Real Estate Lingo Explained: Understanding Your Lender

Categories: Blog Posts

Learn the meaning behind your lender’s real estate lingo so you always know what’s going on.

Real estate, like many fields, has its own vocabulary. This can make it extra challenging for people who are trying to enter the real estate investing world.

So many people come to us confused. Sometimes they don’t even know what to ask because the language is so unfamiliar.

Real estate is all about leverage. Understanding the lingo and how to calculate the most common rates will help you be money-wise and confident in your investment journey.

1. “Points”

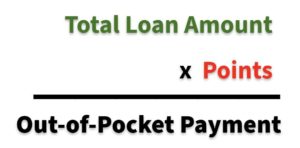

When your lender mentions that something is “one point” or maybe “one and half points,” they’re talking about out-of-pocket cost. So what is a point in real estate investing?

“Points” are a percentage of the loan that the lender is going to charge you.

Hypothetically, let’s say your lender says your loan is a “two point” cost to you. That means they’re going to charge you 2% of the total loan amount.

- Total Loan Amount: $200,000

- Points: 2 (meaning 2% or 0.02)

- Calculation: 200,000 x 0.02 = $4,000

- Out-of-pocket Cost for the Loan: $4,000

The lower the points, the lower the cost; the higher the points, the higher the cost. Also, remember that the points are calculated off the loan amount, not the purchase price.

Always remember to look out for fees. Points are often only part of the upfront charges from your lender.

Make sure you ask ahead of time about additional fees, appraisals, underwriting, escrows, and escrow draws.

2. “Rate”

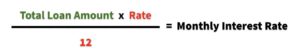

Lenders talking about interest rates can get very confusing very quickly.

The common real estate lingo of saying you have a “10% rate” does not mean you have a flat 10% interest regardless of how long you keep the money out.

“Rate” refers to the simple interest rate over a year, NOT your monthly interest rate.

To find your monthly interest rate, divide by 12.

- Total Loan Amount: $200,000

- Rate: 10%

- Calculation: (200,000 x 0.10) / 12 = 1,667

- Monthly Interest Rate: $1,667

Essentially, if you have your loan for six months (half a year) and you have a 10% rate, you’ll end up paying 5%.

3. “Payments”

When do payments start? How much do they cost?

If you’re new to real estate investing, it’s a good idea to ask a lot of questions about payments so you know what to have in your budget before you begin.

A few terms to look out for:

“Arrears”

Product interest always shows up after the fact (in “arrears”). Basically, your July 1st payment is going to pay all of the interest for June.

Interest accumulates over the course of a month. Then the bill shows up after.

This how all mortgages are set up. So when you’re trying to figure out your payments and when they’re due, always look ahead 30-45 days after you close for the first payment.

Payments are typically due on the 1st or 15th of the month. Check with your specific lender to make sure you know your pay period.

“Simple Interest”

Above, we showed you how to calculate your monthly interest rate based on the simple interest rate of your loan.

When you start paying off your loan, you’ll see a big accumulation of interest. If you’ve taken time to calculate your monthly rate, this shouldn’t be a surprise to you. You can multiply that monthly rate by however long your project took to find your overall interest cost.

You need money to make money in real estate, but you want to know the cost ahead of time as closely as possible.

Take time to figure out these numbers up front so you don’t have any surprises.

4. “Prepayments” or “Prepay Penalties”

You’ll likely see real estate lenders use lingo like “prepays” on products like DSCR or non-QM loans.

“Prepayment penalties” are fees some lenders charge to guarantee a loan is out a certain amount of time.

Essentially, if you pay off a loan during the prepay period, the lender will charge an added fee to ensure they’re making a profit.

Prepays come in all shapes and sizes but often show up in either a 3- or 5-year period. We recommend checking out this previous post to learn more about the intricacies of prepay penalties.

In terms of types of penalties, there are straight and declining prepay options:

- “Straight Prepay” means that you will pay an agreed-upon percentage if you pay of the loan anytime during the prepay period. For example, if you have a straight 5-year 5% prepay penalty, you will be charged 5% whether you pay it off after 1 year or 4 years.

- A “Declining Prepay” might start with a higher percentage, but the penalty gets smaller the longer you keep the loan until it disappears altogether. The first year, the penalty might be 5%, 4% the next, etc.

It’s always a good idea to check the prepayment penalties. Sometimes you can buy them down. But you should always make sure that higher fee is actually worth it. Often the trade-off comes in the form of a higher interest rate.

Don’t fall into a trap of paying a much higher interest rate for a slightly lower prepay penalty.

Using Real Estate Lingo With Your Lender

When you’re talking to lenders, knowing the real estate lingo can help you feel confident about your deals.

When you know what points are and how to calculate interest rates, you gain leverage with the ability to negotiate professionally.

The more you understand, the better pricing and terms you’ll be able to find.

Here at The Cash Flow Company, we have a free Loan Cost Optimizer tool. This, in addition to the formulas you learned above, can help you in your real estate journey.

Knowledge is leverage, and leverage is the key to unlocking your real estate investing potential.

Reach out to us at Info@TheCashFlowCompany.com with your questions.