How Dropping Listing Price Hurts a Refinance

Categories: Blog Posts

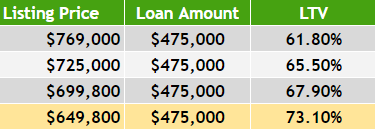

Here’s an example of just how much dropping listing price hurts a refinance.

A recent client of ours came across a common issue in today’s market:

He got caught in the market with a big flip project. After weeks on the market, he just couldn’t sell. Negative cash flow pushed him to continually drop his asking price.

Here are the numbers of his deal and what happened to his chances at a refinance.

How Dropping Listing Price Hurt a Refinance

This client listed his property in late July, early August of this year. Everything had been going well for his investments in the last 7 or 8 years, so he took his time on a couple recent flips. But it took him a little too long on this one, and the timing is now killing him.

Let’s look at his numbers.

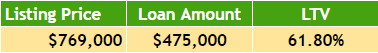

The First Price

This client owed $425,000 on the loan for this property. His initial listing price for was $769,000.

So far, so good. These numbers are great. He has a low loan-to-value. Sixty-five percent is a major threshold for LTVs. Being under 65%, this would be a great position for a refinance.

He would have had a lot of options available to him at this point, even if his income didn’t suffice for a conventional loan.

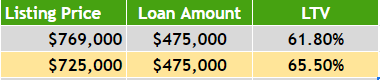

Price Drop #1

A couple weeks later, like most people would do when their property hasn’t sold, he decided to lower the price.

The new price was $725,000. His LTV crossed the threshold to above 65%.

Although not as great as before, he still would have plenty of loan options. Everything still looking good.

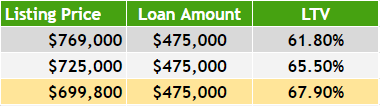

Third and Fourth Price Drops

One week later, he decided to drop price again. His realtor talked him into dropping below $700,000.

Now at $699,800, he’s lowered the price three times. When the appraiser looks at this, they’re going to see the continual drops, making it clear that the property is not selling at these prices.

Eight weeks in, this client started getting desperate. Remember, he’s making monthly payments on this property. The house has a high negative cash flow. So he drops the price to $649,000 in hopes of selling.

He’s crossed another major LTV threshold into 70-75%. He’s created a big hurdle for refinancing by dropping the property 4 times over the last 8 weeks.

Dropping Listing Price Hurts Refinance

The appraiser will see the property isn’t selling at $649,000. So based on the current market rates, they’ll appraise it 1-10% less than that number. With this low appraisal, our client could get trapped above a 75% LTV. Getting a decent refinance loan just became way harder, with a nearly guaranteed negative cash flow.

The LTV has gone up, so now his refinance rates will go up. Additionally, he’s backed into a corner where he’ll need a higher credit score to get the loan. At a 65% LTV, there are options for almost any credit score. At 75%, you need a much higher score to get anything.

Every time you drop the price, you’re putting yourself at a higher risk of a worse rental refinance loan. Dropping price gets you lower LTVs, worse cash flow, and potentially takes away the option to refinance altogether.

Read the full article here.

Watch the video here: