Real Estate Investing, Credit Usage, and Your FICO Credit Score

Categories: Blog Posts

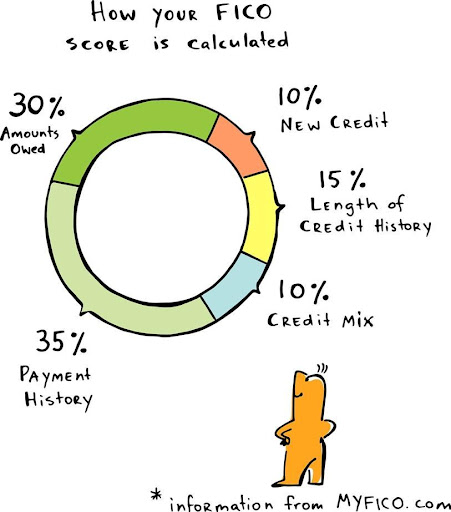

How do they come up with your FICO credit score? And why is it such a big deal?

Usage is a big deal when it comes to your credit score.

But it’s not the largest factor in determining your credit score.

Let’s go over what parts make up your FICO credit score.

What Makes Up My FICO Credit Score?

What’s the biggest factor in your credit score?

Your payment history accounts for 35%.

Are you making payments on time? Are you skipping payments? If so, this will tank your FICO credit score.

If you’re a real estate investor or business owner who does not have a good payment history, then there’s only one thing that can help that: Change your habits. Make all payments on time.

The next biggest factor, at 30% is credit usage. Credit usage and payment history together make up 65% of your credit score.

Here are all the other considerations that go into your FICO score:

- Credit History: How long you have had credit? – 15%

- New Credit: How many new accounts and inquiries? – 10%

- Credit Mix: Do you have a variety of types of debt? – 10%

Pay Attention to Usage

If you’re paying your bills on time, then usage is the largest factor in your credit score.

But how do you keep real estate investment project and your business moving along without being able to use your full credit limit?

One suggestion to this problem is to move those personal cards over to your business. This way, you can still use them, but you don’t have the negative impact on your credit score.

How to Help Your Credit Score

Leverage is king for investors. A major factor in getting leverage and loans is your credit score.

A low FICO credit score is a costly issue for investors.

Check out these other tips to quickly raise your credit score on our YouTube channel.

Send us an email anytime with questions about your credit and real estate investing loans at Info@TheCashFlowCompany.com.