Help! I Can’t Get a DSCR Loan Because of My Credit

Many investors are struggling to get a DSCR loan because of their low credit score! However, there is a magical solution that can easily solve this problem. It is called a 911 usage loan! Here at The Cash Flow Company we help people raise their score so that they can get the loan they need. On average we see 7 out of 10 people struggle with a usage problem. How can they get back on their feet? Let’s take a closer look at how you can magically improve your credit score today!

Usage problem uncovered.

Usage loans are very common in this business because many investors have a usage problem. The usage problem is created when investors excessively use their personal credit cards or personal loans to pay for their business expenses. This will affect you everywhere you go, whether it’s a flip project or you’re applying for a DSCR loan. Here at The Cash Flow Company we deal a lot with credit score struggles, fix and flip properties, and rental properties. No matter what the project is, having good credit is the key to getting the funding you need.

Credit score struggles.

If you are above 30% usage on your credit cards, your score will begin to decrease. This percentage is also referred to as the credit utilization rate. Investors who come in with a 640 or a 660 credit score often need to increase their score to 700. In doing so, they will be able to get either the LTV or rate they need to create cash flow. Nowadays rates are still in the 7’s or 8’s. That is why it is so important to get the best rate you can in order to maximize both your LTV and cash flow.

How can a private loan help your credit?

One quick way to increase your credit score is to use a 911 loan. This loan is used to pay down credit card debt by using private money. These private funds are secured with a property to ensure the repayment of the loan. Once the credit cards are taken off of the credit report and the new statements cycle, credit scores will then reflect the changes.

Where do you get started?

The first thing that you need to do is run a simulation. We ask investors to do a simulation on MyFico, Credit Karma, or Experian to see how paying off a credit card will impact their credit score. We have seen people max out their credit cards at $3K, while others are maxed out at $175K. These maxed out credit cards are not only impacting their credit scores, but their DTI as well. To clarify, DTI stands for the debt to income ratio.

For example: A client in Texas just went through a simulation and his credit score went up 100 points. He went from 653 to over 753 by simply paying off the credit cards that he had maxed out.

High credit score means higher cash flow.

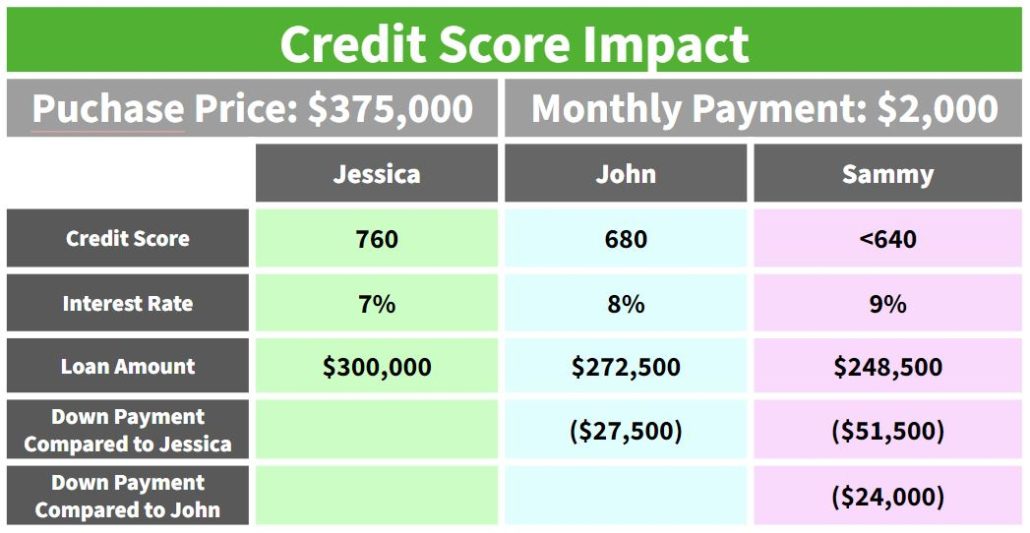

In the following example we are going to look at how credit scores can drastically impact your ability to qualify for a DSCR loan. Not only will a lower credit score increase your interest rate, but it will decrease the cash flow for your property as well. Remember, hurdle number one is making sure that both you and your property qualify for the loan. By taking 2 to 4 weeks to get the 911 usage loan, you will be able to not only buy the property, but you can then refinance it later on. This method also provides the opportunity for you to move over any remaining balances over to a business credit card.

| Loan Type | Property | LTV of 80% | Net Rent |

| DSCR | $312K | $250K | $1,800 |

| Credit Score | Interest Rate | Monthly Payment | Can it Qualify? |

| 680 | 8.8% | $1,976 | No |

| 760 | 7.45% | $1,740 | Yes |

Learn this magic trick today!

Business credit cards are an excellent way to separate business expenses from your personal accounts. These credit cards are easy to get and work the same as personal credit cards. By moving expenses over to business credit cards, it wipes the charges off of your personal credit completely. As a result, your credit score, cash flow, and ability to qualify will all increase.

We are here to help!

Here at The Cash Flow Company we are here to help you get on the right path. Do you need to get your credit card debt off of your personal credit report? Contact us today to find out more about usage loans and how they can set you up for long term financing. Just to clarify, the usage loan is a private loan that does not show up on your credit for 60 to 90 days and won’t affect your DTI. Now is the time to set yourself up for success!

Watch our most recent video Help! I Can’t Get a DSCR Loan Because of My Credit to find out more.