What have we seen in 2023 and how does it inform our real estate market predictions for 2024?

When you’ve been in the real estate investing industry for as long as we have, you start noticing trends.

2023 has been an interesting year for investors as we’ve faced exceptionally high interest rates. At times, this has been stressful, but how can we use this information to help us prepare for the next year of opportunities?

What Have We Seen in 2023?

High interest rates!

Currently, rates are between 7% to a little over 7% for people looking to buy an owner-occupied property with a 30-year fixed mortgage.

According to Realtor.com, we’re also facing a shortage of homes for sale. Although there is high interest in buying single-family homes, there’s a shortage in the market.

Affordability has also been a challenge for buyers and investors alike. All buyers need to afford and qualify for the mortgage in order to move forward.

All in all, it’s been a tough market for real estate. Smart investing has been more necessary than ever before.

2024: A Shifting Market

Demand

Moving into 2024, we’re going to see even more repercussions from the pent up demand from 2023. People want to buy homes, and the market is going to get competitive.

Affordability Concerns

So many young adults are living with friends or family out of necessity. Multi-family households are increasingly common in response to affordability concerns.

As these adults get older, the desire to live in their own space will only get stronger.

Election Year Impact

Even though the Fed isn’t tied to either Democrats or Republicans, there’s always pressure on them to make sure the American people feel good about the housing market.

Pay attention to how interest rates respond to election pressures.

Dropping Rates

The Fed has nearly reached their max which means lower rates are coming! And not just on housing; credit cards, student loans, etc. will all start seeing lower interest rates.

Although it’s tricky to pinpoint exactly how low the rates will drop, our real estate market predictions are confident that lower rates are coming.

The Economics Behind the 2024 Market

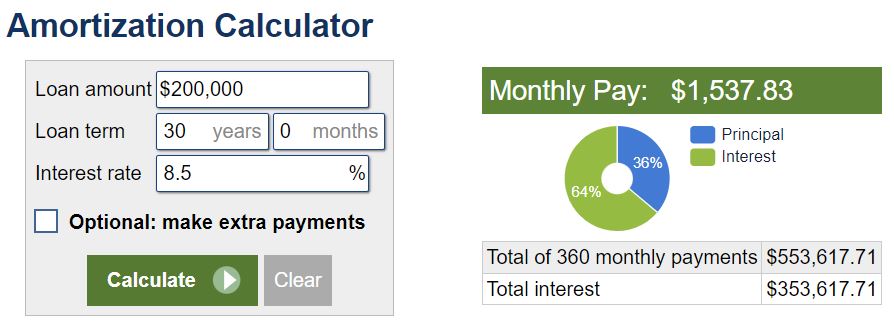

As interest rates go down, you’ll have the opportunity to increase your cash flow just by refinancing or being smart with your purchases.

The lower the interest rate, the more money goes into your own pocket in each deal.

But how does the math work?

