How to Make Wealth NOW in Real Estate Investing

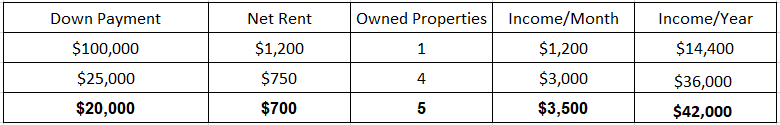

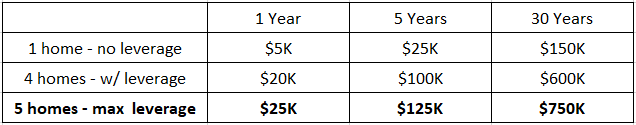

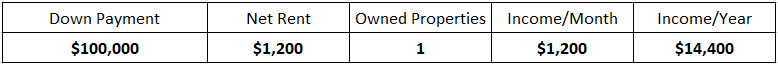

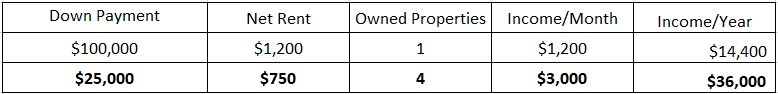

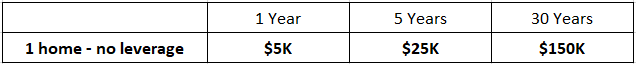

In real estate investing it all comes down to leverage. Leverage or loans make up roughly 50% of what makes a successful real estate investment. Funds that are faster, easier and cheaper will consequently drive your investments and create the wealth. So, how can you make wealth now? In real estate it is imperative that you create a step by step plan regarding what you need in order to accomplish your investment goals. Let’s take a closer look at how you can get started!

First and foremost, you need leverage!

Make sure that you have the right leverage and that you are prepared before jumping into a deal. It is so easy to let your emotions drive your business decisions. In doing so, there is a tendency to overspend and get behind the eight ball. Take a step back and research your options, contact lenders, and analyze all of your numbers. In a nutshell, even if you find the right deal, yet you don’t have the money, then you really don’t have a deal at all.

Second, find the right property.

Again, take a step back and create a plan, research properties, and compare them as well. It may take a couple months to research and test things out. In taking the time to get comfortable with the process, you will in turn be more successful. You need to go through a live example and take a couple test runs in order to understand everything that is involved. Get your hands dirty and you will figure out the nitty gritty stuff down the road. It is important to not just conceptualize the project. Instead just do it!

How do you get into the game?

As a new investor that is just getting started, it can be very daunting. There are three ways that you can get the ball rolling.

1. Find a mentor

It is helpful to find a successful real estate investor to mentor you through the process. By finding a good flipper right now, you will not only have the opportunity to invest with them, but you will be able to walk through the steps as well. Just be careful not to hand over your money to someone who will not use it properly. Do your research and take the time to find the right partnership.

2. Look into the 12 week year program

Currently I’m working on completing a 12 week year program. This method is very structured and helps you complete a year’s worth of work in only 12 weeks. As a result, investors avoid the pitfalls and low productivity that occurs when the goals are stretched out throughout the year.

3. Do your research every day

If you are just starting out in real estate investing, it is important that you get up every day and look at properties, contact realtors, contact wholesalers, and find lenders that will help you achieve your investment goals. The more you talk to them, the more likely they will be to work with you in the future. Now this process should only take 15 to 20 minutes, not 8 hours. If you start out slowly and build your database, then in 3 months time you will be better off compared to others who jumped in right away.

Make wealth Now!

Taking the time to get prepared, will not only increase confidence, but more importantly it will set you up for success. Likewise, you will also be able to regulate your emotions, so they will no longer dominate your business decisions. Ultimately you do need some emotions to drive your business, however, it is important to let the numbers guide your business decisions. Avoid getting behind the eight ball by making investment moves that will set you up to win the game of creating wealth.

Watch our most recent video to find out more about how you can make wealth NOW!

Do you have more questions about setting your business correctly? Do you need additional information regarding lending options? Contact us today!