Let’s break down an example of a loan comparison: DSCR Loan vs Bridge Loan.

DSCR loans and bridge loans are the main ways you can turn a flip into a rental.

Each loan has its pros and cons. When it comes to cost, a bridge loan is better for rentals you’ll keep for less than a year. DSCR loans, on the other hand, are best for rentals you want for two or more years.

But what about a rental you plan to have for between one and two years? Where’s the tipping point?

Let’s look at an example to see how it works.

A Look at the Numbers

To help us understand when a DSCR loan becomes the cheaper option, let’s look at an example. Then we can see exactly when the scale tips in the DSCR’s favor.

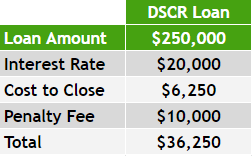

Let’s say we get a DSCR product with the following numbers:

- A higher interest rate at 8%

- All fees and loan costs at 2.5%

- We’re a year or two into the loan and the prepay penalty is down to 4%

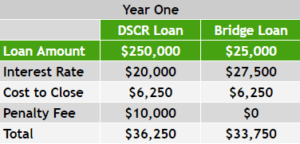

DSCR Loan vs Bridge Loan: Year One

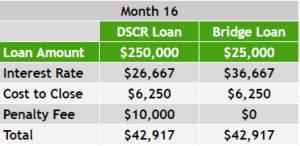

Let’s look at the number comparison for a $250,000 loan.

The DSCR loan’s 8% rate adds up to $20,000/year. The fees at 2.5 points is $6,250. Lastly, that 4% penalty will cost us $10,000.

Now let’s factor in our bridge loan numbers. The average bridge loan for a $250,000 loan would look like an 11% rate costing $27,500 per year. This is $7,500 more yearly than the DSCR loan, or $625 more per month. The closing costs would be the same for the bridge loan, and then, of course, no prepay fee.

You can see the bridge loan is still almost $3,000 cheaper than the DSCR loan.

These calculations only represent year one of the loan, however. Within that first year, a bridge loan will definitely be cheaper.

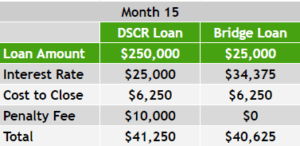

DSCR Loan vs Bridge Loan: Month 15 & 16

Here’s how things change by month 15:

The bridge loan’s interest starts adding up, and suddenly the DSCR doesn’t seem so expensive. And at month 16, the loans are the same price:

After 16 months, the DSCR loan in this scenario would always be the cheaper option. And every year, the DSCR’s prepay fee drops lower; meanwhile, the bridge loan keeps accruing high interest at the same rate.

Is 16 Months a Realistic Timeline for the Market Right Now?

We expect that the market won’t pick back up for another 14-16 months anyway. If your flip is stuck on the market now, you could:

- Get a DSCR loan for the property.

- Take a 12-month tenant.

- Leave 4 months to spare for getting the house ready, on the market, and closed.

This puts you right at the 16 month minimum to make the DSCR loan worthwhile.

Read the full article here.

Watch the video here: