit card with a balance of $2,000 and a credit limit of $10,000, your utilization rate is 20%.

However, it’s important to remember that revolving debt utilization rates only include revolving credit accounts such as credit cards and home equity lines of credit; they don’t consider other types of debt, like installment loans, which have a set repayment schedule. For this reason, credit card balances tend to have a greater impact on your credit scores than mortgage and auto loans, which are reported as installment debt.

What is a good revolving debt utilization rate?

Lenders typically prefer to see that borrowers aren’t using more than 30% of their revolving credit limit. Carrying too much debt could indicate you’re having trouble repaying what you’ve borrowed or may be struggling financially.

In addition, many lenders have their own guidelines for what is considered a “good” revolving debt utilization rate. Some lenders will decline applications for credit or will only approve applicants with revolving debt utilization rates below certain thresholds.

Keeping your revolving credit utilization low is a great way to improve your credit score, and it can also save you money on interest payments. To lower your utilization rate, make sure you pay off your credit card balances each month, and try to keep your balances as low as possible. If you have trouble paying off your balances each month, call your credit card company to see if they can give you more time to pay your bill or set up automatic payments.

Find out how a loan can raise your score in 30 days or less

Utilization Rate Affects Your Credit Score.

#credit score loan