How to Raise Your DSCR Ratio

Categories: Blog Posts

The DSCR ratio measures the break-even point of your investment. How can you leverage your money to actually build wealth?

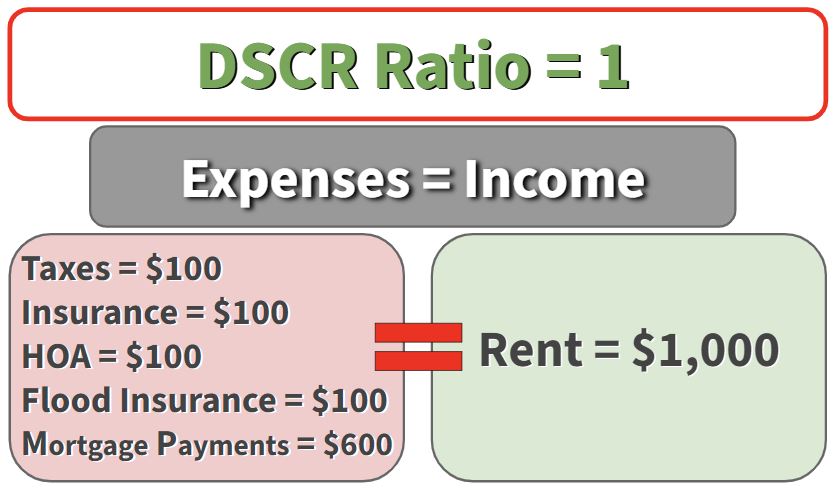

A DSCR ratio of 1 means that the expenses of your rental property are equal to the income you receive through rents. So long as you bring in the same amount of money as you invest, you won’t lose anything.

However, a DSCR ratio of higher-than-1 is even better. A higher ratio means that you’re bringing in more money than you’re spending—generating cash flow and building wealth.

Raising the DSCR Ratio

You can get a higher DSCR ratio in a few ways.

1. Be mindful of your expenses.

Especially if you’re a new investor, make sure you’re shopping around for the best deals.

Before you buy a property, research the typical costs for the area. Is there an HOA? Will you need any specialized insurance? Typical taxes?

Knowing these things beforehand can help you make more informed decisions and keep your costs lower.

2. Set rents intentionally.

Look at the average rents in your area. Remember, the higher your income (rents), the higher your DSCR ratio.

Let’s look at an example:

When rents equal our cash out, lenders may see your loan as “safe,” but it’s not making you any money.

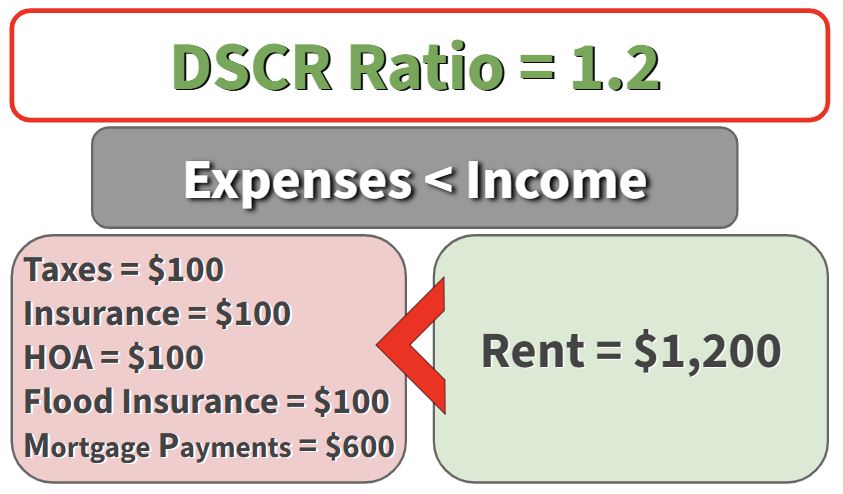

Instead, raising rents can help you end up with a higher DSCR ratio (and more money in your pocket).

When you raise rents, simply divide your expenses by your income (rents) to find your new ratio.

By raising rents by $200, we end up with a much better ratio (1.2) that actually creates wealth instead of simply covering expenses.

As an investor, the goal is to always make decisions that can create generational wealth for us in the years to come. Even small adjustments in rents and expenses can have a significant impact on your ratio. Do your research and your math when you work with rental properties!

Read the full article here.

Watch the full video here: