When the real estate market tightens up, you need to be prepared with leverage so you can take advantage of investing opportunities.

Once you’ve been in the business for as long as we have, you start noticing patterns. The investing world goes through cycles every few years where things tighten up before flowing normally again.

However, a ‘bad market’ doesn’t necessarily mean bad news.

If you’ve prepared beforehand, you can actually take advantage of the challenging landscape to build some wealth.

What is a ‘Bad Real Estate Market’?

Essentially, what’s happening right now is banks are tightening up. This means most are lending out less money, making it harder for investors to get the money they need.

This also means that, over the next 6-9 months, people are going to be getting rid of some properties and fewer people will be buying.

If this sounds like bad news, don’t worry. If you’re ready for these market changes, it can actually be the perfect time for you to buy.

Filling Your Money Buckets

Since there’s going to be fewer loans coming out of banks, what can you do to make sure your finances are prepared for the shift in funding?

For every project, there is an amount of money that goes into it. We call it a bucket of money, or, your money bucket.

Your money buckets needs to cover purchase, rehab, closing costs, etc. Part of that money bucket comes from lenders, and part of it comes from you.

If you’re a newer investor, don’t panic! Read on to learn how to fill those buckets.

3 Key Strategies For Better Loans in a Bad Real Estate Market

Our goal is to help you figure out how you can get more money from lenders so less is coming out of your pocket.

1. Get Your Credit Score in Line

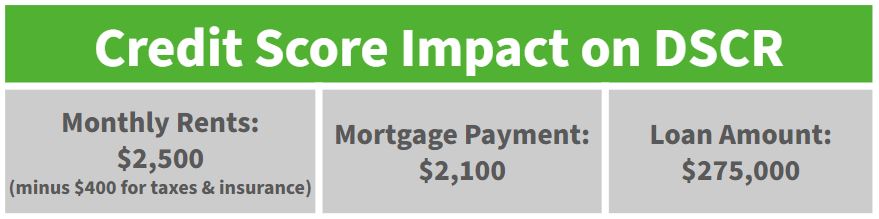

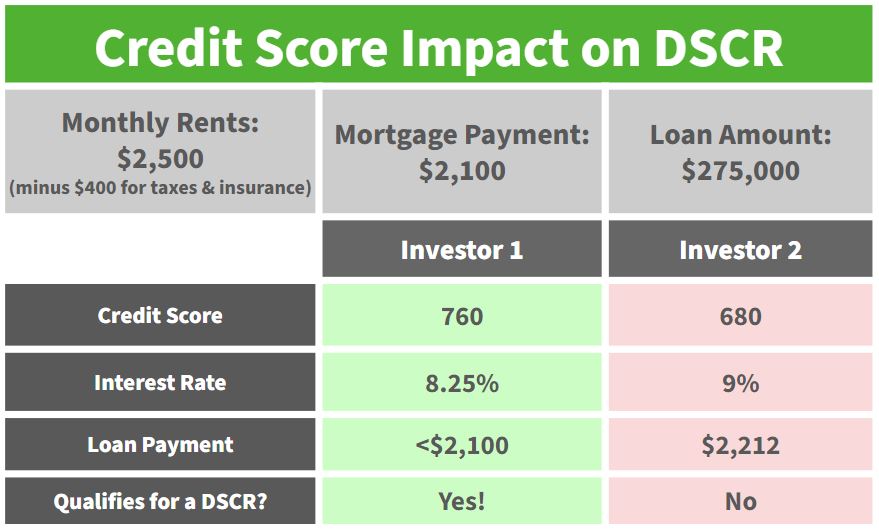

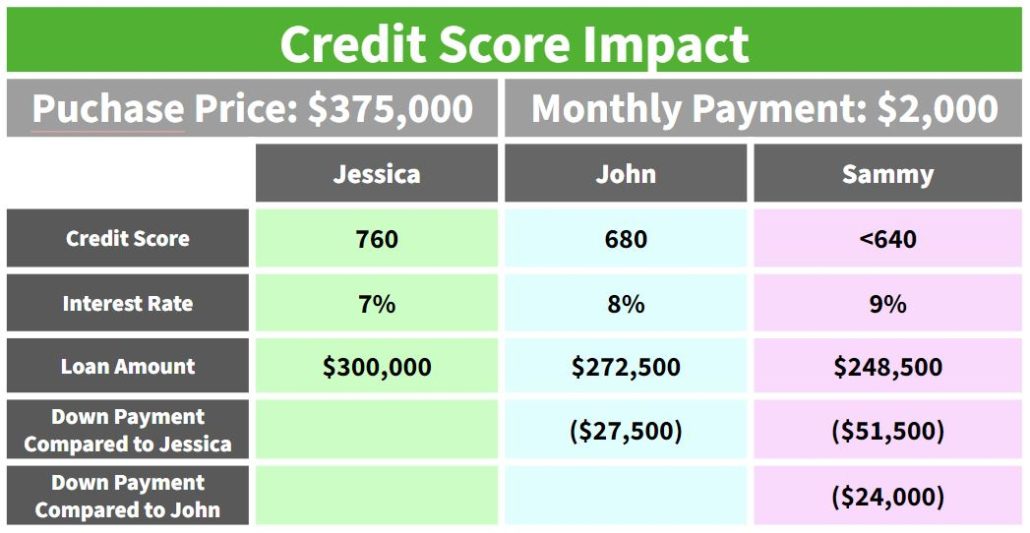

In the past, 660-680 used to qualify you for an okay loan. Not anymore! As lenders tighten up, most will be looking for scores closer to 750-799+.

Lenders are depending more and more on credit scores. Make sure your credit score isn’t holding you back!

If you’re using personal credit cards for your investing projects (using them to buy supplies, pay vendors, etc.) stop now!

Personal credit cards aren’t made for that level of usage, and most cards will drop your credit score if you’re using too much of your balance on a regular basis.

This can lead to a significant usage issue. There are two things you can do to help fix this problem:

Once you raise your credit score, make sure you maintain it. Since lenders look so closely at your score, you should too!

2. Fill Your Bucket With More Money

If you’re new to real estate investing, this is often the hardest part. However, there are many ways you can work to fill your money bucket without needing to drain your personal bank account.

Obviously your lines of credit can be an asset to your money bucket, but Other People’s Money (OPM) is also important.

Ask around your friends, neighbors, family members, or investment clubs. Many of them could be interested in investing a few thousand dollars into a project with a secured return of 8-10%.

There are so many creative ways to help fill your money bucket from hard money, to lines of credit, to OPM. With more money in your bucket, you can do more transactions.

If you need help filling your personal money bucket, reach out to us. We’ve coached many new investors through this process.

3. Be Picky With Your Deals

Don’t feel rushed. Be selective.

As you shop around for investment properties, look for ones that are under a 70% After Repair Value (ARV).

This is a good time to be picky, especially if you’re new to the game. Choose safe deals that will guarantee you a solid return when the market heats up again.

If you do it right, finding the deals that are 70% ARV or below can open up many more deals and transactions in the future.

In five years, when everything is back to normal, those properties are going to have great value and you could create significant wealth.

We’re Here to Help You Navigate This Real Estate Market!

If you take the time to get your credit score and money buckets in order now, you set yourself up well to move quickly when you do find the right deals for you.

If you need help figuring out where to start or you want to discuss loans or investment strategies, reach out to us at Info@TheCashFlowCompany.com or fill out a contact card.

We also have many free tools and resources that you can check out. Our goal is to help you feel equipped as you enter your investment journey, and we are always happy to help.