Peer to Peer Lending – Why You Need it NOW

Today we are going to discuss why you need peer to peer now! This form of lending allows you to work with people in the community who have just as big of a need as you do. In today’s market more people are looking for new sources to meet their needs. Let’s take a closer look.

Who are peer to peer lenders?

Whether they are in retirement and needing extra income, or have money in an IRA, these individuals are looking for a better investment. These individuals are going through the same crunch as you are in this market. By switching these lenders can have anywhere between 6% to 8% secured while helping you with your investment needs. It creates a win-win for both people!

Changes with affordability.

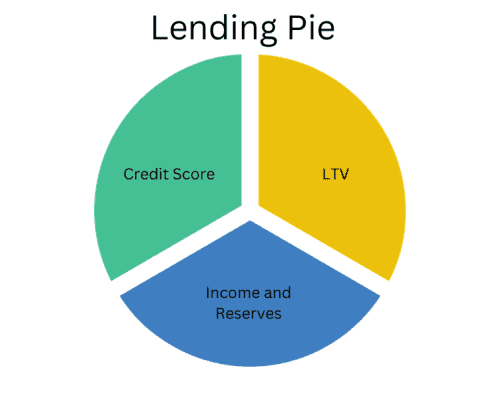

We all know what is happening with affordability in today’s market. Banks are not only charging more than they have in years past, but they are increasing their requirements as well. The lending pie is now heavily dependent on your credit score, while taking the LTV and income into consideration as well. In looking at the changes in rates, DSCR loans are rising into the 9% and 10% range. Fix and flips have increased as well and are now into the 11% to 13% range.

Benefit of taking out the middleman.

Peer to peer lending allows us to work directly with humans again by taking out the middleman. This form of lending has been around since before banks were established. Many good investors have a few relationships established already. This not only helps to provide funding, but it also creates the flexibility they need to close deals quickly. Additional benefits are flexible terms, no prepay requirements, simpler underwriting, and fewer closing costs.

Do it right to succeed.

As a real estate investor it is important that you take the time to make everything secure. In doing so, you will create a good relationship with your lender. This relationship not only helps you financially, but it also creates the flexibility you need to succeed. Any investor or business owner should be looking at alternative lending! Whether it’s for a down payment or funding for an entire project, there is money available.

Don’t make it complicated

It is not uncommon for people to feel uneasy asking family and friends to become financially involved. Whether it is a family member, friend, or a complete stranger, the most important thing you need to do is put them in a good deal. If you are not diligent about this, then it will make things uncomfortable and puts a strain on relationships. What is a good deal? These are deals that have cash flow, or properties that will be easy to flip. Take your time, crunch the numbers, and make sure it is a good deal for both of you.

In conclusion.

As a real estate investor you need to set yourself up for success by finding peer to peer lenders within your community. Over the past few years we have seen things tighten up and become stricter. In doing so, it has created the perfect opportunity to reintroduce this alternative lending source. There are billions and even trillions of dollars out there that can be used for your lending needs!

Contact us to find out more and how we can help you with your investment needs.

Watch our most recent video to find out more about Peer to Peer Lending – Why You Need it NOW.