Learn from this mistake: an important lesson about DSCR loans, LLCs, credit, and partners.

DSCR loans are a great option if you need a loan in an LLC’s name.

However, there’s a major risk to be aware of when you look for financing under your LLC’s name.

Let’s walk through what recently happened to a client whose credit score dipped… and a big secret was revealed.

Credit Usage Can Impact Your Loan Terms

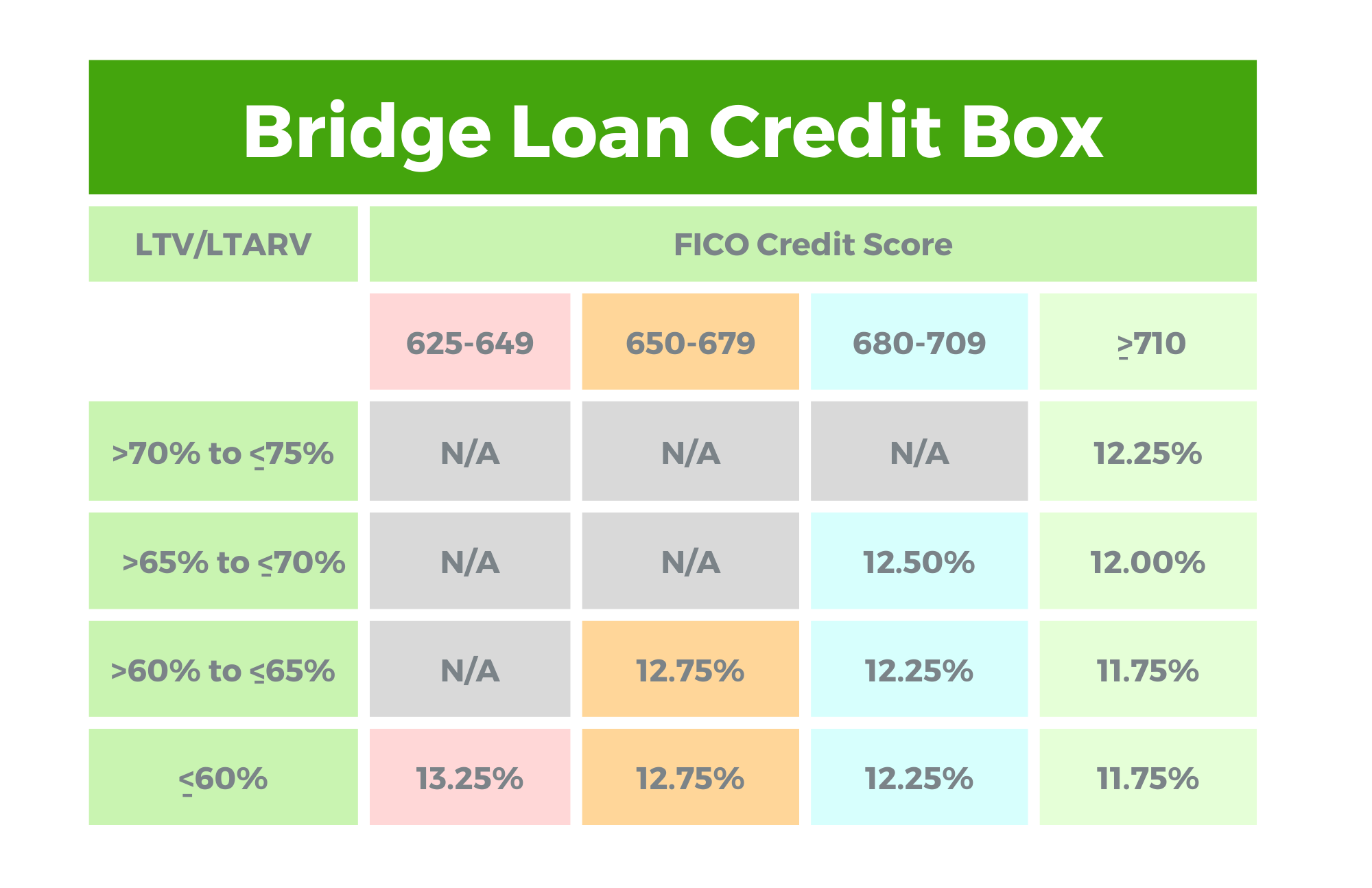

This client was quoted by another company for a DSCR loan:

- 9% interest rate

- 3 origination points

- On a cash-out, 70% refinance of a remodeled, rented property.

Doesn’t that seem high?

His main hurdle was that his credit score had dipped during the remodel of this project.

He started with a score of 720 and a credit limit of $35,000. To get the property rent-ready, he used $30,000 of this credit. This caused high credit usage – which dragged his credit score down to a 679.

This plummet in score cost him a couple of points in interest and origination, resulting in a much more costly refinance than he was prepared for.

How to Fix Bad Credit as a Real Estate Investor

To get his score back up, we helped him with a usage loan.

This means:

- We gave him a private loan.

- He used it to pay off his credit cards.

- Paying off the credit cards lowered his usage.

- Lower usage raised his credit score.

When usage is the reason for your low credit score, a small short-term private loan like this can be a solution.

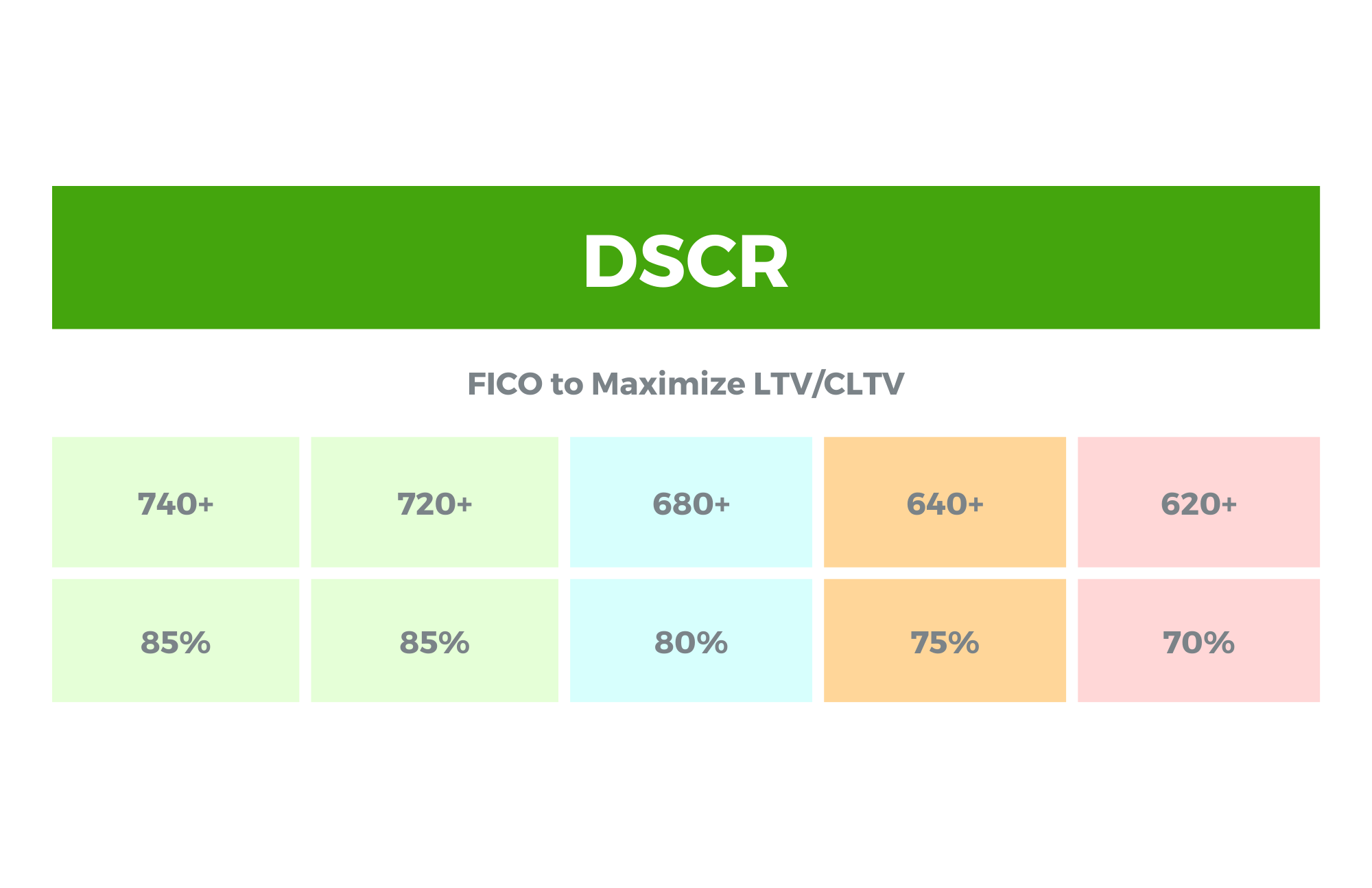

In our client’s case, this higher credit score refreshed the refinance DSCR he was quoted to a 7.625% interest rate, with a half-point origination, on a 30-year fixed loan.

WAY better. Until he dropped a bomb on us…

DSCR Loans and LLCs

This client told us he owned the property. All the properties were his. Then we got to ordering the title…

And the property was under an LLC. No problem! DSCR loans are great with LLCs.

Then he mentioned that he has a partner. And the partner owns 40% of the LLC. And his partner’s credit score was even worse than his.

Depending on the lender, a partner has to own a certain percentage of the LLC before their credit score matters. For some, it’s a minimum of 5% ownership. For others, it’s 50%.

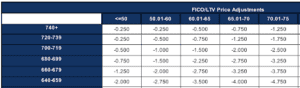

In this case, at 40%, we look at the lowest credit score in the LLC to determine the loan rate and LTV.

Be warned: if your financing is under an LLC, you can get quoted one set of terms, but once it comes down to it, your partners’ credit scores can make the actual terms worse. Don’t let this catch you off guard.

Be careful not only with your own credit – but with the credit of everyone in the LLC.

How to Fix a DSCR Loan When Your LLCs Partner Has Bad Credit

In this client’s situation, we’re going to try another solution, but it will take much more time.

We’re going to move this partner off the LLC while we do the usage loan. Then give it a month or two until the lender can see that it’s only the client’s name, with no partner.

There are hurdles this way. But there are always ways to get through it.

Keep this in mind when you put LLCs together for real estate investing. You might want one person with great credit and one with great experience, but however you piece it together, make sure you’re upfront with your lender. Being open about the LLC at the beginning can prevent roadblocks down the road.

Help with DSCR Loans, LLCs, and Other Investor Loans

If you have any other questions on DSCRs, fix and flips, or any kind of loan in the investor world, we’re happy to help.

For more info on real estate investing, you can check out our YouTube channel. You can also reach out directly at Info@TheCashFlowCompany.com.