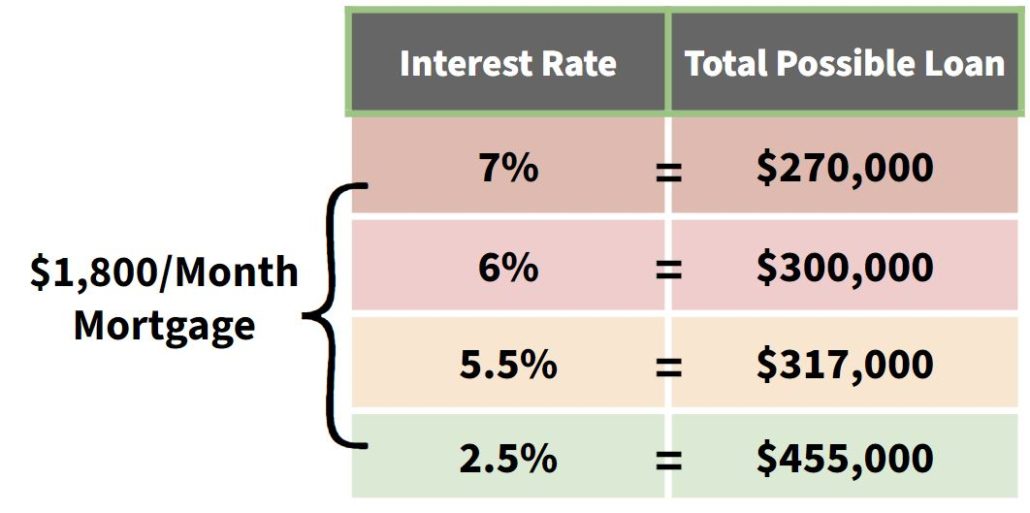

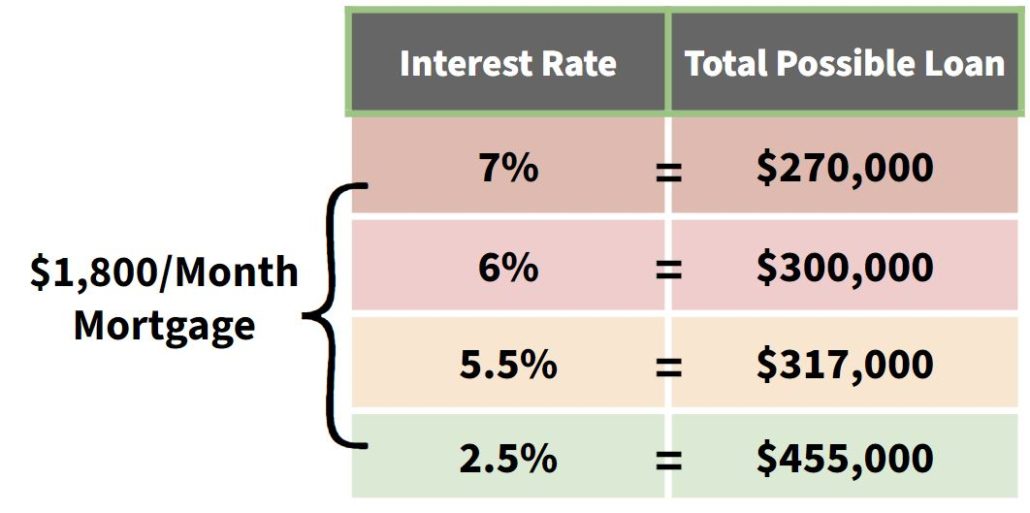

If you’re looking at your finances, and you think you can afford approximately $2,000 for a monthly mortgage payment, here’s the breakdown:

- In total, you can afford $2,000 a month in payments

- Subtract $100 for taxes

- Subtract $100 for insurance

- TOTAL: Investor can afford about $1,800/month that goes towards the mortgage

Now, let’s run that through different interest rates.

Even though you can afford only $1,800/month towards a mortgage, the interest rate significantly changes the loan amount which in turn changes the types of property you can pursue:

Even a change from a 7% to a 6% interest rate results in an 11% increase in the price of a home you can afford.

As interest rates go down, more people can access what’s on the market.

If you’re in real estate investing, having homes ready to flip in 2024 to meet that pent up demand as interest rates drop can make a huge difference for you.

Make a Game Plan

Even though rates are still high, based on these evidence-based real estate market predictions, you should start buying and getting properties ready to flip by the end of this year.

Real estate markets move quickly, so you’ll want to be ready for those falling rates when the market demand spikes.

If you’re wondering why should I buy when interest rates are so high? here’s the deal: If you buy right now when interest rates are high, you can cash flow them as rates fall. This makes your properties more valuable when you flip them, and cash flow is going to increase.

We’re Here to Help

As a real estate investor, you’ve got to keep up on interest rates. If you need somewhere to start, you can contact us to sign up for our weekly mortgage report. It comes to your inbox and tells you what’s happening in the mortgage industry that impacts you as an investor.

We’re also happy to answer any questions you have about preparing for this upcoming year. For questions or to sign up for our mortgage report, email us at Info@TheCashflowCompany.com.

Remember, prepare now to keep the money train rolling in 2024!