What Does Debt Service Coverage Ratio Mean?

Today we are going to discuss what debt service coverage ratio means and how a DSCR loan can help you achieve your investment goals. Thankfully there are a multitude of products that are available for investors to not only purchase new properties, but to refinance as well. Whether or not you have a job, just changed jobs, or write everything off on your taxes, there are products out there for you. How can a DSCR loan help you? Let’s take a closer look!

What does debt service coverage ratio mean?

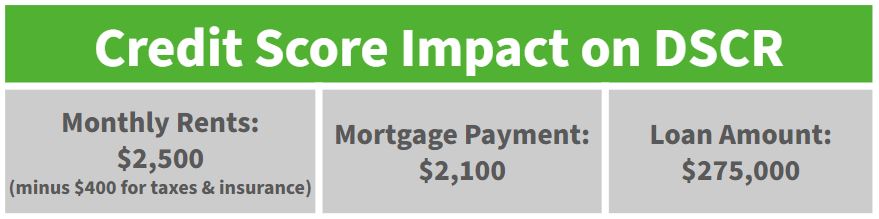

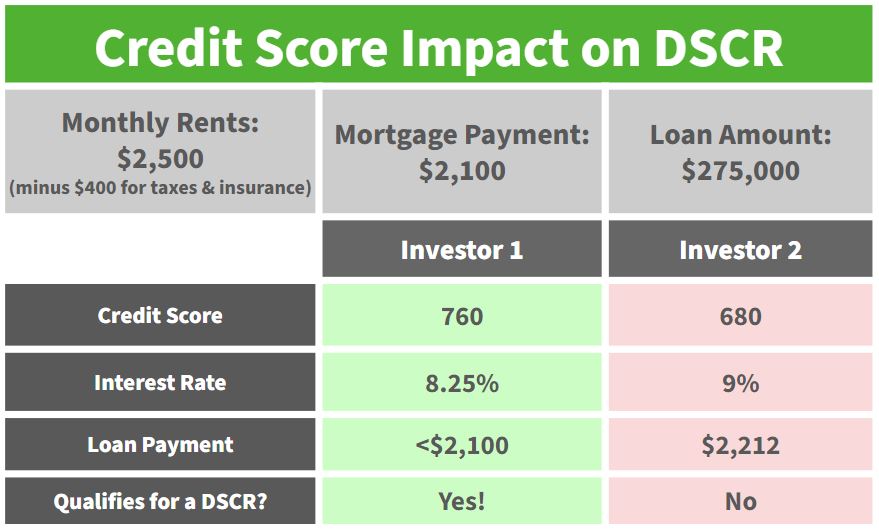

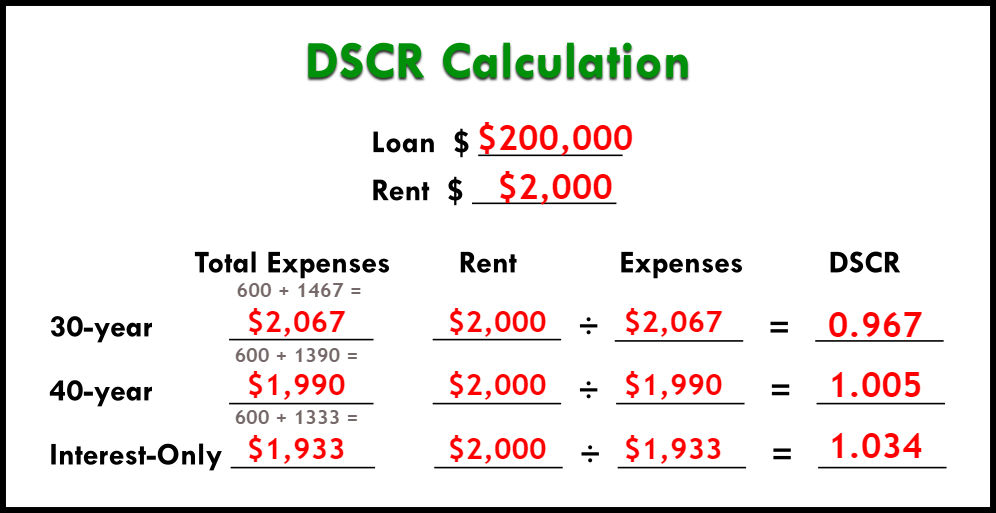

The debt service coverage ratio is where your property breaks even. Just to clarify, that is when the income from the property and the expenses break even. While every property has a different break even point, this is the value that lenders will be looking at to determine whether or not the property qualifies for a DSCR loan. The expenses that lenders take into consideration are the mortgage payment (including interest), taxes, insurance, flood, and HOA. For example, if your rent is $1,000, then your expenses need to be $1,000 or less in order to qualify for a DSCR loan. The best scenario would be if your rents were $1,500 and the expenses were $1,000. This would create a $500 cash flow for the property.

A DSCR is the best loan option!

One of the most versatile loan options available for investors is a DSCR loan. How do you qualify? As long as your rental property will cover the debt, you will be able to qualify for a DSCR loan. Unlike traditional loans, a DSCR loan will not take into consideration when you started your job or how long you’ve been self-employed. Instead, the lender’s primary focus is whether or not the income from the property qualifies for the loan.

Contact us today!

Here at The Cash Flow Company we are happy to run through the numbers with you to see what product is best for you. Contact us today to find out more about how you can qualify!

Watch our most recent video: What Does Debt Service Coverage Ratio Mean?