Where is buying power going? How do you determine home prices in 2023?

This is the perfect time to start real estate investing. Great properties are available. …As long as you understand how to price them for the current market.

The good news is, real estate prices aren’t a complete guessing game. Supply, demand, and other circumstances do factor in. Ultimately, however, everything consumers buy is based on affordability, not necessarily price.

For example, someone who could afford a $10,000 car could also afford a $30,000 car – as long as the financing worked out to be the same monthly payments.

Let’s go over the simple math of how this idea of affordability affects real estate, especially in 2023.

How to Determine Home Prices in 2023 (and Payments!)

As an investor, you have to understand where prices are now and where they’ll be in a few months. If you buy a property now, 4 to 6 months from now is when you’ll either be selling as a flip or appraising for refinance.

For medium-priced homes and below, purchases are mainly based on affordability. Interest rates dictate affordability. Affordability dictates the value of homes.

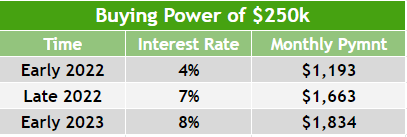

So let’s look at the numbers. We’ll use an example of a homebuyer who can afford a $1,000 monthly payment right now at the end of 2022.

Affordability – The Payment

Affordability is the monthly payment a buyer can afford. This number is determined by:

- The buyer’s financial comfort.

- The income and budget of the buyer.

- And most importantly: the lender’s qualification requirements.

Many buyers would feel comfortable paying a higher monthly amount, but they’re restricted by their lender. Affordability is a major factor in the loan approval process. Buyers in the mid- to low-price range only get approved for one monthly number, regardless of market conditions or property values.

Buying Power – The Price

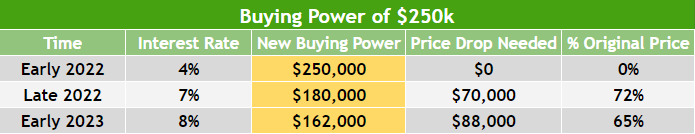

Interest rates are currently at a 7% average. Only being able to afford a $1,000 payment, this buyer could qualify for a $150,000 home. The $150k is their “purchasing power.”

But interest rates are expected to increase to 8% next year. What happens for this buyer then?

When interest rates rise, purchasing power falls. This buyer still only qualifies for a $1,000 payment, but at an 8% rate, they can only afford a $136,000 house.

What if rates rise to a whopping 9%? Buying power for this buyer decreases to $124,000.

A $124,000 house with a $1,000 payment may not be realistic in many markets today. You have to see what the current environment is in your area, and base your numbers on current interest rates and property values.

Affordability and Buying Power Impact the Seller

Affordability doesn’t just impact the buyer; it should also change your expectations as a real estate investor. With higher interest rates, affordability will drop. You have to take this into account when you’re buying properties in this market.

If you buy a house right now in the 7% market, you expect it to sell for $150k. However, you need to keep changing interest rates and affordability in mind. In 6 months when you’re ready to sell, interest rates may be at 8% and your list price will sink to $124k.

Each time interest rates rise by 1%, prices drop by a little over 9%. When interest rates go up 2%, there’s a 17.3% drop in values.

Rates when you’re buying matter less to price than rates when you go to sell. You need to anticipate where rates will go. If rates rise 1-2%, you have to account for affordability.

This balancing of affordability and buying power is one of the biggest factors in home pricing. The majority of people buy based on payments and affordability. Their payments are not going to change despite price changes.

Home Prices in 2023 for a Higher Price Point

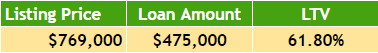

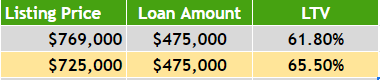

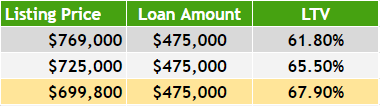

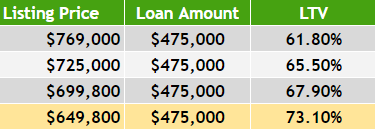

To show how affordability and buying power work at any price point, let’s go over an example with a $750,000 property.

If a buyer was looking at a $750k home in 2022 at a 7% interest rate, their payment would be $4,990. Their affordability (the monthly payment they’ve qualified for) is $4,990. So if interest rates change, the home price they can afford will go down.

For example, if rates go to 8%, their buying power drops to $680,000.

At 9%, they can only afford a $620,000 house.

Make sure you understand where rates are projected to be in the future. The profitability of both flips and rentals are dependent on these rates.

As of right now in late 2022, rates are expected to continually increase – potentially up to 9-10%.

Comparing Home Prices in 2021 – 2023

Knowing past and future interest rates, affordability, and buying power will help you make informed decisions about your next real estate purchase.

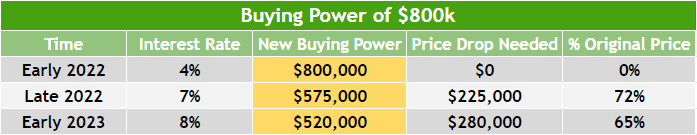

For reference, let’s work out some examples of purchasing power for a homebuyer in 2021.

Purchasing Power in 2021 for $1,000 Payment

If we had a buyer who could afford a payment of $1,000 today, they could buy a $150,000 home.

Just a year ago, buyers could get interest rates at 3% or lower. So in 2021, this buyer would have a purchasing power of $252,000.

That same buyer, in 2023, is anticipated to have a purchasing power of only $124,000.

Purchasing Power in 2021 for $5,000 Payment

If another buyer was going to buy a $750k house in 2022 at a 7% interest rate, what was their purchasing power in 2021?

For the same $5,000 payment, someone in 2021 could afford a $1.2 million house! In 2023, that payment could only get a $620,000 property.

How Purchasing Power Impacts Sellers

As an investor, it’s wise to keep this reality in mind:

In a matter of two years, someone can go from being able to afford a $1.2 million house to a $600,000 one.

With no change in income. No change in qualifications. No change in credit score. The only change is how interest rates impact payment.

Although affordability changes so drastically in a short amount of time, mindset does not. People will still expect the quality of their previous higher price point while they’re looking at homes in their current lower price point.

In addition to focusing on the numbers of your flip, you also have to obsess on quality. If buyers don’t see the quality they expect, they’ll either stay in their current home, or find another property on the market that won’t need any fixes.

Buying Now to Sell at the Home Prices in 2023

Going forward in 2022 and 2023, you need to look at affordability. The US buys on payments, so your prices need to be adjusted to buyers’ affordability.

If you have any questions on how to price properties, or have a deal you’d like us to look at, reach out. Email us at Info@HardMoneyMike.com.

And be sure to check out our YouTube channel for more information on real estate investing.