How to Find Out Your Real Estate LTV by Credit Score

Categories: Blog Posts

This is how lenders figure out your LTV by credit score…

Credit scores are a major factor in any kind of financing.

When you’re looking for real estate investing loans, credit score determines your down payment/LTV. In a refinance, your amount is also decided by credit score.

Let’s look closer at how lenders decide how much you get.

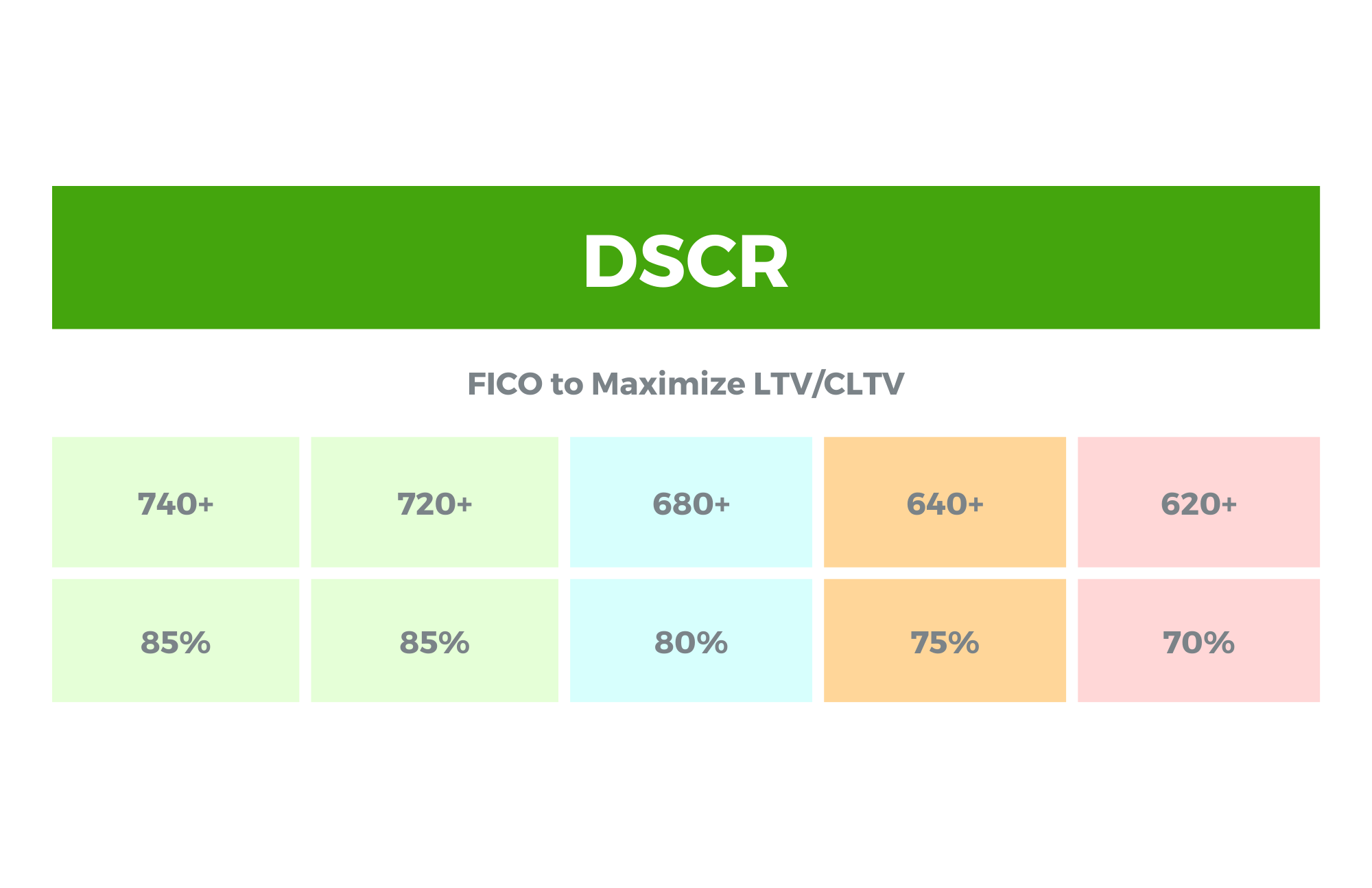

DSCR & Bridge Loan Interest Rate Credit Box

Lenders each have a credit sheet or credit box that they use for all borrowers.

