Why 2024 Is a Great Time to Get a DSCR Loan

Are you a real estate investor looking for a smart loan option in 2024? Look no further! The DSCR loans, or Debt Service Coverage Ratio loan, might be the perfect fit for you. But why is this year a great time to get one? Well, it’s simple. DSCR loans focus on the property’s income as opposed to your personal finances. Consequently, they offer fast approvals and excellent rates. Today we will explore all the reasons why 2024 is a great time to take advantage of a DSCR loan. Let’s dive in!

What is a DSCR Loan?

A DSCR loan, or Debt Service Coverage Ratio loan, is a fantastic tool for real estate investors. It’s often called a “no personal income loan.” Why? Because it doesn’t look at your personal income or tax returns. Instead, it focuses on the income from the property itself.

Why Choose a DSCR Loan?

1. No Personal Income Needed

First, the best part about DSCR loans is that you don’t need to prove your personal income. Whether you just started your business or have no job, it doesn’t matter. Therefore, as long as the property’s cash flow, you’re good to go. For example, if you have a rental property that makes enough money to cover its expenses, you can qualify for a DSCR loan.

2. Quick Approval Process

Next, because there’s no need for personal income verification, the approval process is fast. More importantly, you don’t need to wait for tax returns or employment verifications. This means you can get your loan quickly and start investing sooner.

3. Perfect for Rental Properties

Moreover, DSCR loans are ideal for rental-ready properties. This means that the property is ready to rent out without needing major repairs. For instance, if you have a duplex that’s ready to rent, a DSCR loan is a great choice.

How to Qualify for a DSCR Loan

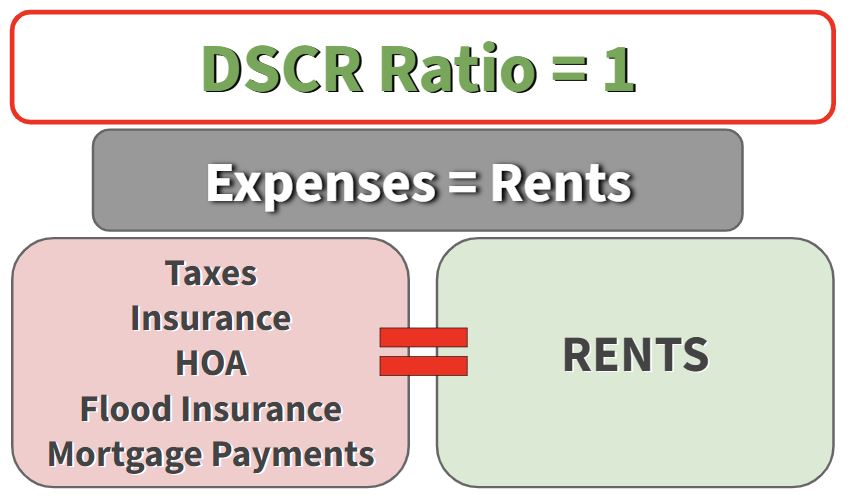

Step 1: Property Income

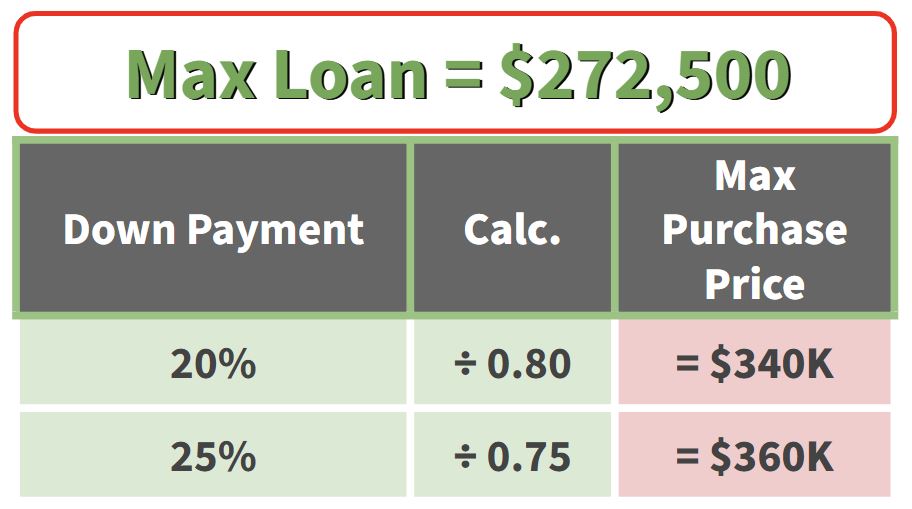

Firstly, the key factor is the income from the property. Again the property must make enough money to cover its bills. These expenses include the mortgage, taxes, insurance, HOA fees, and flood insurance. If the property can cover these expenses, you’re on the right track.

Step 2: Rental Ready

Secondly, the property needs to be rental ready. This means it should be in a condition where tenants can move in right away. If it needs major repairs, it won’t qualify for a DSCR loan.

