DSCR Loans: How Flexible Are the Rules and Guidelines?

Many investors wonder how flexible the rules and guidelines are for DSCR loans. Do all DSCR lenders have the same guidelines or follow universal rules? The answer is no! Unlike Fannie and Freddie, or traditional lenders, DSCR loans do not have the same guidelines. Instead, DSCR loans are regulated by a few big investors and do not force people to fit into a computerized box. This creates the opportunity for investors to find the perfect loan to meet their needs.

Every lender is different.

Every DSCR lender is different and they each have their own guidelines that they follow. While a lot of lenders will only do 1 to 4 units, others will be more adventurous and do commercial properties. For these lenders, you either fit in their box or you don’t. All DSCR lenders are not the same, they don’t always look the same, and most importantly they are not priced the same. It is important to keep this in mind when you are looking and shopping for DSCR loans. Shopping around for the best loan to fit your needs is especially important if you have something unique.

Unique properties require unique loans.

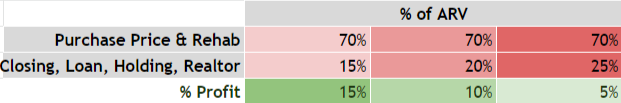

Many unique properties include ones that need a smaller loan, a rural loan, mixed use, or properties that are above 4 units. Keep in mind that some lenders are not always able to meet your needs. Unlike traditional loans, DSCR lenders all follow different guidelines and requirements. While one will do a DSCR ratio of 1, another lender will require 1.1 to get their best rates. Your credit score also plays a role in loan approval. Some lenders will go down to a 620 credit score, while others will say that 680 is the lowest they will go. There are so many different options that are available to investors. Be sure to take your time to find the best option for you and your property.

The lending box.

There is a lending box that 60% to 70% of investors fit into. This box requires them to have a 700 credit score, 75% LTV, and a 1 to 4 unit property. For these investors, it becomes a matter of price shopping to see which lender has the best price for their property. If you don’t fit into this box don’t worry! There are a multitude of loan options available that can provide the flexibility you need to succeed. Do you have a VRBO, Airbnb property, pad rental, or a rural property? Find the right loan and the right amount for your next investment project. Whether it’s $50K or $300K, DSCR lenders have the versatility that can open the door to endless possibilities.

What to look for?

It is important to keep in mind all of the options available to you when looking at DSCR loans. This includes the pricing, rules, and regulations, which can vary depending on the lender. Here at The Cash Flow Company we have between 7 and 10 different places that we work with for DSCR loans. That is because not every DSCR loan type will fit in every lender’s box. For example, we are doing a portfolio for a customer who has a 12 plex, 4 plex, and a couple single family properties. The borrower only wants one loan. Another customer is doing 3 single family properties, but two are very unique situations. One is a pad split, another is a contract for a deed. Our goal for both customers is to find a lender that can do all of these properties in one loan. By finding the right DSCR lender, the sky’s the limit to your success.

We are here to help!

Are you in need of a DSCR loan for a unique property? Here at The Cash Flow Company we are happy to run through the numbers to see which loan is best for you. Most importantly, there is no need to run your credit! Don’t get stressed trying to fit into a lending box! Keep your options open and find the right DSCR lender today!

Contact us today to find out more about DSCR loans!

Watch our most recent video “DSCR Loans: How Flexible Are the Rules and Guidelines?” to find out more!