Here’s an example of a DSCR loan credit box. It shows the maximum LTV a borrower could get depending on their credit score:

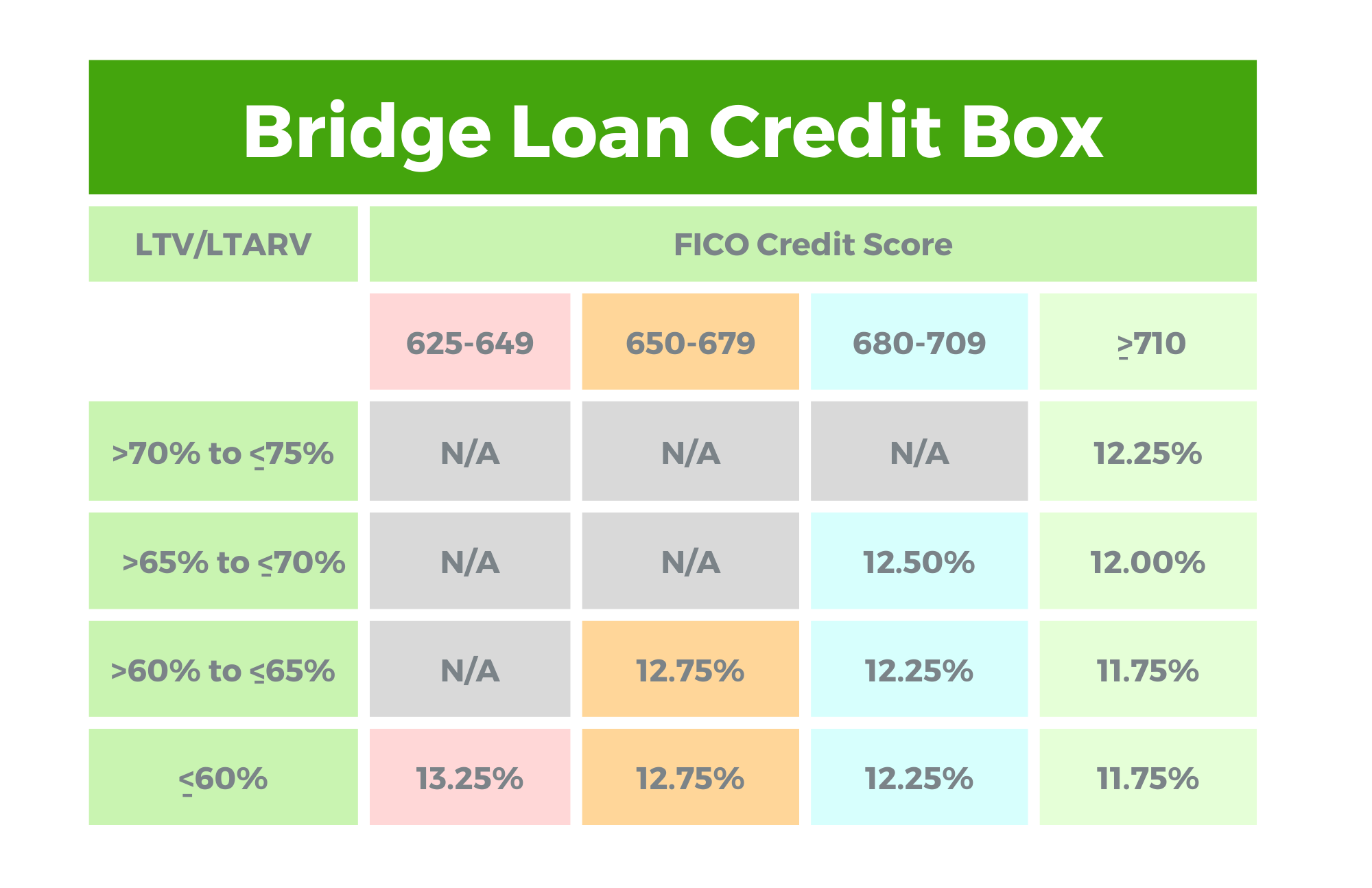

Similarly, here’s an example credit box for a bridge loan:

As you can see, a low credit score not only leaves you with a bad interest rate but also a lousy loan-to-value. In the best case, a low score gets you a 10-15% lower LTV, and in the worst case – you’re left with no loan at all.

Example Impact of Credit Score on LTV

Let’s walk through an example. Say we need to either refinance or purchase a property with $300,000.

So, what are our options based on the above credit boxes?

A 625 credit score is about the lowest most lenders will lend to in the current economy. Here’s what we could get for our $300k property:

- Max loan amount on a DSCR loan: $210,000

- Max loan amount on a bridge loan: $180,000

A 720 is considered excellent by most lenders. Here are the amounts we’d get from the same lenders on the same property with this score:

- Max loan amount on a DSCR loan: $255,000

- Max loan amount on a bridge loan: $225,000

This is up to $45,000 difference in your loan amount based solely on your credit score.

Credit Usage & Real Estate Investing Help

In short: the higher your credit score, the more funding you can receive.

The higher the funding, the lower the amount of the down payment and interest rate costs. Your credit score will always save or cost you money in real estate.

You can find out how credit impacts your rates and or cost here. Additionally, you can get quick ways to increase your score here.

We are here to help you increase your cash flow by using all means to increase the availability of cheap, easy, and quick funding.

Reach out with any questions, and for more on real estate investing, check out our YouTube channel.