This loan type is an investor’s secret weapon… Here’s how to get a DSCR loan in 5 steps.

You need money to make money. But it doesn’t have to be your money.

Real estate investing is a highly leveraged game.

DSCR loans are different from conventional loans like Fannie Mae and Freddie Mac because they have more lenient guidelines. DSCR loans can have anywhere from 30 to 100 different funding sources, and each one has their own underwriting rules.

Every lender will have different prices, terms, and underwriting criteria. But here are 5 things you’ll definitely need to know to get a DSCR loan approval.

1. Credit Score: Understanding Your Credit

Your credit score is the main factor that lenders consider when evaluating your loan application.

A higher credit score can get you a better loan-to-value (LTV) ratio and a lower interest rate. For example, a 740 score will get you an LTV 5-10% more than a 640 score. Your interest rate with a 740 score will be .5-2% lower than the interest rate with a 640 score.

If your credit score is below 700, you should take steps to improve it – such as paying down credit card debt and making sure all your payments are on time.

This article offers some ideas for raising your credit score quickly. You can also download this free credit score checklist to get you where you need to be.

2. Money: Down Payments, Closing Costs, and Reserves

In addition to the down payment, you’ll need to have enough money for closing costs and reserves.

For reserves on a DSCR loan, lenders often require you to have 3-6 months’ worth of mortgage payments. This extra cash protects the lender in case your tenant unexpectedly vacates or some other unexpected situation arises.

The money doesn’t necessarily have to be yours – you can borrow OPM from a business partner, friend, or family member. To get a DSCR loan, though, your lender will want to see the funds for a down payment and reserves to approve you.

3. Know Your Numbers: Property Income and Expenses

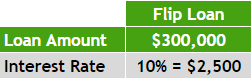

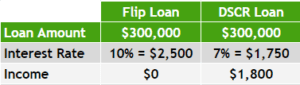

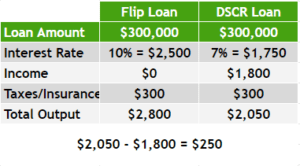

DSCR loans are based on the property’s ability to generate income and pay for itself. So your in-flow and out-flow numbers are a major factor in whether or not you get a DSCR loan.

The minimum requirement is that the rents cover all expenses, including:

- The mortgage payment

- Taxes

- Insurance

- Any HOA fees

Expenses not considered by your lender include:

- Property management fees

- Utilities

- Maintenance

If the property generates more income than expenses, you’ll get a better rate. However, if it doesn’t break even, you’ll likely end up paying a higher rate.

For example, if you show a lender your property can bring in $1,250 and your payments are only $1,000, you can get a better rate.

Know your numbers to get your DSCR loan approved.

4. Be Prepared: Gather Your Info to Get a DSCR Loan

If you want to not only get approved for a DSCR loan, but have it happen quickly, make sure you have all your documents and information ready to go.

Treat your real estate investing like a business – and like you’re a professional. If you come to a lender prepared, you get:

- First dibs

- Fast service

- Better rates

Lenders want to do business with people who prove they can stay on top of their finances and paperwork. Just as you want to rent to “easy” tenants, lenders want to help investors who cause the least amount of friction.

It also benefits you to be competent and prepared so you can read the lender better. Unfortunately, not all financial institutions have your best interest in mind, so being prepared helps ensure you find the best deal.

5. Shop Around: Compare Offers from Multiple Lenders

There are many different funding sources for DSCR loans, and they all have different terms and rates. To get the best deal, it’s important to shop around and compare offers from multiple lenders.

It may benefit you to stay away from jack-of-all-trades lenders. Look for lenders who specialize in DSCR loans and have a track record of working with real estate investors. They will have the most options for you to get the DSCR loan product that best fits your specific property.

Have the money, understand where your credit is, and know the numbers for the property. Taking 20 minutes per week to stay on top of this means all the difference for your approval on a DSCR loan (and for your real estate investment career!).

How to Get the BEST DSCR Loan

These 5 steps will get you well on your way to approval for a DSCR investor loan.

Remember to focus on:

- Improving your credit score

- Having money for down payments and reserves

- Knowing your numbers

- Being prepared

- Shopping around for the best deal.

Leverage is king in real estate. With a little bit of effort, you can secure the financing you need to grow your real estate investment portfolio.

Send us an email at Info@TheCashFlowCompany.com. Show us a deal you’re looking at or ask any questions you still need answered.

Let’s make you the most successful investor we can.