Leverage is a powerful investing tool. How does it look to maximize your leverage?

A real estate investor’s goal is to maximize leverage – get the best, cheapest, easiest leverage available.

This means going an extra step:

- Having great credit.

- Having great income.

- Coming to the lender prepared.

- Having investment experience.

In a previous blog post, we broke down the difference using leverage makes for your income and net worth.

Now, let’s say you’ve done everything right, and you’ve earned yourself better leverage from your lender.

What happens when the same scenario is taken to the next level with top-tier leverage?

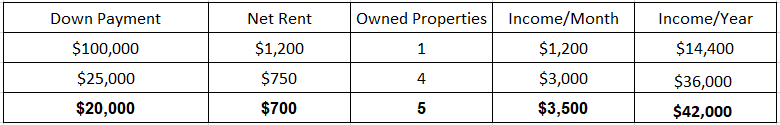

80% Leverage

To start, we’ll say you meet the bank’s criteria, and they agree to lend you 80% (or $80,000) on each $100,000 house you purchase.

Income with Maximized Leverage

Your down payment per property is now only $20,000, so you can afford 5 properties. But since you borrowed more money, the mortgage payment is higher, and the net rent goes down to $750/month.

Five properties with an income of $700 per month is $3,500 per month. This works out to be $42,000 per year. Annually, that’s $6,000 more than using a 75% loan, and $27,600 more than using no leverage at all.

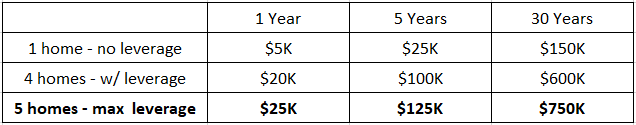

Equity with Maximized Leverage

Lastly, let’s look at the wealth side with maxed-out leverage.

Thirty years adds $750,000 to the value of the 5 homes. All that money is added to your net worth.

As a result of the $750k of equity plus the $500k of the original purchase of the homes, your net worth increases by $1,250,000.

Once your mortgage is paid off and you own all 5 properties free and clear, you earn the full amount of rent per month. This is $1,200 × 5 properties, or $6,000 per month!

Using good leverage has the potential to make you literal millions of dollars over buying investment properties in cash.

Read the full article here.

Watch the video here: