The Real Estate Investor’s Battle: Hurdles and Solutions

Do you want to use other people’s money to generate cash flow? Wondering what hurdles you will face along the way? Unfortunately people tend to get greedy and let emotions take over their investing decisions. They begin purchasing multiple properties in a short period of time, which is not always a profitable method. Investing is all about the numbers and determining whether a property will create cash flow, or will instead create spiraling debt. By setting your business up correctly and not letting your emotions take over, the sky’s the limit for your success. Let’s take a closer look at the real estate hurdles and the solutions that will get you back on track.

First, limit the number of properties

We see so many people who want to do 5 or 6 deals a year. In doing so, they tend to lose money on at least 2 if not 3 of those properties. Thus resulting in investors breaking even, as opposed to making money. By taking on too much too quickly, investors fail to grow their money. It is possible in 3 years to obtain good wealth, but achieving it in one year is very difficult. Be strategic to ensure that you’re making money on each deal!

Second, regulate your emotions

80% to 90% of people either take on too much, or they let their emotions drive their business. Even though they know their numbers going into a deal, many investors let their emotions drive the bidding. This causes them to become overextended and unfortunately results in little to no profit on the property. Real estate investment is designed for everyone, however it’s only profitable for those who can take their energy and put it back into the property.

Third, leverage

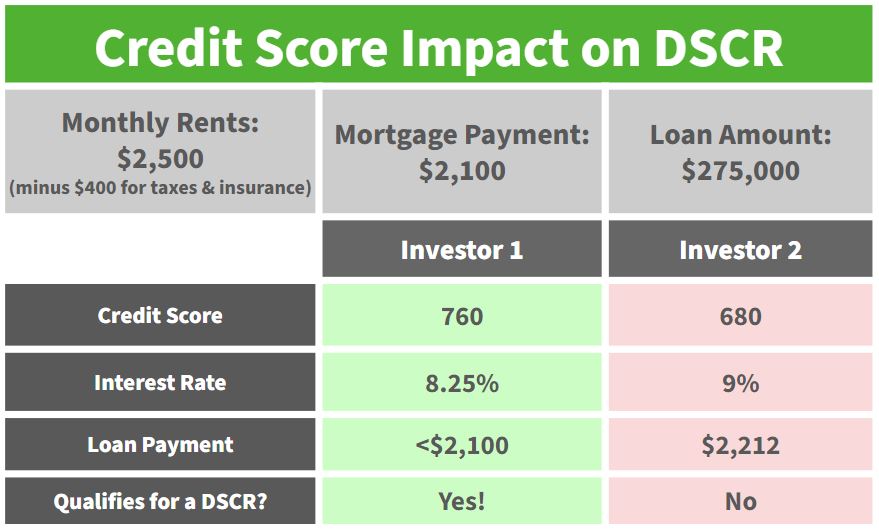

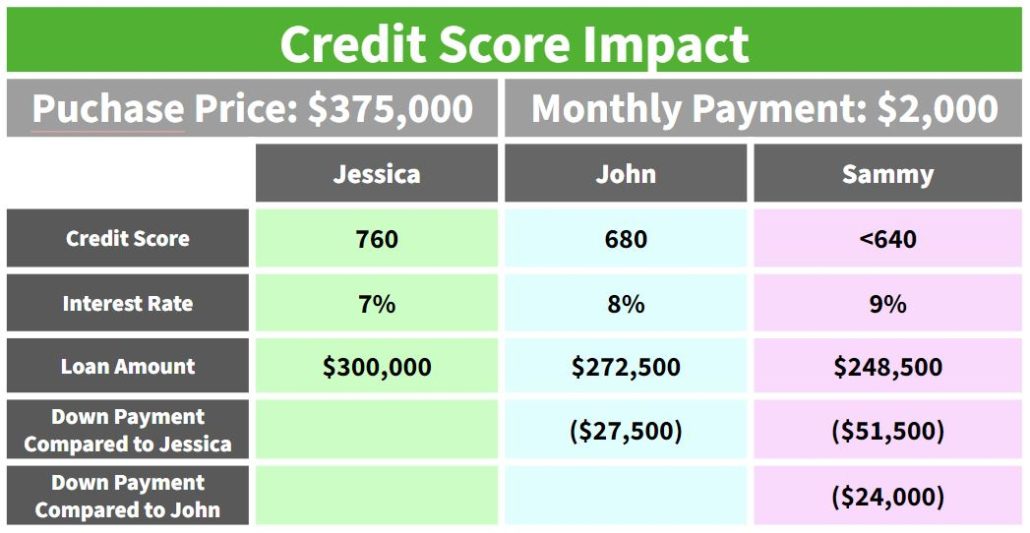

It is imperative that you leave your emotions out of the deal and instead focus your attention on the leverage that your investment holds. As an investor, you have to understand how to use leverage properly in order to create income and generational wealth. While not everyone has $300K to start investing, you need to make sure that the property can pay for itself. For example, if a property is bringing in $4K and is only costing $2K, then you can feel comfortable taking on another mortgage without facing financial strain.

Fourth, do your research

Whether you are house hacking or joining a fellow investor, you need to make sure that you are comfortable with the numbers before diving in. It is important to research and compare properties prior to investing to determine if the investment will be profitable. Another component in this process is evaluating the property for sellability. Unfortunately there are a number of properties that have been fixed quickly or had things covered up for a fast sale. In knowing what you are looking for, you can save time and money by investing in a property that people want to buy.

In conclusion

There is a reason that it’s “simple not easy” in real estate investing. You have to follow the process and take the steps until you feel comfortable enough to eliminate the emotions. This in turn will prevent you from getting into a situation that could jeopardize your success. Finally, by getting help from realtors, designers, or even finding ideas online, you can ensure that you have something that your audience will love. We can help you tackle the hurdles and find solutions to the challenges that are holding you back from achieving cash flow.

Watch our most recent video to find out more about Real Estate Investment Hurdles and Solutions

If you have any questions on liquidity, fix and flip loans, or any other real estate investment questions, please reach out to us!