Step 3: Good Credit Score

Additionally, while your personal income doesn’t matter, your credit score. A good credit score can help you get better rates. However, the loan itself won’t show up on your personal credit report since it’s made to your business.

Why 2024 Is a Great Time for a DSCR Loan

Better Rates Than Conventional Loans

Surprisingly, in 2024, DSCR loans have better rates than conventional loans. Usually, conventional loans are cheaper, but this year, it’s different. Many DSCR loans offer lower rates, making them a more attractive option.

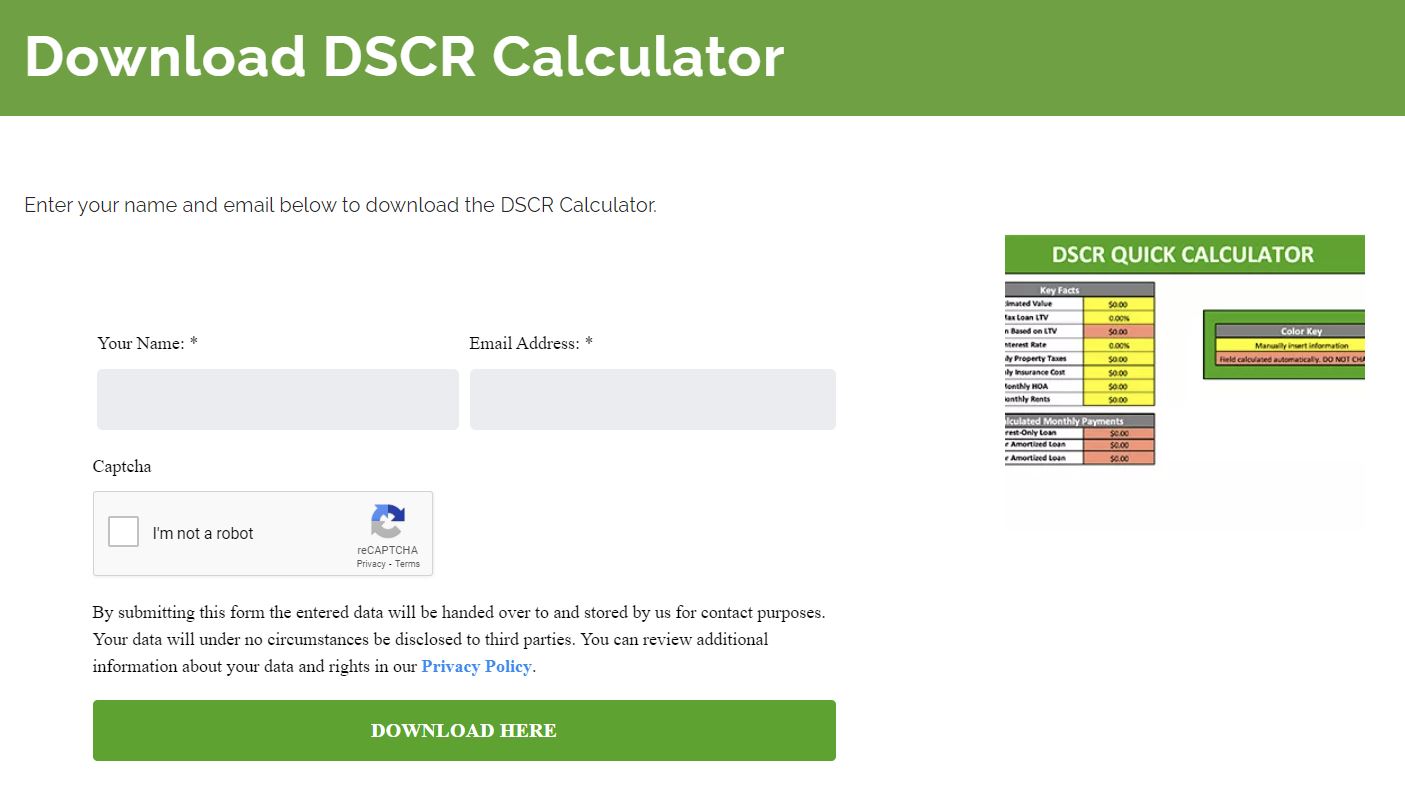

Tools and Resources

Don’t forget to use tools like the DSCR calculator available on The Cash Flow Company’s website. This tool helps you check if your property will cash flow, which is crucial for qualifying for a DSCR loan.

Conclusion

In conclusion, 2024 is an excellent year to consider a DSCR loan. With no need for personal income verification, there are fast approvals, and better rates than conventional loans, DSCR loans are a perfect choice for real estate investors. If you have rental-ready properties and a good credit score, now is the time to take advantage of this opportunity.

If you’re interested in learning more, visit The Cash Flow Company’s website! Start taking advantage of DSCR loans today!

Watch our most recent video to find out more about: Why You Need DSCR Loans In Today’s Real Estate Market