What is your lender talking about when they mention points on your loan? What is a point in real estate investing?

Real estate, like many fields, has its own vocabulary. This can make it extra challenging for people who are trying to enter the real estate investing world.

So many people come to us confused. Sometimes they don’t even know what to ask because the language is so unfamiliar.

Real estate is all about leverage. Understanding the lingo and how to calculate the most common rates will help you be money-wise and confident in your investment journey.

What is a “Point”?

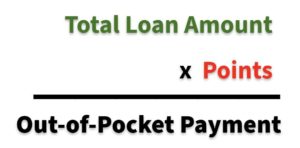

When your lender mentions that something is “one point” or maybe “one and half points,” they’re talking about out-of-pocket cost. So what is a point in real estate investing?

“Points” are a percentage of the loan that the lender is going to charge you.

Hypothetically, let’s say your lender says your loan is a “two point” cost to you. That means they’re going to charge you 2% of the total loan amount.

- Total Loan Amount: $200,000

- Points: 2 (meaning 2% or 0.02)

- Calculation: 200,000 x 0.02 = $4,000

- Out-of-pocket Cost for the Loan: $4,000

The lower the points, the lower the cost; the higher the points, the higher the cost. Also, remember that the points are calculated off the loan amount, not the purchase price.

Always remember to look out for fees. Points are often only part of the upfront charges from your lender.

Make sure you ask ahead of time about additional fees, appraisals, underwriting, escrows, and escrow draws.

Read the full article here.

Watch the full video here: